A few years ago, many telecom operators proclaimed they were moving from being telcos to becoming “tech cos.” And at the time, it sounded like a marketing gimmick. But according to ABI Research, the vast majority of telecom operators in the world are actually trying to break free from their antiquated, legacy infrastructure to become technology platforms.

Today, ABI Research says it’s measuring the progress of telco transformation by quantifying the number of patents that telcos hold and also measuring their involvement in standards-setting initiatives.

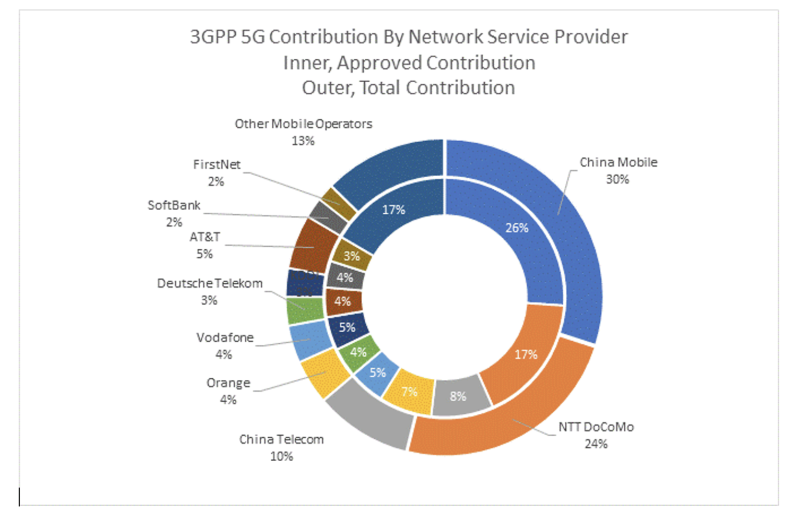

“Telecom operators from China and Japan are currently at the forefront of technology transformation, which shows in their involvement in 3GPP and patent holdings,” said Dimitris Mavrakis, senior research director at ABI Research. He specifically called out China Mobile, NTT Docomo and China Telecom as leading operators in terms of transforming themselves into tech companies.

Other leading operators are Orange, Vodafone and Deutsche Telekom, whose Standard Essential Patent (SEP) holdings are similar to the Asian operators.

In terms of China Mobile, NTT Docomo and China Telecom, Mavrakis said, “These operators are far more successful in addressing the enterprise market segment compared to other telcos. This is not to say that standards/patents is the only innovation metric for the telco-to-techco transformation, but at the end of the day, it’s all about new revenues and these three operators are very good success cases.”

In addition to filing multiple patents stemming from their R&D Labs and shaping standards through 3GPP, the three Asian operators have also taken risks such as deploying 5G standalone (SA) core networks from the start.

The findings of the latest ABI Research report on telecom operator innovation indicate that operators contribute about 8% of the total contribution to 3GPP standards work, while the majority of contributions come from infrastructure vendors such as Huawei, Ericsson and Nokia.

Of the telecom operator contributions, 43% originate from China, 29% from Japan, 14% from Europe, and 12% from the United States.

ABI’s breakdown of 3GPP standards contributions shows paltry contributions from American operators, with AT&T contributing 5% of the overall service provider contributions.

Fierce Wireless asked why T-Mobile didn’t rank, given the good progress that it’s made with its 5G SA network and network slicing trials. Mavrakis said, “T-Mobile US is part of Deutsche Telekom, which is represented in the chart above. They are indeed making progress toward network slicing, but our report measures 3GPP standards activities and patents, which is a different area of innovation.”