The latest RAN report from the Dell’Oro Group found that virtualized RAN (vRAN) and Open RAN (O-RAN) revenues grew more slowly in Q1 2023 than last year. The analyst firm found that vRAN revenues grew 20 to 30 percent, while O-RAN advanced 10 to 20 percent in the recent quarter. This is decent growth, but as Dell’Oro reported O-RAN revenue more than doubled in 2022.

“Early Open RAN adopters include the greenfields (Dish, Rakuten) plus some of the brownfields in Japan/US,” Dell’Oro VP and RAN specialist Stefan Pongratz told Silverlinings in an email. “Most of them are deploying Open RAN and vRAN but in some cases they are prioritizing one before the other – vRAN is just now starting to pick up with some of the brownfields in Japan (they prioritized Open RAN before vRAN),” he continued.

“These are large scale deployments involving hundreds of thousands radios,” the analyst noted. “So, when the volumes in these deployments stabilize, total growth will slow unless the sum of the other on-going deployments firm up.”

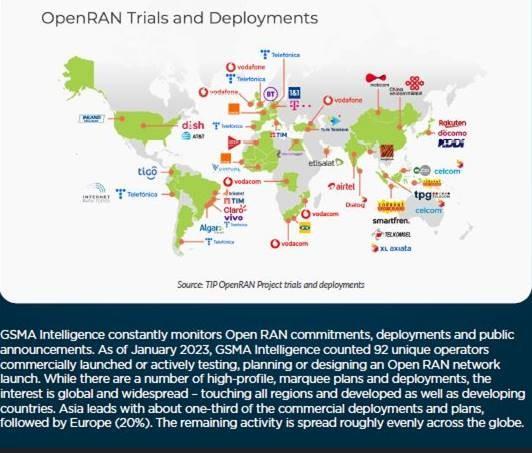

That said, Pongratz said that “there are nearly hundred operators investing/testing/planning Open RAN” right now. These operators include AT&T in the US, Vodafone in Europe and KDDI in Asia, among many others.

Top O-RAN suppliers in the period included Samsung, NEC, Fujitsu, Rakuten Symphony and Mavenir.