In 2012, one of the leading RAN suppliers expected virtualized RAN (vRAN) would comprise 20% of the RAN market by 2018. As with many other technology transitions, there is generally a tendency to be a bit optimistic over the near-term. And the case of vRAN turned out to be no different.

We estimate vRAN baseband still accounted for about 0% of the RAN market in 2018. Fast forwarding a couple of years, and prospects are firming up. Preliminary analysis suggests 4Q21 vRAN revenues surprised on the upside, paving the way for some upward revisions to the short-term forecast. So the question now is if the higher vRAN baseline combined with the rise of new solutions tailored to narrow the performance, energy and cost gap with ASICs is enough to get excited about vRAN this time around?

After years of disappointing vRAN traction beyond Rakuten’s network, initial findings suggest vRAN revenues, including virtualized centralized unit (vCU) and/or virtualized distributed unit (vDU) software, more than doubled year-over-year in 4Q21 and for the full-year 2021, underpinned by stronger-than-expected acceleration in the North America region.

In addition to the more favorable regional mix, the supplier landscape also improved in the fourth quarter as more vendors reported that vRAN is starting to move above the noise, partly because the scope is expanding from a deployment, technology and bandwidth perspective. While narrowband networks still drive the lion’s share of the vRAN installed base, vRAN supporting wide-band 64T64R Massive MIMO 5G NR radios was a significant driver behind the 2021 ramp.

Virtualization in the telecom world is far from new. According to the Dell’Oro Group's Mobile Core Network (MCN) Report, network functions virtualization comprised around 70% of total MCN revenues in 2021. One of the main reasons vRAN adoption has not accelerated at the same pace as in the core is simply that the tradeoffs have been difficult to justify – performance, power consumption and BOM-related cost benefits with optimized baseband hardware have so far outweighed the benefits with standard signal processors. In other words, the traditional GPP architectures use an excessive amount of CPUs, energy and capex to support signal processing requirements for NR Layer 1.

At the same time, the vRAN architecture offers a confluence of benefits, including more flexibility and an improved path toward automation. These advantages with vRAN taken together with the success of the early adopters are fueling a new wave of solutions aimed at narrowing and ultimately closing the gap between dedicated silicon and hybrid approaches relying on GPPs/accelerator cards.

RELATED: Is the U.S. back in the 5G RAN game? — Pongratz

Both traditional and new macro baseband component suppliers including Marvell, Intel, Qualcomm and Xilinx are announcing new solutions and partnerships at the MWC Barcelona 2022 event this week, promising to close the gap. Dell and Marvell’s new open RAN accelerator card offers performance parity with traditional RAN systems, while Qualcomm and HPE have announced a new accelerator card that will reduce operator TCO by 60%, allegedly.

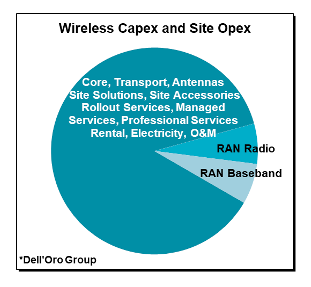

Keeping in mind that the RAN accounts for around 10% to 20% of total operator TCO, including capex and site opex, service providers are not only monitoring the potential savings with the RAN. Automation-friendly architectures that can enable non-RAN related cost reductions will also contribute to total TCO savings.

In short, baseband suppliers believe the gap with traditional RAN is shrinking. Meanwhile, traditional RAN systems utilizing optimized baseband hardware is also evolving. So if Thomas Sowell is right that “there are no solutions; there are only trade-offs,” operators will have plenty of options now and in the not-too-distant future to figure out the right trade-offs.

From a forecasting point of view, we are encouraged by the progress on the technology side and the commercial vRAN bump in 2021. We have raised the vRAN outlook for 2022 to reflect the improved short-term visibility but are not ready at this point to revise the long-term forecast, meaning vRAN is still projected to approach 5% to 10% of the overall RAN market by 2026.

After all, it is 2022 and not 2012. The timing is right to be a bit excited about vRAN. But it needs to be in moderation. Or as the Swedes would say, the vRAN excitement level is “lagom."

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm's Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of the editorial board.