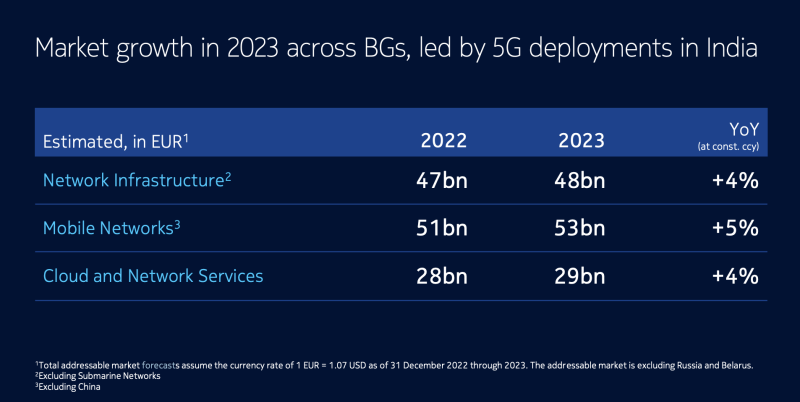

Nokia expects its mobile networks business to be its fastest-growing business unit in 2023. It attributes this to the fast ramp-up of 5G in India as well as implementation of 5G standalone (SA) core networks around the globe.

On its Q4 2022 earnings yesterday, Nokia reported full year net sales of EUR 24.91 billion ($27.04 billion), a year over year increase of 12% (or 6% on a constant currency basis).

For the fourth quarter, net sales grew 16% (or 11% year over year on a constant currency basis).

And during the quarter, mobile networks net sales were EUR 2.96 billion ($3.21 billion), growing 7% (or 3% on a constant currency basis).

But the company saw margins decline in the mobile networks group in 2022.

Nokia CEO Pekka Lundmark said the margin decline in mobile was largely due to “a meaningful shift in regional mix” in the fourth quarter. Sales grew in India, Europe, Latin America and Asia Pacific. But sales in North America declined by double-digits in the quarter, following significant strength in the first three quarters of 2022.

“As we look into 2023, even as some developed markets, like North America, mature, other markets, like India, are just starting to ramp up,” said Lundmark.

Nokia is expecting its mobile business to grow about 5% in 2023, which would make it the fastest-growing of its business units. “Our aspiration in the mobile business is to get to double digit profitability,” said Lundmark.

“When it comes to the U.S. market…. we of course saw a couple of years of heavy investment in America,” he said. “So after this, it is natural to expect some level of adjustment in 2023, and it could also include some inventory digestion.” But he said this is all built into its 2023 assumptions. The company expects the second half of 2023 to be stronger in mobile than the first half.

Lundmark said Nokia not only works with the major carriers in North America, but it also works with Tier 2 and Tier 3 operators. And of the big three carriers in the U.S., he said, “We have to remember the need for new capacity will continue in North America.”

In terms of growth in India, Lundmark acknowledged that margins are lower in that country. “It is clear that the regional mix will put pressure on mobile network gross margin in 2023,” he said. “We do expect that we will be able to mitigate that drop with scale benefits, technology development and normalizing supply chain. So, the drop will not be that dramatic as if we only took the price differences between the different regions.”

Nokia expects a quick ramp-up of investments in India through 2024. “Like in 4G, there will be a certain peak when operators are really scrambling to get coverage as fast as possible,” said Lundmark. “After that there will be some kind of a leveling off. Then it becomes a steady business where you have a gradual opportunity to improve margins.”

5G SA

When asked about 5G SA core projects, Lundmark said, “Obviously 5G standalone is now the name of the game because you need 5G standalone in terms of getting the full benefits of 5G. There is going to be a lot of investment in 5G core, and operators will be implementing some critical important services like slicing, which require investment in the 5G core."

He said Nokia’s core network software is “highly profitable, and it is something we are investing significant amounts of money in.”

Nokia is in the process of making its core network software cloud-native, and it’s also started offering it as-a-service. Lundmark said this can be targeted to enterprise customers and smaller operators, as well as large operators.

Speaking of enterprise, Nokia saw 49% growth among enterprise customers in Q4 2022. “While the 49% growth in Q4 might be somewhat exceptional, I’m pleased with the 21% growth for the full year,” said Lundmark. “And we are broadening our customer base with momentum in private wireless and webscale, both of which should continue to grow well in 2023.”

Of the 5G SA core business, Lundmark said, “Obviously, that business is much smaller compared to the radio part. But it is strategically an important part of the portfolio.”