Regional carrier Cellcom started its 5G launch in Wisconsin February 7 and has plans to bring the service to rural areas of its footprint, with a variety of spectrum bands that can come into play down the line.

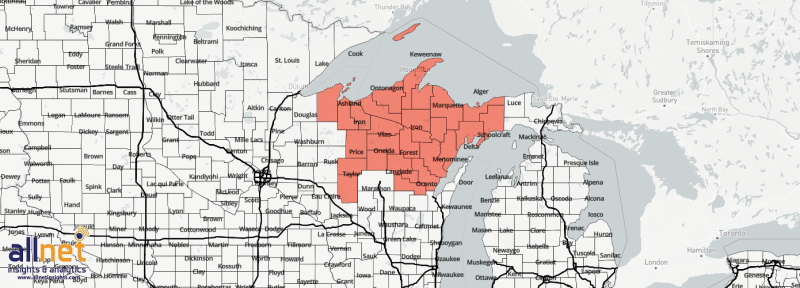

The Green Bay-based carrier is currently delivering 5G in eastern Wisconsin across Brown County (home to Green Bay along an arm of Lake Michigan) with sites in Shawano County and Langlade County, and plans to expand throughout 2022.

Fierce spoke to Nsight (parent of Cellcom) CEO Brighid Riordan and CTO and VP of Engineering Rick Brooks. Riordan just became chief executive effective last month after first joining the company in 1999. The Riordans have held a majority interest in Nsight since 1923 and she is only the fifth CEO in the nearly 100 years since.

RELATED: For Cellcom, open RAN is not a slam dunk

Efforts to upgrade the network and build out a new core have been well underway, as Cellcom aims to stay in line with technology evolution, but added functionality and efficiency wasn’t the only big driver for shifting to the next generation of mobile, according to Riordan.

“The market advertising from our competitors sort of makes it feel to our consumers that this is table stakes, so that’s also a reason why we wanted to deploy it quickly,” Riordan told Fierce.

Right now Cellcom has a small number of 5G-capable phones but expects to expand that rapidly throughout the year, she said. With network upgrades and a 5G launch, roaming is also part of the picture.

“I think we’ve well positioned ourselves to be a really powerful roaming partner as well,” Riodoran said, including for new entrants like Dish. Cellcom is working with roaming partners on bilateral agreements to have 5G roaming in place later this year, Brooks added.

Upgrading sites to 5G

At launch, the 5G network is running on non-standalone (NSA) architecture, with radio gear supplied by Ericsson and an NSA packet core from Cisco.

It’s initially serving users in parts of Green Bay, De Pere, Howard, Suamico, Pulaski, Denmark, Belle Plaine and Antigo. While everything today runs on NSA 5G, Brooks said it’s working toward evolution of a standalone (SA) 5G core in the near future.

Around 200 sites were touched last year, either to add capacity or add additional sites, Brooks said, something he doesn’t anticipate slowing down.

“We’ve been upgrading radios throughout the network for the last several years and we’ll continue to do that,” he said, noting that any time the company has gone to a site to either add spectrum or move radios up the tower, they’ve taken the opportunity to upgrade radios to NR-capable.

Starting with low-band spectrum

Another effort to get the network ready for 5G was spectrum refarming in several markets.

“That was a big endeavor that we sped up to ensure we had ample spectrum, both for LTE and 5G,” Brooks said, adding that it’s not necessarily complicated, but a work-intensive process.

To turn up 5G, Cellcom is initially using lower band spectrum, specifically Band 5 (850 MHz) and Band 71 (600 MHz), but it has amassed licenses in a variety of bands including mid-band and millimeter wave.

In some areas it’s using dynamic spectrum sharing (DSS) technology and has millimeter wave in the 28 GHz band activated at one site, he said.

When it comes to how much spectrum, he noted that Cellcom is a bit different than Tier 1s in that its holding are very different per county, so the amount varies depending where in the footprint a user is located.

“Really whatever we can [use] to get that extra efficiency out of our spectrum and access to our customers, especially in some of these rural areas,” Brooks said of choosing whether to use 600 MHz, 850 MHz or DSS.

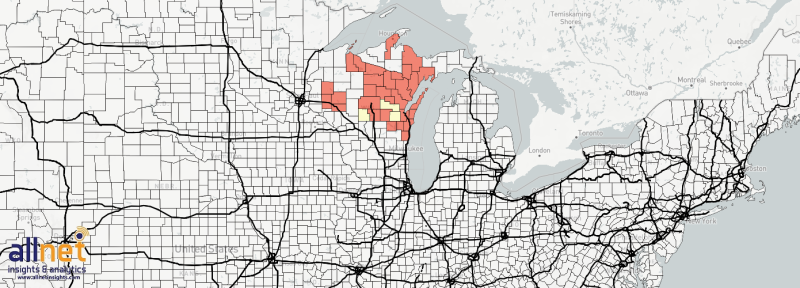

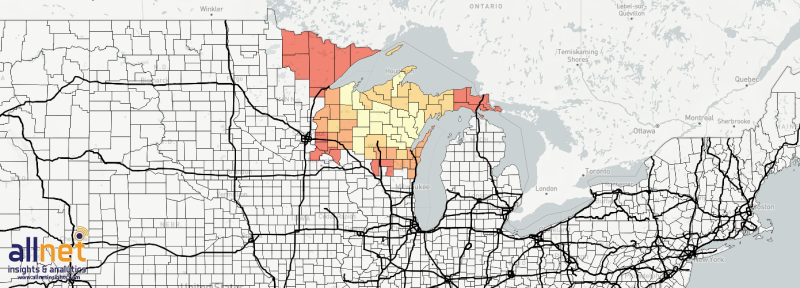

According to spectrum research firm AllNet Insights & Analytics, Nsight has Band 5 in two of Cellcom’s largest counties (Brown County and Marathon County). It has about 10 MHz of 600 MHz in Eau Claire but doesn’t hold those frequencies in any of its other largest markets (with populations greater than 100,000).

Allnet’s Brian Goemmer estimates Nsight generally has about 20 MHz of LTE spectrum at its disposal, but as mentioned, there is mid-band spectrum including CBRS, 3.45 GHz and C-band.

As seen with other major carriers nationwide 5G rollouts using low-band spectrum, speeds and capacity don’t dramatically increase but layering on its recently acquired upper mid-band to the mix could make a bigger difference.

Nsight participated in three mid-band spectrum auctions: CBRS (spending $3.56 million to acquire 69 PALs across 33 counties), C-band ($5.42 million for three licenses in two partial economic areas) and the recent 3.45 GHz auction ($4.68 million six licenses in three PEAs).

It also holds millimeter wave licenses in the 24 GHz, 28 GHz, 37/39 GHz and 47 GHz bands.

“I think that’s a pretty growth path,” Goemmer said for Nsight/Cellcom’s spectrum outlook.

He estimates Cellcom generally has 20 MHz channel of LTE spectrum, including Green Bay where they likely have 10 MHz of cellular and 10 MHz of PCS for use, with part of that shared with 5G.

The 20 MHz is virtually doubled with upper-mid-band, with about 20 MHz of CBRS or 20 MHz of 3.45 GHz potentially added to the mix, according to Goemmer.

“They will, with those two bands together, double the effective capacity that they have, and all of that doubling would be for 5G,” he said. However, Cellcom doesn’t have 3.45 GHz in Green Bay’s Brown County, Goemmer noted, which is why mmWave could be part of the picture.

Plans for mid-band and mmWave

Mid-band spectrum has been a prime target for major carriers deploying 5G, and Cellcom is looking at how to put its own holdings to best use.

The carrier is already using CBRS spectrum for fixed wireless service, according to Brooks. He said there are several sites up in the network, leveraging both general authorized access (GAA) use and priority access licenses (PALs).

It’s evaluating CBRS from a mobility standpoint, first for LTE but will be performing proof of concepts for using it for 5G as Cellcom moves to a SA 5G architecture.

Brooks noted there’s some time before 3.45 GHz and C-band will be cleared, with its 3.7 GHz spectrum in the second tranche not expected to be ready for use until 2023.

“Our NR architecture team is really going through that almost county by county perspective to figure out what’s the best use of that spectrum to really provide our customers the best experience,” he said. “So it will probably vary depending on where we are in the footprint, but it will be a combination of using [mid-band] both for 5G as well as for LTE.”

RELATED: UScellular, Nokia, Qualcomm stretch 5G mmWave 10 km in new record

Putting mid-band to use for 5G will follow the cadence of when spectrum becomes available and 5G adoption. As he pointed out 5G-capable devices have been available on the network for more than a couple of years, but people are holding onto them for longer.

On the millimeter wave front, Cellcom doesn’t expect to follow carriers such as Verizon in leveraging the high-band spectrum for fixed wireless, given the makeup of its footprint. Brooks acknowledged tests by other carriers (such as UScellular) in rural settings that extended the range of fixed wireless, delivering 1 Gbps speeds at over a distance of over 6 miles , but Cellcom’s service area poses more of a challenge for mmWave propagation.

“In most of our footprint up here, it’s very rural but not a lot of farm,” he said, noting there are a lot of trees and density, creating line of sight issues. “So millimeter wave is not the best in that area.”

Still, the company is evaluating how to use it to enhance broadband in different areas, he said, but also where it can be used in places that people gather, such as farmers markets or sports complexes.

The company also sees potential for tech partnerships that leverage millimeter wave, more on that here.