As C-band 5G pushes finally get underway, AT&T and Verizon still have some catching up to do. The carriers started turning up much anticipated C-band spectrum last week after delays and disputes with the aviation community and regulators. However, recent network testing including a new report from Opensignal show T-Mobile had already increased its lead in the 5G metrics department across download and upload speeds, availability and reach.

T-Mobile in November hit its target of reaching 200 million people with its Ultra Capacity 5G, which uses mid-band 2.5 GHz spectrum and now covers 210 million. Verizon since last week covers 90 million people with 5G Ultra Wideband in 46 markets, using the newly activated 3.7 GHz C-band, and plans to hit 100 million this month. AT&T, meanwhile, had a much more reserved C-band launch with just eight markets covered by what it dubs 5G+.

RELATED: Verizon readies 5G C-band launch, limits deployment near airports

Verizon’s plans to quickly expand C-band 5G have been well in the works and some early testing, like by PCMag in New York City, found the carrier’s mid-band 5G service is already outpacing T-Mobile speeds in certain neighborhoods although varied widely. According to the outlet, Verizon 5G peak download speeds in Brooklyn and Queens areas hit 733 Mbps, with averages of 534 Mbps in the best performance locations compared to around 100 Mbps in the slowest.

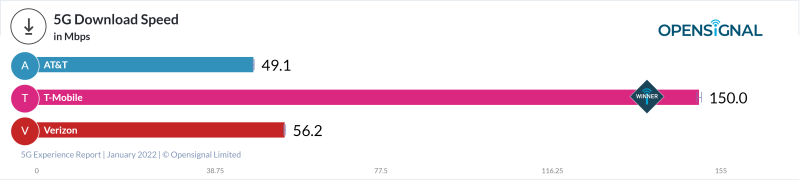

Still, AT&T and Verizon agreed to push back timelines for mid-band rollouts from December and T-Mobile was forging ahead with its own 5G network. Opensignal’s latest 5G Experience Report collected data between September 16 and December 14, 2021, during which users on T-Mobile 5G saw speeds 2.7-3.1 times faster than Verizon and AT&T. At that time, AT&T and Verizon only had nationwide flavors of 5G using lower band spectrum and relying on technologies like dynamic spectrum sharing.

Opensignal found T-Mobile users average 5G download speeds came in at 150 Mbps, beating not only Verizon (at 56.2 Mbps) and AT&T (49.1 Mbps) - but increasing significantly from the operator’s own score a year ago of 58.1 Mbps. Verizon’s 5G download speeds stayed flat since Opensignal’s October report while AT&T actually decreased by 2.4 Mbps.

RELATED: T-Mobile 5G speeds on 2.5 GHz see 40% boost – Opensignal

5G availability was also twice that of AT&T and Verizon, although T-Mobile’s metric for this category didn’t change significantly since the last report. T-Mobile scored 35.4% for amount of time 5G users spent with an active 5G connection, versus 16.5% for AT&T and 9.5% for Verizon.

Similarly, 5G reach, which is the proportions of locations where 5G users have connected to 5G, T-Mobile came out on top with a score of 7.4 out of 10 compared to 5.2 for AT&T and 3.7 for Verizon.

Despite losing out to T-Mobile in four key categories on a nationwide basis, Verizon scored top marks for 5G games and voice app experience – although T-Mobile also saw improvement.

T-Mobile has clearly made its head start, but the other carriers aren’t sitting idly by. Verizon is now in the go phase for its C-band ambitions and AT&T just scooped up 40 MHz more of mid-band spectrum at the FCC 3.45 GHz auction.

Still, T-Mobile took the opportunity to tout its reach and current 5G network prowess, with T-Mobile President of Technology Neville Ray in a statement saying the carrier is “continuing to pull away form the pack” and noting UC 5G coverage is more than double Verizon’s Ultra Wideband and “light years ahead of AT&T’s 5G+.”

“Our competitors are trying desperately to convince consumers and businesses otherwise, but there’s no denying T-Mobile is THE [emphasis T-Mobile] leader in 5G and in a position to deliver the best network performance and capabilities to customers throughout the 5G era,” Ray continued.

C-band rollouts key

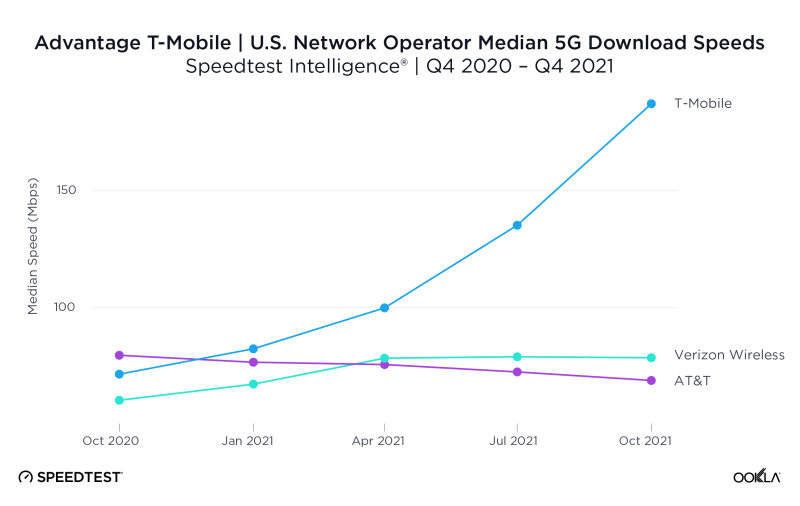

A recent blog from another test and measurement company, Ookla, also highlighted why Verizon and AT&T couldn’t hold off any longer to start deploying the key mid-band C-band airwaves that offer both coverage and capacity for 5G.

One was catching up to T-Mobile, whose median 5G download speeds accelerated upwards between Q4 2020 and Q4 2021 while Verizon stayed largely the same and AT&T dipped.

C-band will help reset the 5G playing field, Ookla said, noting Verizon initially gets to deploy 60 MHz of C-band and AT&T 40 MHz.

“While [C-band] reach isn't as wide as the lower frequency spectrum, it allows operators to add much more capacity while also allowing for significantly better geographical reach when compared to mmWave,” wrote Ookla lead industry analyst Mark Giles.

“…deployments in the 3.7 GHz band will drive a considerable uplift in performance, helping them begin to close the gap on T-Mobile,” he continued.

Ookla also highlighted how C-band has boosted speeds in other countries. For example, C-band deployments by Taiwan Mobile alongside a competitive densification strategy drove median 5G speeds near 300 Mbps, while SFR in France has median 5G speeds above 200 Mbps with similar C-band bandwidths.

T-Mobile standalone 5G, carrier aggregation

To keep its 5G network in a leadership position, T-Mobile has more than just 2.5 GHz spectrum up its sleeve.

Recent network testing by Signals Research Group showed how 5G NR FDD/TDD carrier aggregation is giving a boost for higher data speeds and extended 2.5 GHz coverage.

T-Mobile also flaunted new 5G carrier aggregation capabilities last week using two channels of 2.5 GHz for faster traffic with less congestion and more capacity, as well as combining 2.5 GHz and lower band 600 MHz.

Another unique feature – T-Mobile’s the only U.S. carrier to deploy a nationwide standalone (SA) 5G network, although so far has been fairly quiet about what it’s done for network performance.

A key aspect of standalone is that it no longer relies on LTE support that’s seen in non-standalone (NSA) 5G deployments which have been rolled out for initial 5G networks.

RELATED: T-Mobile notches 4.95 Gbps on 5G standalone network

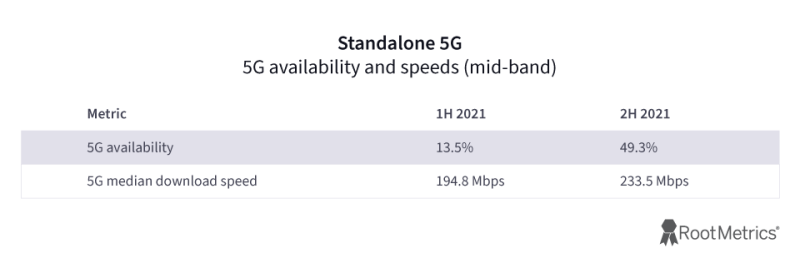

In tests of T-Mobile’s standalone network in Las Vegas, Rootmetrics (which was recently acquired by Ookla) last week reported a significant proportion of results on SA 5G, specifically mid-band 5G, and compared it to the carrier’s own NSA network.

T-Mobile use of mid-band 5G increased from 23.5% in the first half of 2021 to a whopping 80.5% in the second half in Las Vegas. SA 5G availability meanwhile jumped from just 13.5 % to 49.3% in 2H 2021.

“That rise in SA 5G availability helped boost T-Mobile’s standalone 5G median download speed from an already impressive 194.8 Mbps in 1H 2021 to an outstanding 233.5 Mbps by year’s end,” the blog stated.

RELATED: How’s 5G standalone doing in the U.S.?

And that median SA 5G download speed was over 2-times faster than T-Mobile’s NSA 5G score of 107.5 Mbps. Still, it should be noted that while the Las Vegas analysis showed SA 5G speeds improved noticeably since the first half, median speeds on T-Mobile’s NSA 5G network declined by more than 100 Mbps from 213 Mbps in the first half, which Rootmetrics attributed in part to signal conditions.

“The bottom line is that T-Mobile’s standalone 5G network clearly impressed, delivering an outstanding speed over twice as fast as its speed on non-standalone 5G. T-Mobile also showed a commitment to expanding its standalone 5G presence in Las Vegas, quadrupling its SA 5G availability in the city since the first half of 2021,” wrote Rootmetrics.

Another important metric for standalone 5G is latency. In Las Vegas T-Mobile’s SA mid-band 5G network scored 53.5 ms in the second half of 2021, showing a roughly 15% improvement over its NSA mid-band 5G and LTE networks. Latency comes into play for applications like gaming, as the report pointed out Microsoft Xbox Game Pass recommends latency of 60 ms or below for a smooth experience and only SA 5G on T-Mobile's networks hit that threshold.

RELATED: AT&T, Verizon likely need C-band before activating 5G SA cores: analyst

AT&T and Verizon do plan to implement SA 5G networks at some point, but haven’t shared definitive timelines.

Dell’Oro analyst Dave Bolan recently told Fierce that AT&T and Verizon needed to get the bandwidth from mid-band C-band spectrum up before activating a standalone network core, as they need the support from 4G networks alongside 5G in NSA mode to provide enough throughput for now.

Corrected to reflect that T-Mobile hit its 200M coverage target last year, not in 2022.