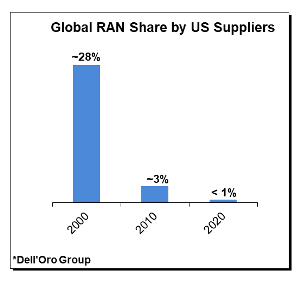

A Wall Street Journal article in 2021 said the U.S. government has upended the $35 billion radio access network (RAN) market. While there are some early indicators that the on-going efforts by the U.S. government to curb the rise of Huawei are starting to show in the numbers outside of China — with the aggregate RAN share of the top three suppliers declining a couple of percentage points between 2020 and the first nine months of 2021 — the question is if the main beneficiaries are the U.S. RAN suppliers and if they are really back in the game?

The data contained in the Dell’Oro 3Q21 reports reveal that the combined RAN revenue share of the larger U.S. RAN hardware and software suppliers — including Airspan, CommScope, Corning, JMA Wireless, Mavenir, Motorola Solutions, and Parallel Wireless — is trending upward, underpinned by mixed adoption.

Still, the majority of the year-to-date share drop for the top three is actually driven by movements within the top five suppliers, with both Samsung and ZTE gaining share for the 1Q21-3Q21 period relative to 2020, partly as a result of opportunities emerging within and outside of China.

And it is important to keep in mind that not all RAN is the same. While our estimates indicate the U.S. suppliers account for less than 1% of the combined RAN market, the competitive dynamics differ markedly across the various RAN segments. Perhaps not surprisingly, the U.S. suppliers have had more success gaining footprint with low power sites versus macro sites, accounting now for a single-digit share of the global small cell RAN market.

Since 5G is dominated by macro sub 6 GHz investments, it should come as no surprise that the U.S. suppliers still account for a fairly small part of the overall 5G macro plus small cell RAN market, in line with the share developments of the combined 2G-5G RAN market. These trends are also extended to the contribution domain — external sources suggest U.S. RAN system suppliers comprise a negligible portion of total 5G contributions.

RELATED: Not all open RAN is the same — Industry Voices: Pongratz

On the upside, the picture appears more flattering if we zoom in on the Open RAN segment. Though this market remains nascent, preliminary findings show that the U.S. suppliers collectively accounted for a double-digit share of the 3Q21 Open RAN market, reflecting some initial success with both greenfield and brownfield deployments.

More importantly, the U.S. RAN landscape is still evolving. Favorable prospects with new RAN opportunities taken together with the promise of reduced barrier-to-entry are spurring more suppliers to invest in 5G – our estimates don’t include any material commercial revenue yet from new U.S. 5G RAN players such as Cambium, Celona and Verana Networks.

In short, the competitive dynamics is improving and a string of indicators suggest the aggregate share of the U.S. suppliers is moving in the right direction. Keeping in mind that the American RAN vendors still account for less than 1% of the global 5G RAN market, it is of course debatable if the relative trends are enough to support the narrative that the U.S. is back in the 5G game. Regardless, it will be exciting to monitor this space going forward so we can eventually address another key question: how much RAN share will the U.S. suppliers have by 2030?

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm's Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by FierceWireless staff. They do not necessarily represent the opinions of the editorial board.