If Verizon had not shown improvement in the fourth quarter – traditionally a lucrative time for carriers – that would have raised some serious alarm bells.

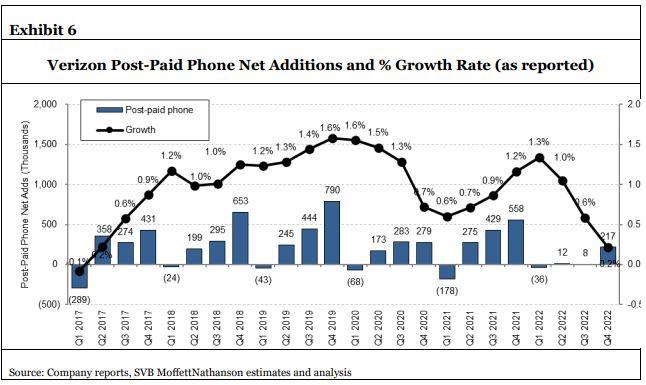

Instead, Verizon delivered what might be considered at best a ho-hum performance, reporting 217,000 postpaid phone net adds. Rival AT&T added 656,000 postpaid net phone customers for the same quarter, and T-Mobile already upstaged both of them by announcing preliminary Q4 results of 927,000 phone net adds.

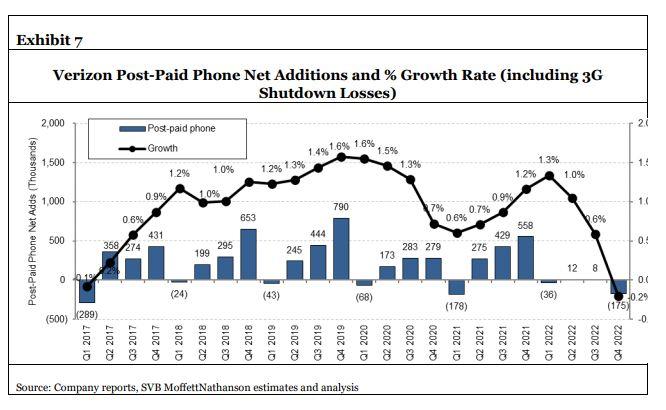

The thing is, Verizon’s Q4 2022 net adds would have been a lot worse if they had included losses due to the shutdown of the 3G network, according to analysts at MoffettNathanson. The 3G loss was treated as an adjustment to the subscriber base but was excluded from net additions or losses. That’s not a knock directed solely at Verizon; its peers have treated their own 3G shutdowns the same way, according to analyst Craig Moffett in a report for investors published Tuesday.

Verizon was the last of the Big 3 wireless carriers to shut down its 3G network, calling it quits on December 31, 2022. Sprint’s 3G CDMA network was shut down as of March 2022 and T-Mobile’s older 3G UMTS network was turned off as of July 1, 2022. AT&T shut down its 3G network in February 2022.

According to Verizon, it lost about 576,000 consumer and 333,000 business connections, including 392,000 wireless retail postpaid phone connections, Moffett noted.

“Including 3G shut-down losses in the totals results in a much uglier picture, where Verizon’s total retail phone base has contracted by 1.3% YoY,” he wrote.

“To be fair, there is no obvious ‘right way’ to treat these 3G losses. They are inarguably real and should absolutely be included in industry totals (they represent real people using real devices, and they are necessarily going somewhere to replace their decommissioned devices). But including them in subscriber growth rate trends may not be reflective of forward trends. There is, in other words, a case to be made for looking at subscriber trends both ways,” Moffett said.

Other Wall Street analysts also noted the omissions. LightShed Partners analyst Walter Piecyk said in a tweet: "And to be clear. $VZ post-paid phone sub base declined in Q4 by 153k. Companies highlighting 'net adds' exclude the lost subs from legacy 3G network shutdowns. We consider that churn."

3G shutdowns across industry

AT&T reported Q4 results on Wednesday and included these jumbled numbers in a footnote: “1Q22 subscribers and connections include a reduction of 10,707k subscribers and connections (899k postpaid including 438k phones, 234k prepaid, 749k reseller, 8,825k connected devices) resulting from 3G network shutdown in February 2022.” It also said that “3Q22 and 4Q22 also include adjustments of +169K and +360K connected devices, respectively, related to the 3G network shutdown.”

T-Mobile reports its Q4 and 2022 results next week, but it previously said it lost 212,000 and 284,000 postpaid phone customers in Q1 and Q2 of 2022, respectively, due to the decommissioning of Sprint’s CDMA and LTE networks and T-Mobile’s UMTS network shutting down.

The ordeal of shutting off a 3G network was perhaps most troubling for Dish Network, which thought it had three years to migrate Boost Mobile customers off 3G CDMA handsets and onto more modern ones that would work on T-Mobile’s LTE network. It was embroiled in a very public and acrimonious fight with T-Mobile until that got resolved almost a year ago.

Besides phones, the shutdown of 3G meant IoT devices needed to find new homes if they were still on 3G. That was exacerbated for the alarm industry, much of which depended on AT&T for their connections. Supply chain problems related to Covid didn’t help their situation as they tried to swap out old gear for new.

Peeling back the onion

Part of the reason financial analysts create their models is they aren’t getting all the data they want direct from the carriers, said Bill Ho, analyst at 566 Ventures. With 3G, it’s especially difficult to say where the 3G customers are going because there’s such a broad mix, ranging from the people who stash their phones in a glove compartment to tablet users and IoT devices, he said.

“It’s really hard to peel back the onion unless you get cooperation from the carriers,” he said. In some cases, “they don’t want to reveal it” or it gets too much in the weeds.

Further clouding things are multi-line phone plans, where consumers get a discount for adding more phones to their monthly bill. The concept goes back to quadruple or triple plays from years ago – the idea being to get customers to sign up for as many services as possible, which makes it harder for them to leave, Ho said. Cable operators are doing it too, offering, for example, mobile services to customers who already take their internet service packages.

3G shutdowns make way for 5G

Of course, U.S. operators are shutting down 3G and repurposing that spectrum for 5G, which promises so much more than what 3G offered.

Ivo Rook, who worked for Vodafone and U.S. carriers before taking the president/COO role at cellular IoT firm 1NCE, calls 3G the “lost generation” because the productivity gains – or the amount of bandwidth that could be squeezed into spectrum – never lived up to the promise, “so it was the shortest of the Gs.”

For IoT, there were almost no “3G-only” devices but rather 2G models that eventually got replaced by LPWAN/LTE models. In short, 3G was an “economic/technical miss, rapidly replaced by the much more efficient 4G,” he said.

That might explain in part why 5G is such a disappointment thus far. “4G was the real game changer, both in efficiency of spectrum and the associated gains in speed and therefore the value (speed for money). A side effect of the 4G battle was the introduction of unlimited and the reaching of saturation levels in smart phone penetration,” Rook said via email.

"Therefore, 5G could not just be about more speed because the prices were locked,” and it’s logical for operators to look at other things like low latency, IoT and fixed wireless access (FWA) to monetize spectrum where there’s enough capacity.