Enterprise fiber connectivity in the U.S. ramped up in 2022, reaching more than 1.4 million commercial buildings and data centers in 2022, per new data from Vertical Systems Group.

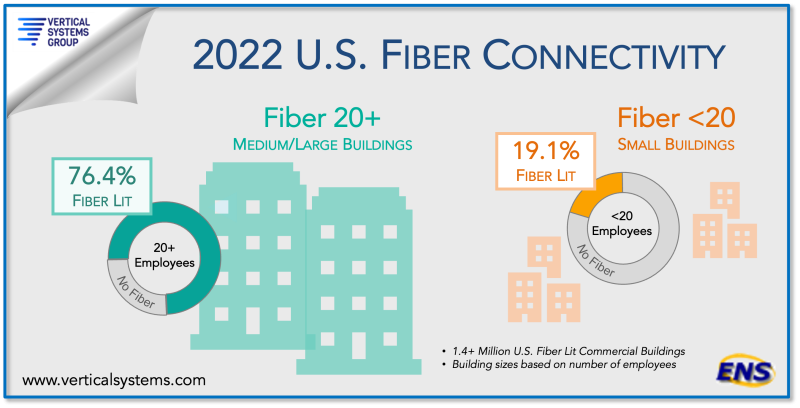

Medium and large commercial buildings, which range up to 250+ employees, saw fiber availability increase to 76.4%. In contrast, nearly 20% (19.1%) of small buildings – sites that have fewer than 20 employees – were connected to fiber last year.

According to VSG Principal Rosemary Cochran, small buildings made up the majority of new fiber lit sites in 2022. For its study, VSG leveraged data from over 5 million commercial buildings and data centers across the country.

“Suppliers include the hundreds of fiber providers across the U.S. with nationwide, regional or metro footprints,” Cochran said in a statement. “Fiber expansion continues to be boosted by multiple factors, including business demand for higher speed network services, government funding incentives, M&A activity, joint ventures and private investments.”

She explained to Fierce the larger the building, the more likely it already has a running fiber connection. These buildings include data centers as well as healthcare and financial companies “that need diversity of connectivity and backup.”

Cochran added there may be multiple companies housed within a site, and “they are all using the fiber that’s coming into the building.”

VSG defines a lit building as one that has optical fiber connectivity to a network provider’s infrastructure, along with active service termination equipment onsite. Residential buildings, dark fiber installations, HFC-connected buildings and standalone cell towers were not included in the study.

The number of fiber lit businesses was up from around 1.3 million commercial buildings in 2021. Still, most commercial sites have some catching up to do, as VSG noted more than 3.8 million sites in 2022 had no optical fiber access to network services.

Cochran said while that number has been going down, economic pressures may cause the number of commercial sites to fluctuate.

“There’s a lot of pressure on the real estate markets because the leases are coming up and they’re not getting workers back at the same levels,” she said. “So, there’ll be some changes in the buildings but not necessarily in the number of fiber connections, just because of the need that’s there.”

Commercial buildings typically use fiber from major U.S. operators. In 2022, AT&T boasted the highest number of fiber lit sites for the seventh year in a row, according to VSG rankings published in May. Verizon, Spectrum Enterprise, Lumen and Comcast Business are also notable retail and wholesale fiber providers.

Cochran told Fierce in May smaller providers are installing fiber in commercial and mixed-use buildings, but those installations may also serve adjacent residential areas. Some larger commercial sites (37%) have fiber connections from three or more different providers.