New data from ACA Connects and consulting firm Cartesian indicates 6.4 million unserved and underserved locations will be eligible for Broadband Equity, Access and Deployment (BEAD) funding, once states and territories begin selecting broadband deployment projects.

According to version four of ACA and Cartesian’s BEAD framework, the U.S. currently has 10.3 million unserved and underserved locations, but that number is poised to go down by June 2024, when states are likely to begin awarding BEAD money to subgrantees.

Further, the 10.3 million locations, determined from the newest version of the Federal Communications Commission’s national broadband map, decreased from 12 million eligible BEAD locations found in mapping data from December 2022.

“Although the total number of eligible locations has decreased, in a few states the number of locations has increased, likely due to reasons such as updated provider coverage and resolved data discrepancies,” ACA and Cartesian noted.

Given that Louisiana is the only state thus far to receive full approval for its BEAD initial proposal (describing how a state intends to run its grant program), ACA and Cartesian pushed back their assumed BEAD project award date from January to June of this year.

But they said, “even that [timeframe] is optimistic.”

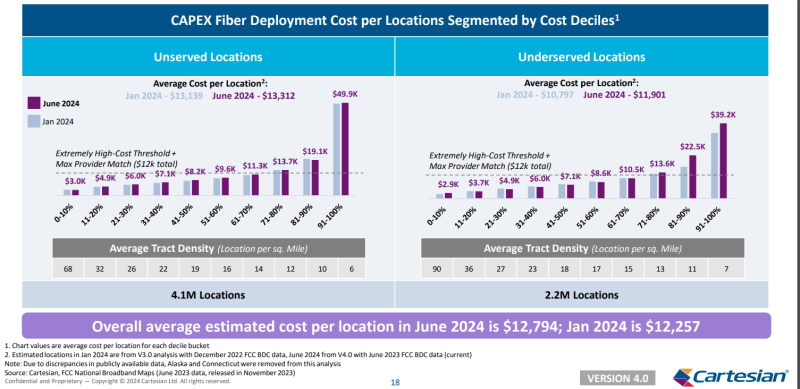

Despite the drop of BEAD eligible locations, ACA and Cartesian pointed out the locations in the latest FCC map are, on average, more costly to serve. That’s because the number of unserved and underserved locations went down “at the lower end of the fiber cost curve.”

The average cost to serve an unserved location with BEAD funding would be around $13,300, while an underserved location would cost $11,900. These figures mark increases of roughly $175 and $1,100, respectively, from version three of ACA and Cartesian’s framework.

The cost of fiber deployments

ACA and Cartesian estimate fiber providers will be willing to match up to $3,000 per location and that all states should have “sufficient funds” to deploy fiber to all unserved and underserved locations below a reasonable “extremely high-cost threshold.”

Although the NTIA has expressed a preference for fiber in BEAD deployments, it’s allowing states to set thresholds in regard to areas where it will be extremely expensive to deploy fiber – opening the door for other deployment technologies.

Taking into account matching funds from fiber ISPs, ACA and Cartesian estimate states will have a total of $61 billion in capital available for deployment projects.

They said that amount should be enough to deploy fiber below a reasonable “extremely high-cost threshold” to around 4.5 million unserved and underserved locations, using roughly 67% of the estimated available capital. The remaining 1.9 million locations would be reached with other technologies.

If states allocate more BEAD funds to fiber (meaning they are willing to deploy fiber above the high-cost threshold), ACA and Cartesian said around 5.4 million BEAD-eligible locations can be reached with fiber. However, that would require roughly 95% of the $61 billion available capital.