-

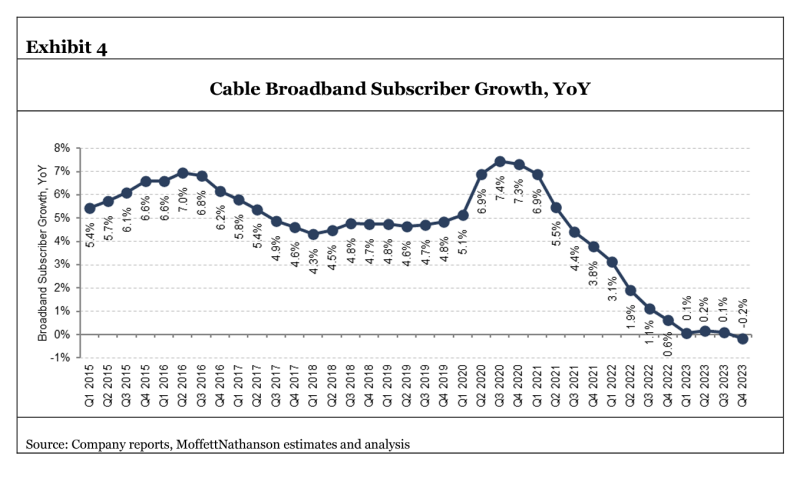

TD Cowen says there's a bearish sentiment in the cable space in regard to broadband subscriber additions

-

Pressure is coming from fixed wireless access and fiber

-

The end of the Affordable Connectivity Program won't help

The analysts at TD Cowen aren’t expecting to hear good things from cable operators during their upcoming Q1 earnings reports.

They note that the stock prices of the big four public cable operators Comcast, Charter, Altice and Cable One have all dropped since the beginning of 2024.

In a research note the TD Cowen analysts said, “The bearish sentiment in the cable space remains historically low as we expect the worst cable losses in Q1 in history.”

Ouch.

And this follows the fourth quarter 2023, which saw subscriber losses for the first time ever among U.S. cable operators.

Cowen says its reasons for the bearish sentiment include market maturity and saturation, low churn volumes, pressure from fixed wireless access (FWA) and relentless new competition from fiber builders over the next few years.

FWA from T-Mobile, Verizon, and to a lesser extent AT&T, is definitely having a negative impact on the cable industry. Cable executives argue that FWA will eventually face capacity restraints. But the TD Cowen analysts said that T-Mobile and Verizon will use spectral efficiencies to boost their capacity for FWA. They don’t expect the FWA threat to cable to begin waning until 2026 or beyond.

However, the analysts at Moffett Nathanson are more optimistic.

In terms of the threat from FWA, Moffett wrote, “We have long expected that 2023 would be the peak year for FWA net additions, and therefore the peak headwind to cable net additions. Our forecast remains little changed and calls for FWA growth to decelerate by approximately 600,000 net additions in 2024 and to continue to moderate thereafter.”

ACP

Adding to cable’s financial woes is the imminent end of the Affordable Connectivity Program (ACP).

In terms of ACP’s demise, the TD Cowen analysts wrote, “The impact is still widely unknown, though broadband is more critical than ever (i.e., where would the subscribers leave to?)”

Only a modest portion of ACP subs are expected to migrate to mobile-only broadband. But we won’t know the full impacts of the loss of ACP until the second quarter of 2024.

For ACP projections for the second quarter, TD Cowen expects 29,000 sub losses at Altice, 4,000 at Cable One, 325,000 at Charter at 100,000 a Comcast.

The Moffett Nathanson analysts, again, were more measured. They wrote that the impact of ACP won’t be felt as a one-time event. “Subscriber losses, and their corresponding revenue, EBITDA, and free cash flow impacts, will be felt gradually over some indeterminate number of quarters after the program sunsets.”