The CEO of Brightspeed Bob Mudge indicated during a keynote at last week’s Connect(X) conference in New Orleans that the company is working fast to transform nearly every aspect of the assets that it purchased from Lumen Technologies in October 2022.

Brightspeed is the company, majority owned by the private equity firm Apollo, that bought ILEC assets in 20 states from Lumen Technologies for $7.5 billion. Its service territory encompasses about 6.5 million homes, making Brightspeed the fifth largest ILEC in the U.S.

Being a private equity company means it’s working much faster to completely overhaul its business than Lumen was ever able to do as a legacy telco with a dividend burden.

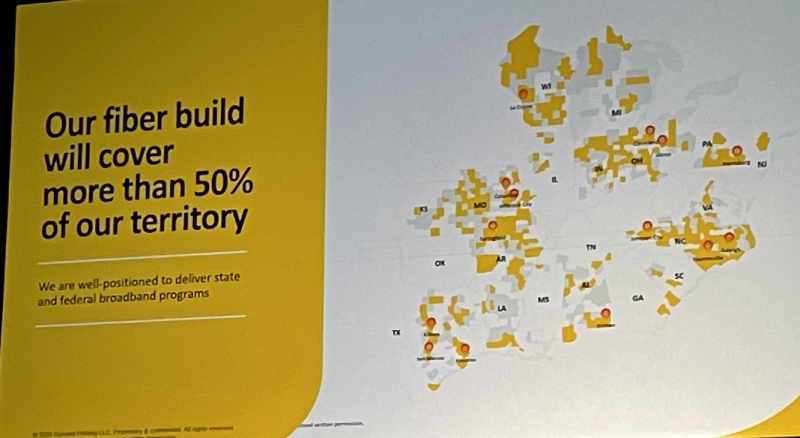

The vast majority of Brightspeed’s footprint is currently served with copper, but the company aims to pass 3 million homes and businesses, as well as towers, with new fiber over the course of about 3.5 years. And its new fiber build will cover more than 50% of its territory.

At Connect(X) Mudge said the average income in its footprint is about 15% lower than the national average, and the areas it serves are fairly underserved. Its footprint is 90% rural and suburban. Rather than seeing this as the glass-mostly-empty as Lumen did, Mudge said this makes the footprint “really ripe for investment.” He said only about 3% of the homes and businesses in the footprint it acquired from Lumen are passed with fiber. But he sees this as the glass being “97% full.”

The company plans to spend at least $3 billion in capex to deploy fiber and make other upgrades. And in addition to private investors, it will also pursue BEAD funding. “We’re going to go from a minimum required capital to robust investment,” said Mudge.

Earlier this month, Brightspeed announced that the Abu Dhabi sovereign investor Mubadala will invest $500 million into the operator.

Fiber deployment strategy

Mudge’s background includes a 7-year stint with Verizon, which he indicated gave him some knowledge about deploying fiber.

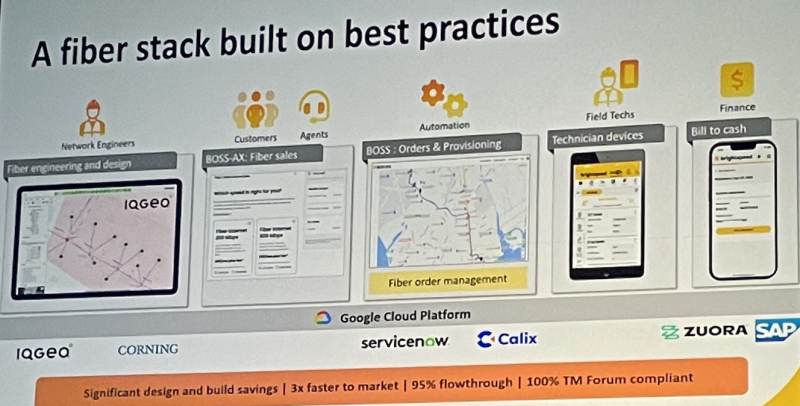

At Brightspeed, he and his technical team decided to re-work the company’s fiber deployment stack. It’s working with vendors including IQGEO, Corning, ServiceNow, Calix, Zuora and SAP. “As we build the network in IQGEO, it will download in real time to our systems, stitching between design, build and right through to billing,” said Mudge. “This was a bit of a heavy lift. I like to think of it as a stack not so much built on technology but common sense of best practices.”

Brightspeed is pursuing multiple markets with its fiber, including consumers and small businesses, large enterprises, wholesale contracts and business contracts with wireless tower companies.

It says it will go from 6,000 lit towers to 10,000 lit towers and from 12,000 to 30,000 lit buildings.

Other transformations

In addition to deploying more fiber, the company also plans to upgrade its core network from 10G metro Ethernet to 100G.

“We didn’t realize the need to update our core network,” said Mudge. But he said the updates are being driven by demand from its customers. "The core network will allow us to participate with the largest competitors out there," said Mudge. "Cable competitors are our number one concern.”

Brightspeed will also transform its IT infrastructure from a hodge-podge of legacy systems to a cloud-based platform.

Finally, the company is already working to improve its customer service. It has an employee base of about 4,000 people, many of whom came from Lumen. “It’s big enough to have impact, but small enough to make quick changes,” said Mudge.

It has hired about 300 new people since the company bought the Lumen assets in October. Many of these are in customer service where Brightspeed is working to improve speed-of-answer. Mudge said his team wanted to start improving customer service right away because “we knew the existing profile would not attract new customers…When we come knocking to sell fiber, people will recognize that a different provider is serving them.”