Analysts are predicting that 2022 will be a banner year for fiber rollouts in the United States. And at least one Washington, D.C. think tank seems pretty concerned about the prospect of new entrants threatening the status quo of incumbent broadband providers.

The demand for fiber really began to spike in 2020 when the pandemic was in full force and Americans were ordered to shelter in place. Overnight, everyone suddenly had to work and learn from home, which meant huge reliance on home broadband connections. The situation highlighted all the weak points in the U.S. broadband ecosystem.

These weak points are, ironically, laid out by Robert Atkinson, president of the think tank the Information Technology & Innovation Foundation (ITIF). Atkinson defends the current broadband incumbents, and in a blog post attempts to shoot down every complaint about the current system, which include:

- Speeds are too slow

- Rural coverage is too limited

- Urban coverage suffers from digital redlining

- Corporate ISPs don’t protect users’ privacy

- Big broadband wants non-neutral pipes

- Prices are too high

- Profits are too high

Atkinson says “populists” and “socialists” are driving the changes in the current competitive landscape for broadband. He theorizes that the “ultimate end game” of these people is to have government-owned networks.

But perhaps it’s really just a case of the free market at work. I think the vast majority of Americans are pretty stoked about the prospect of faster broadband speeds, more ubiquitous coverage and more competitors to choose from.

RELATED: Fiber ecosystem gets stoked about the infrastructure bill

The Infrastructure Investment and Jobs Act earmarks $65 billion for broadband. And the National Telecommunications and Information Administration (NTIA) will be overseeing the distribution of these funds to each of the 50 states as well as territories and the District of Columbia. These states and territories will have a level of discretion to award the funds in their locales.

RELATED: Finding the money: A US broadband funding guide

Some incumbents may try to fight this historic opportunity to modernize the nation’s broadband infrastructure because they don’t want new competition from municipal broadband providers and other small entrants. But most incumbents will likely expand their own fiber networks, potentially tapping federal funds themselves.

More fiber is coming

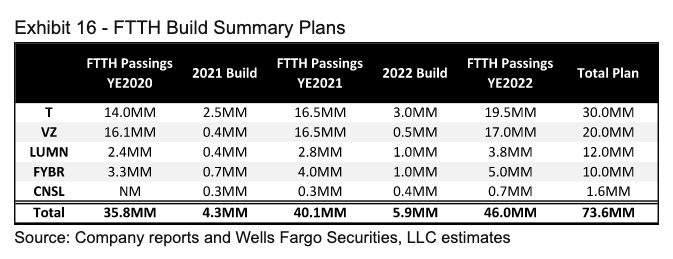

A Wells Fargo note to investors this week said fiber-to-the-home (FTTH) will hit terminal velocity during 2022, driven by incumbents, including AT&T, Verizon, Lumen, Frontier, Consolidated Communications, Windstream, Ziply and others.

The analysts predict telcos will add 8 million new FTTH passings in 2022 versus about 5 million in 2021. And passings will accelerate even faster in 2023 to about 10 million.

“We think fiber subs grow >15% in 2022,” wrote the Wells Fargo analysts. “Fiber-to-the-home construction is to grow >50% year over year as the telcos accelerate overbuilding of legacy plant.”

While telcos often use the word “overbuilding” in a derogatory fashion when talking about new competitors, apparently it’s okay for them to “overbuild” their own decrepit DSL networks.

“We suspect the first stage of FTTH builds will focus slightly more on denser metro areas, which can be upgraded more quickly and cost-efficiently (in many cases with aerial fiber),” wrote the Wells Fargo analysts. “These will also largely be overbuilds of existing network, which helps mitigate elongated zoning and permitting timelines.”

Other types of broadband competition

A 2022 Telecom Industry Outlook report from Deloitte published this week noted that federal broadband grant programs have traditionally favored wired solutions, but states are increasingly technology-agnostic in awarding grants as long as a service can meet minimum performance thresholds. This trend opens the field to new players, including entrepreneurial fixed wireless access (FWA) and low-earth-orbit satellite internet service providers.

“Many telecom organizations may not be fully equipped to shift to a more decentralized state-managed and potentially more competitive award program,” states the Deloitte report. “As a result, there will be a need to develop more nuanced methods to keep abreast of many local funding mechanisms and grant programs.”

Circling back, ITIF's Atkinson suggests that the sea-change in the broadband environment is being driven by populists who hate big companies and want government-owned networks.

I completely disagree.

I think this historic moment is being driven by a people’s outcry for better broadband. And federal funds will benefit incumbents as much, or more, than new players. The result will be a more competitive, disperse broadband landscape. This is the polar opposite of socialism where systems are managed centrally.