The Fiber Broadband Association (FBA) is working with the consulting company Cartesian to develop business models for deploying fiber in extremely high-cost situations. And FBA and Cartesian held a webinar today, explaining their work.

The National Telecommunications and Information Administration (NTIA) has expressed a preference for fiber when it comes to dispensing $42.5 billion from the Broadband, Equity, Access and Deployment (BEAD) funding. But the NTIA rules allow U.S. states some leeway in regard to areas where it will be extremely expensive to deploy fiber.

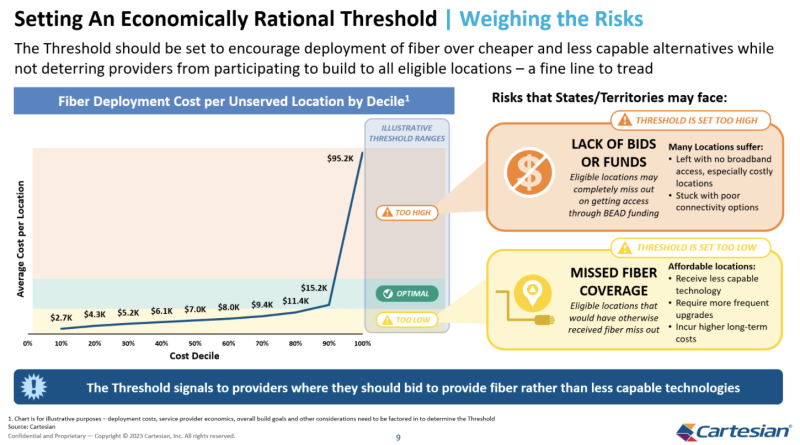

Specifically, states and territories must define their thresholds for extreme high-cost locations. This will open the door for less expensive alternatives to fiber to be deployed in areas where the fiber cost is over the threshold.

But the NTIA expects the thresholds to be set as high as possible so that as many people receive fiber as possible.

Extreme high-cost deployments of fiber got a lot of attention last summer when reports surfaced of some USDA ReConnect grants being allocated for crazily expensive fiber deployments. For example, the Alaska Telephone Company won a $33 million ReConnect grant to run fiber to 211 homes and five businesses at a shocking cost of nearly $204,000 per passing.

FBA and Cartesian

To help states and territories set their thresholds, the FBA has joined with Cartesian to develop a methodology.

Michael Dargue, VP with Cartesian, said on today’s webinar that in essence, the thresholds that states and territories must set will determine locations where they need not prioritize fiber and instead may consider other technologies.

States and territories must address their thresholds when filing their initial proposals with the NTIA. They can either specify their threshold or give a detailed process for how they will determine their threshold.

Generally, providers that receive BEAD funding must contribute at least 25% of a project’s cost. States and territories will want to set their thresholds at a high enough rate to encourage providers to deploy fiber, but not set the threshold too high where providers feel like they don’t have a business model.

Since providers must contribute a minimum of 25% to a project’s cost, they’ll have to determine how much those costs are and if the project will support their revenue projections.

“Setting the threshold is quite a delicate balance,” said Dargue. “If the threshold is set too low, there’s a risk that fiber coverage will be missed, and there will be eligible locations that otherwise would have received fiber that will get a less capable technology. Conversely, if the threshold is set too high that can affect provider participation. The threshold is signal to providers on where they should bid to provide fiber.”

There are a lot of factors that Cartesian incudes in its models to determine the cost of building fiber to a location. Some of those factors are:

- Terrain

- Distance to the site

- Existing infrastructure

- Materials and labor

- Regulations and policies

Cartesian’s methodology starts by estimating the deployment costs. Then it develops various provider business cases that define reasonable payback periods. With the business cases, states can run deployment scenarios to see the effect of different thresholds.

Dargue said that ultimately each state's and territory’s extremely high-cost threshold will tell providers which technology they should be sending bids for. “If it’s under the threshold – come with your fiber bids,” he said.

Why is FBA doing this?

Tom Cohen, regulatory counsel for the FBA, said, “The NTIA didn’t direct us to do this or fund us to do this. This is our own undertaking. What we’re trying to do is educate people, including NTIA. We talk to them and share this with them. This is an enormous undertaking. And we all need to sort of join hands together to maximize the use of funds and get these stranded locations the best technology.”

Gary Bolton, CEO of the Fiber Broadband Association, said, “Our goal is to make NTIA wildly successful. Our goal is to get everyone connected.”