Fiber-to-the-home (FTTH) has established itself as a mainstay in the broadband market as services have become more affordable and accessible to the public, according to a recently published report from Cowen.

In a survey of over 1,200 consumers, Cowen found the average household income of a FTTH subscriber was around $83,000, compared to approximately $85,000 for those not subscribed to fiber. For the first time since Q4 2020, when Cowen began conducting its quarterly FTTH survey, income for FTTH subscribers is lower than income for non-FTTH subscribers.

The income shift is indicative of providers building out more fiber to the general population – rather than just wealthy neighborhoods – according to Cowen analysts Gregory Williams and Michael Elias.

In the report, Williams and Elias explained that in the past two decades, initial target markets for FTTH were “typically in wealthier zip codes that could command higher ARPU to justify the high build costs and otherwise challenging businesses case.”

“We contested that this trend would pivot going forward as FTTH builds target broader markets and more typical populations, and as FTTH plans offer lower rack rate pricing compared to that of Cable,” wrote Elias and Williams.

Frontier, for instance, offers a 1-gig fiber optic plan for $80 per month, whereas cable operators like Comcast and Charter charge over $100 monthly for “similar stand-alone plans,” said Cowen. And Google Fiber, which already offers 1-gig for $70 per month, this month disclosed plans to eventually debut a new low-cost service tier.

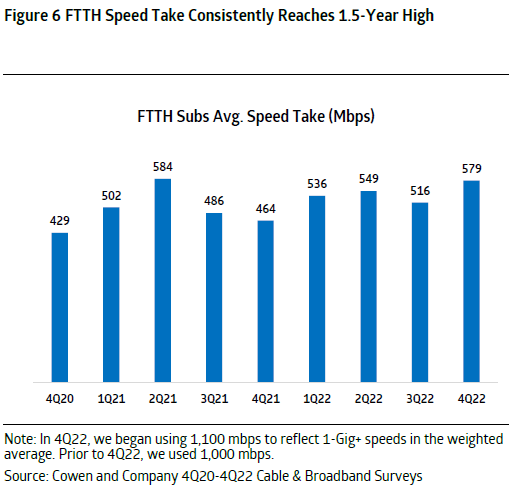

While FTTH household income has come down, speeds from fiber services continue to rise, said Cowen. The survey showed FTTH subscribers receive an average speed of 579 Mbps, whereas non-fiber customers are getting an average 419 Mbps.

“With the superior value proposition, we expect FTTH to take >90% of wireline broadband net add share over the next three years,” said Cowen’s report. “The growth in already superior speeds also gives us conviction that fixed wireless, with its longer-term capacity constraints, poses little to no threat to FTTH providers.”

As fiber continues to pick up steam, it doesn’t mean cable operators are standing still. Comcast has been doubling down on mid-split upgrades to facilitate its network transition to DOCSIS 4.0. The operator also plans to turn up 2-gig service across 10 million locations by the end of this month and teased a forthcoming announcement related to fiber.

“It seems clear that Comcast will continue to respond quickly to the threat posed by fiber and fixed wireless providers by evolving its broadband networks to DOCSIS 4.0,” said Dell’Oro Group’s Jeff Heynen in a recent column.