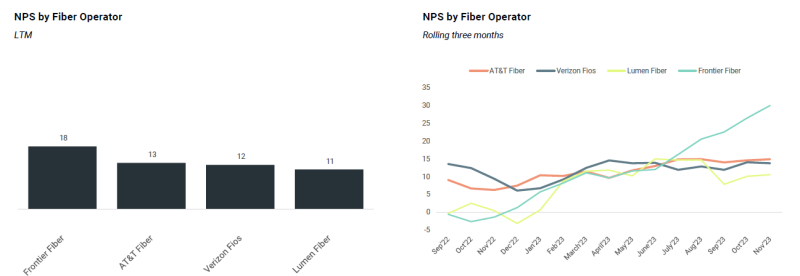

Frontier Communications boasts a higher Net Promoter Score (NPS) for its fiber product compared to competitors like AT&T, Verizon and Lumen, according to New Street Research’s broadband trends report.

An NPS measures the loyalty of a company’s customer base from a scale of -100 to 100. It comes from asking customers how likely they are to recommend the product or service to others.

New Street used data from Recon Analytics to compare NPS among operators.

“The improvement in Frontier’s NPS over the last twelve months has been astonishing,” analysts wrote. “It has climbed from being the lowest in the group to being double the average, and the gap between Frontier and others is widening.”

Frontier in the third quarter racked up 75,000 fiber customers, ending the period with 1.8 million fiber subscribers – representing a 19% year on year increase. Its fiber penetration rate reached 44% in Q3, just shy of its long-term target of 45%.

New Street analysts said Frontier’s NPS “provides strong support for Frontier’s target of mid-40s penetration, particularly when you compare the trends with those of Cable competitors.”

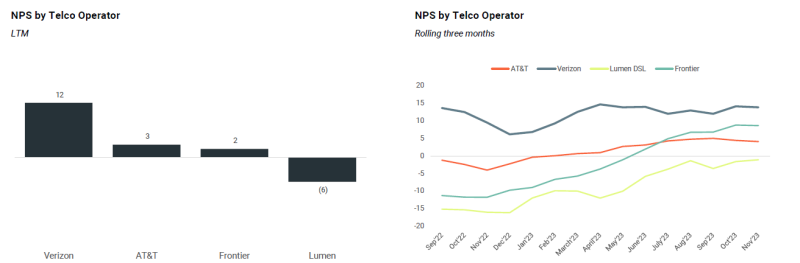

For overall broadband, Recon Analytics data shows Verizon has the highest NPS. However, New Street said that’s “largely due to product mix; they have very little DSL.”

AT&T and Frontier have both seen broadband NPS improve due to a “shift in product mix” and in Frontier’s case, improved NPS for fiber. Lumen, on the other hand, has the lowest NPS of the four for both overall broadband and fiber.

“With only a third of its customers on fiber, Lumen’s overall score is shaped by the low score on DSL,” said New Street analysts, but they noted Lumen “has shown improvement too” through product mix.

Lumen cut its Quantum Fiber build pace twice this year, most recently announcing it would reduce its 2024 target from 800,000 to 500,000 new locations.

New Street described Lumen’s fiber product as “adequate,” but noted only 32% of its customer base is on fiber, compared to 67% at Frontier.

“This suggests that the trends in the mass market business can be fixed if Lumen had the capital to invest in fiber,” analysts wrote. “We see this as a massive opportunity that is eroding as others overbuild them.”

In a note to investors last month, New Street suggested Lumen sell its Mass Markets business, as “the asset is worth more to someone who can invest in fiber.”