The Affordable Connectivity Program (ACP) is in grave danger. According to estimates from the Federal Communications Commission, the program – which offers a $30 per month broadband subsidy to more than 22 million subscribers across the U.S. – will run out of money in April. A wave of sudden disconnects associated with the program’s end could hit ISPs hard. But just how much exposure do they have? And do they have any plans in place to keep vulnerable customers connected?

A basic understanding of the major ACP players can be gleaned from ACP data the FCC shared with Senators Ted Cruz and John Thune in April 2023.

The top 10 ACP providers by funding received at that time were Charter Communications (a hair under $910 million), Q Link Wireless ($288.2 million), Tracfone Wireless (which is now owned by Verizon, with $250.2 million), Comcast ($232.4 million), T-Mobile ($208 million), AT&T ($188.4), Excess Telecom ($181.8 million), Sage Telecom ($168.6 million), Dish Wireless ($119.7 million) and Cox Communications ($117.8 million).

Other major providers, including Verizon ($18.2 million) Mediacom ($8 million) and Consolidated Communications ($35,229) had received substantially less.

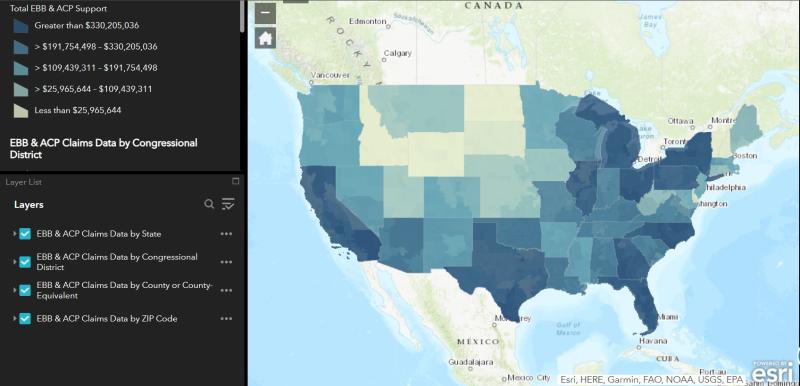

But that data is obviously out of date now, as it was only current through the end of February 2023. At that time, there were only 16.4 million people enrolled in the ACP. As of January 22, 2024, there were 22.8 million. A graphic depicting the latest breakdown of ACP funding by state is below.

We took the subscriber question straight to the big guns and asked what plans they have for keeping subscribers connected in a post-ACP world. Here’s what they told us (and what we could dig up).

Altice USA: Altice didn't answer our questions about how many ACP subs it has today. But a rep did say “We are closely monitoring for updates and guidance on the future of the program and will keep our customers informed on how they can stay connected to their Optimum services as we continue to provide low-cost options to meet the needs of all our customers.”

It looks like Altice's Optimum brand currently offers a 50 Mbps Advantage Internet plan for $15 per month for households with students, seniors and veterans. It also has a symmetrical 300 Mbps fiber service for $40 per month.

AT&T: During Q4 2023 earnings, CEO John Stankey said "it's unfortunate we're at this moment" and advocated for regulatory reform of the various subsidy programs. He didn't share a subscriber figure, but stated "either way it goes we'll be fine." A spokesperson declined to provide further detail about its ACP subscriber count.

AT&T currently has an Access Internet plan which provides 100 Mbps for $30 per month.

Brightspeed: Like its peers, Brightspeed kept mum about its subscriber figures but a rep confimed it does indeed "have customers who depend on the Affordable Connectivity Program subsidy to afford internet connectivity." It advocated for an extension of the program.

Charter Communications: During Q4 2023 earnings, CFO Jessica Fischer stated Charter has a "little over" 5 million subscribers that receive ACP benefits. CEO Chris WInfrey said "we're probably the largest ACP provider in the country" but warned it's hard to predict the impact the program's end might have on customer disconnects.

The 5 million figure is higher than a recent estimate from New Street Research, which concluded the operator had between 4.1 million and 4.8 million subscribers participating in the ACP.

Charter's low-income plans fall under its Spectrum Internet Assist umbrella. These provide discounted 30 Mbps service for eligible customers. Pricing varies by state.

Comcast: During Q4 2023 earnings, Comcast Cable CEO Dave Watson said “We have 1.4 million customers that have benefited from this program…Most of these customers and this customer base were already our customers prior to the ACP program." He added, "We want the program to continue, but I think we’re very well positioned to support these customers if it does not.”

A company representative told Fierce that if the program ends it will will continue to offer its Internet Essentials plans, which run $9.95 per month for 50 Mbps and $29.95 per month for 100 Mbps. The rep added Comcast may come up with some new packages once it is confirmed that the program is ending.

Consolidated Communications: Consolidated declined to disclose its ACP subscriber count but a representative told Fierce "The impact of ACP being discontinued will be limited on our business."

Cox Communications: A Cox representative said the company has less than 1 million ACP subscribers. In terms of what happens if the ACP ends, the rep noted that most of those currently receiving the subsidy “are eligible for our other digital equity programs that have existed for years.”

Cox currently offers a Connect2Compete plan providing 100 Mbps speeds for $9.95 per month for eligible families who have school-aged children and participate in certain government assistance programs. For individuals, it offers 100 Mbps for $30 per month through its ConnectAssist plan.

Lumen: Lumen declined to provide an exact subscriber figure but stated ACP subscribers account for less than 1% of its consumer broadband business. The company counted roughly 2.8 million copper and fiber broadband subscribers as of the end of Q3 2023, the most recent quarter for which it has released data.

A company representative added that “customers will not automatically lose their internet service when the ACP runs out of funding unless they specifically asked to have their service end when the ACP benefit ends.” Those currently receiving ACP benefits will keep the same service but will simply be subject to Lumen’s current rates.

Mediacom: Mediacom told Fierce it has less than 73,000 households enrolled in the ACP.

Even if the program ends, the Mediacom rep said it still plans to offer its Connect2Compete plans which offer eligible households home internet for $15 or $30 per month, depending on the speed tier they choose. The $30 per month plan tops out at 100 Mbps.

Verizon: During its Q4 2023 earnings call, Verizon CFO Tony Skiadas said the operator’s ACP exposure is primarily in its prepaid mobile business, where it has approximately 1.2 million subscribers receiving the benefit. It’s exposure to subsidy participants in its post-paid mobile and Fios fiber internet businesses is “minimal,” he said. That tracks with the FCC data above, which highlighted Tracfone (now part of Verizon's pre-paid business) as a major funding recipient.

In terms of its post-ACP play, Skiadas said “In the event the funding goes away, we have plans to address it and we'll see what happens there.”

Verizon's lowest tier Fios plan currently runs $49.99 per month for 300 Mbps. It is free with ACP and Verizon Forward discounts applied, but it is unclear whether Verizon intends to continue offering discounts through Verizon Forward if the ACP ends.

Update 1/25/2024 10:05 am ET: This story has been updated to include comments from Comcast's Q4 2023 earnings call.

Update 2/1/2024 2 pm ET: This story has been updated to include comments from Charter's Q4 2023 earnings call.

Fierce Telecom editors Masha Abarinova and Julia King contributed to this story.