In the first quarter of 2023 subscribers on usage-based broadband (UBB) plans for the first time reached and marginally surpassed consumption parity with flat-rate broadband (FRB) plan consumers, according to the latest OpenVault Broadband Insights (OVBI) report.

Operators have long pushed for this to happen, but now they must face the network health and congestion challenges that come hand-in-hand with UBB consumption growth.

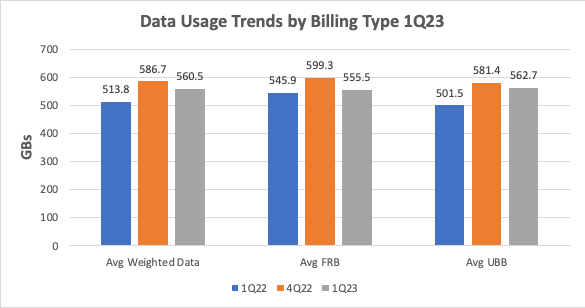

The OVBI report said that significantly higher rates of usage growth among UBB subscribers resulted in average (562.7 GB) and median (382.0 GB) monthly consumption — slightly higher than the 555.5 GB average and the 371.1 GB median for consumers on FRB plans.

The report leverages data aggregated from OpenVault’s suite of broadband management tools and comes from “dozens of operators serving hundreds of markets” mostly throughout North America, according to CEO and founder Mark Trudeau. OVBI findings are based on data from the company’s cable DOCSIS consumers, although Trudeau noted he is seeing the same trend across fiber users.

“Understanding subscriber behavior at a very granular level really helps operators understand the impacts of those subscribers on their network and how much data volume they're going to need to support down the road,” he said. “All of these networks — whether it's DOCSIS or fiber — are all shared networks, so understanding those trends is really critical for them to stay ahead of the curve, because usage isn't slowing down.”

Of the two approaches, the more profitable for operators is “absolutely” the UBB billing pricing model, Trudeau told Fierce Telecom. And despite misconceptions about UBB, he said it's actually beneficial for consumers, too.

Subscribers on UBB plans tend to self-select faster speed tiers, because those tiers oftentimes come with higher or unlimited usage quotas. Many operators that have usage-based billing in place offer unlimited internet to subscribers who upgrade to a gig service, for example.

The report noted UBB operators are seeing significant ARPU growth compared to their FBB counterparts. But OpenVault attributed this to a higher take rate on the faster speeds consumers are self-selecting in usage-based billing scenarios — not because operators are inundating subscribers with overage fees as some might assume.

“The results speak for themselves where you see a much bigger mix of fast bandwidth speeds being adopted by subscribers on usage-based billing versus the flat-rate billing where everything is all-you-can-eat,” Trudeau said.

Operators face UBB growth implications

While ARPU is higher for UBB, the implications of higher UBB consumption for the broadband industry are still “mixed,” the OVBI report said.

Traditionally, the industry has seen higher usage on flat-rate billing plans because by nature, they’re unlimited. Comparatively, usage-based billing has in the past curtailed consumption because subscribers didn't want to go over their quota and pay extra fees, Trudeau said.

“Now, usage is largely at parity,” he added, due to a “clear correlation between speed and usage.” As more subscribers on UBB upgrade to faster speeds, oftentimes upgrading to a gig service and getting unlimited usage, their usage “skyrockets.”

This is because subscribers moving to faster speed tiers doesn’t necessarily mean they have to change their usage behavior to chew up more data. In the case of streaming, for example, they will just enjoy higher quality videos from their providers.

“By default, you're watching the same movie, but now you're going to chew up more data than you did before you had that speed,” Trudeau said.

Past OVBI reports have detailed this connection between faster internet speeds and increased data consumption. OpenVault’s analysis shows that in the first quarter of this year around 30% more UBB subscribers (90%) tapped into speeds of 200 Mbps or faster than did FRB subscribers (63%). During the same period average usage grew at a rate of 12.2% for UBB subscribers, nearly 7x that of FRB consumers.

This means that operators who have incentivized UBB as a tool to reduce strain on the broadband plant and differentiate from their competitors now have to face the consequences of their successful campaign and figure out how to keep up with snowballing network traffic.

“They were successful in getting subscribers to move up the food chain but all of a sudden, it's like holy cow, look at all this traffic now that we have to support,” Trudeau said.

To that point, when they design their networks, operators must keep in mind the oversubscription ratio they’re comfortable with as more subscribers pick up UBB plans, Trudeau added, and they should also pay attention to the metrics available through reports like OBVI's to understand where congestion is coming from when it happens.

“Operators, I think, did it to themselves, but they also did it for competitive reasons...a lot of these operators are being overbuilt with new competition in place. They want to make sure that they're putting their best foot forward for their customers, but they just have to remember that there are impacts on the network that they have to keep up with.”