The fall season seems to be ripe for fiber M&A, as Shenandoah Telecommunications (Shentel) announced Tuesday evening it will acquire fiber provider Horizon Telcom for $385 million.

Based in Ohio, Horizon has 14,000 fiber passings within its ILEC footprint and has passed around 18,000 homes in greenfield markets adjacent to its commercial network. According to Shentel’s press release, 64% of Horizon’s revenues come from commercial customers.

The transaction includes $305 million in cash and $80 million of Shentel’s common stock. In a conference call discussing the news, CEO Chris French said the Horizon buy will double the size of Shentel’s commercial fiber business and give the operator a foothold outside its Mid-Atlantic footprint.

“The Horizon acquisition will allow us to increase the size of our overall footprint by approximately 25% across most key metrics,” French said.

On the fiber front, Shentel is upping its multi-year passings goal from 450,000 to 600,000 by the end of 2026. During Q2 earnings, the operator noted it’s invested $99 million year-to-date in Glo Fiber expansion.

Shentel scoops up Horizon about a week after Searchlight Capital Partners and BCI announced they will acquire the remaining stake in Consolidated Communications for $3.1 billion.

Also last week, PE firm Jana Partners revealed it acquired a stake in Frontier.

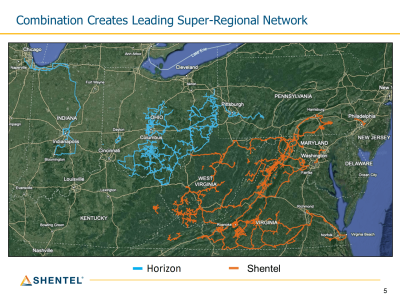

French added Shentel plans to connect its network with Horizon’s “to provide a contiguous super regional network covering nine states.”

“From a commercial business perspective, the combined 16,000 route mile fiber network will provide on-net connections in key data centers,” he said, such as Ashburn and Chicago.

The combined network will also provide “many unique routes” in the rural parts of Ohio, Virginia and West Virginia.

Shentel expects to realize $10 million in annual run rate synergies within 18 months of the transaction’s close. Analysts at New Street Research noted that number puts the company’s fiber multiple, i.e, the valuation of Shentel’s fiber assets, “at close to 20x before synergies and a robust 13x after synergies.”

‘We are pleased to see that fiber multiples are in-line with recent history, despite the increase in rates and in fiber deployment costs,” NSR wrote.