-

Smaller open RAN vendors say reports of their death are greatly exaggerated

-

As operators lower their cap ex spends, vendors of all sizes are feeling the pinch

-

Smaller vendors like Mavenir and Airspan say they’re encouraged by AT&T’s big open RAN deal with Ericsson

There’s a scene in the 1987 classic “The Princess Bride” where Miracle Max (Billy Crystal) tells Inigo Montoya (Mandy Patinkin) that his friend Westley is only “mostly dead.”

There’s a big difference between “mostly dead” and “all dead,” Max explains. If someone is “mostly dead,” that leaves room for “slightly alive,” whereas if he’s “all dead,” about all you can do is go through his clothes looking for loose change.

No one is definitively saying the open radio access network (RAN) market is dead. But when it comes to smaller suppliers with aspirations of making the big league and into the macro sites of large carriers? It’s “mostly dead,” according to industry analyst Earl Lum of EJL Wireless Research.

One of the basic concepts behind open RAN is choice and the ability to mix and match products from different vendors. When it emerged several years ago – before COVID turned the world upside down – it was driven by smaller vendors that wanted a stab at a business long dominated by the likes of Ericsson and Nokia. Flash forward six or seven years and Ericsson, Nokia and Samsung are increasingly in the driver’s seat.

Mavenir, Airspan weigh in

Ask smaller vendors – like Mavenir or Airspan – about the state of open RAN and they’ll tell you it’s alive and well – even gaining momentum, thanks in large part to AT&T awarding a $14 billion contract to Ericsson. “It’s a validation of the concept,” Mavenir President and CEO Pardeep Kohli told Fierce.

“I see it as a big opportunity and a momentum builder” for open RAN, said Glenn Laxdal, president and CEO of Airspan. (The Boca Raton, Florida-based company recently filed for Chapter 11 bankruptcy, which would seem a solid sign that its days are numbered. But no – it’s got a turnaround plan to eliminate debt and secure $95 million in new equity financing, so … not dead!)

In fact, Airspan expects to continue pursuing open RAN deals. “I share the industry narrative that open RAN has been slow to take off, but I don’t share the industry narrative that it hasn’t taken off,” Laxdal said, pointing to deployments by Dish Network in the U.S, 1&1 in Germany and Japan’s Rakuten.

“It’s only a matter of time before operators look for more and more creative ways of standing up more multi-faceted solutions that enable them to build applications on top of the network, and open RAN enables all of that,” Laxdal added.

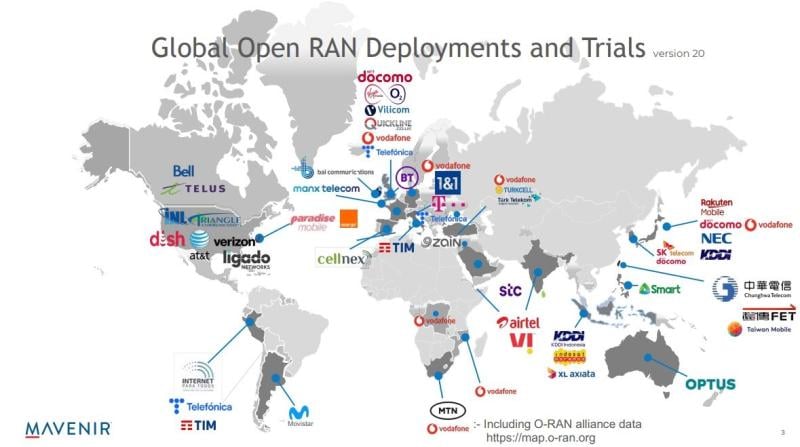

Mavenir SVP of Ecosystem Business Development John Baker points to crowd-sourced data showing worldwide open RAN adoption by 127 organizations in 21 countries. Besides Mavenir, a number of end-to-end systems suppliers in the open RAN ecosystem are using their own technology, including NEC/NTT, Fujitsu, Rakuten, IS Wireless (Poland), Capgemini, Radisys/Jio, Viettel and Acceleran, he said.

But Lum has seen those same charts and said it’s his belief that at the end of the day, the big winner in all of this will be “Samsung and team Japan for the radios,” meaning NEC and Fujitsu, minus Rakuten Symphony. Ericsson and Nokia will continue to win some open RAN-compliant contracts. Smaller vendors might find more success in rural areas, private networks and small cells.

The big money is on the macro layer, which is where the large vendors are playing. Ericsson will no doubt get the biggest markets in AT&T’s footprint, Lum surmised. Nokia’s future is in question as Samsung wins more market share. What little amount of the business that companies like Rakuten Symphony and Mavenir win will be “irrelevant,” in Lum’s opinion.

If an operator wants lower prices, as open RAN promises, and it gets that through a deal with someone like Ericsson, what’s the motivation to go with smaller open RAN vendors?

“Look at the basics. The first question an operator needs to ask is: Why? What are they trying to do? Virtual RAN? Cloud RAN? The first two don’t require open RAN,” Lum noted.

So, is Mavenir in denial when it comes to the state of open RAN? “No,’ Kohli said. “We’re realistic.”

The ecosystem needs mature baseband and radio companies and vendors that specialize in test and measurement so that the technology can be validated, Kohli said. Those things are all coming together. “I think there’s momentum in all three areas,” he said. “We can make it work.”

They’re showing how it can work through the Acceleration of Compatibility and Commercialization for Open RAN Deployments Consortium (ACCoRD), an effort led by AT&T and Verizon. It’s a testing and evaluation program that goes beyond the traditional suppliers like Ericsson, Nokia and Samsung to include Fujitsu, Dell Technologies, Intel, Mavenir, Radisys, Rakuten, Red Hat, VMWare by Broadcom and Wind River Systems.

And Kohli points out that nobody is forcing Mavenir, which was founded in 2005, to pursue open RAN as a business. With proper due diligence and investors backing it, “this is our desire,” he said. “We believe we can make a difference. We have a good track record of gaining market share when things evolve into open architecture.” (So far – not dead!)

What others say

“Open RAN is making progress,” said Joe Madden, founder and chief analyst at Mobile Experts. “I think some people are unhappy with the way the progress is going because it doesn’t work in their favor, but it’s definitely coming along.”

By way of example, he said, the original idea with open fronthaul was something known as the 7.2 specification, which was proposed as an industry standard interface through the O-RAN Alliance. But Ericsson held out, arguing for ULPI, which stands for uplink performance improvement.

Then AT&T announced it’s going all in on open RAN in a big way with Ericsson – to the tune of $14 billion. Boom!

“We’ll see other shoes drop over the next five years, but it won’t be a big boot like AT&T,” Madden said. “It will be small shoes dropping.”

Mobile Experts expects to see a fairly flat RAN market from 2025-2029, with the telco market shrinking but the private cellular market offsetting losses in the public networks.

Dell’Oro Group analyst Stefan Pongratz said recent activity bolsters the thesis that open RAN is happening. The firm recently revised projections upward to reflect the improved pipeline in the U.S. and is now forecasting open RAN to account for about a fourth of the RAN market by 2028.

“We are rather optimistic about the open RAN/total RAN spend in both the U.S. and Japan,” Pongratz said. “And while the transition will be more gradual in other parts of the world, especially in the more GDP per capita sensitive markets, this will not be enough to derail the movement.”

While Open RAN/vRAN gears up for its second growth cycle, Téral Research expects the lull to persist this year followed by 2025 as the trigger year, which will be driven by the beginning of large-scale rollouts, led by AT&T and Vodafone, as other major Tier 1 service providers start their own small buildouts.

All of which is to say, vendors might live to fight another day. Otherwise, about all we can look forward to is digging through pockets for some loose change.

Be sure to sign up for all of our newsletters here.