-

Liquid cooling is used in data centers to remove heat from servers

-

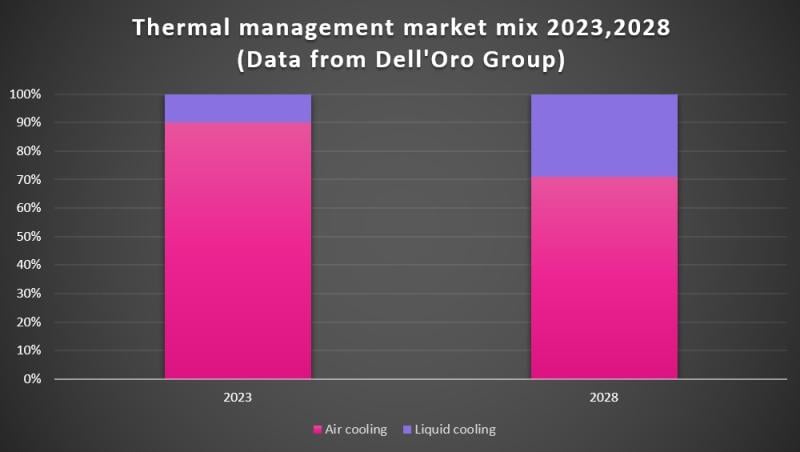

Air cooling systems account for 90% of the market today

-

AI will drive a rapid shift to liquid cooling systems over the next five years

Artificial intelligence (AI) is set to spur massive growth in the liquid cooling market over the next five years, with the technology expected to account for nearly a third of all data center thermal management spending by 2028.

That prediction comes courtesy Dell’Oro Group, which just updated its long-term outlook for data center physical infrastructure (DCPI).

While the DCPI market includes both power distribution and thermal management solutions, Research Director Lucas Beran homed in on the latter in an exclusive interview with Silverlinings. He noted that between 2023 and 2028, the overall thermal management market (comprising both air and liquid cooling systems) will expand at a 14% CAGR to reach $12 billion.

Of that $12 billion, liquid cooling solutions — including direct, immersion and rear-door heat exchanger systems — are expected to account for $3.5 billion by 2028. That compares to Dell’Oro’s previous expectation that the global liquid cooling market would reach $1.8 billion by 2027.

“The need for air cooling is not going away, but liquid cooling is what’s going to rapidly grow in the market, at a CAGR over 40%," said Beran.

Put another way, Beran said liquid cooling’s share of the overall data center thermal management market is going to grow dramatically.

Today, the revenue split is about 90% air cooling — which Beran said will still grow at a 9% CAGR over the forecast period — and 10% liquid cooling. By 2028, that’ll shift to roughly 70% air and 30% liquid.

Cool market drivers

As we’ve previously covered, AI is a key driving force in the liquid cooling revolution. That’s because AI workloads require higher-power chips that generate more heat in servers.

That means the data centers of the future will increasingly be hybrid-cooled facilities. But the logistics of how these will be laid out to accommodate both liquid cooling and air cooling systems is still being decided.

Beran added that different regions are also leaning toward different types of liquid cooling. For instance, direct liquid cooling systems are in favor in North America while there seems to be more support for immersion systems in Europe and the Asia Pacific region — excluding China.

Interestingly, the shift toward liquid cooling comes with the opportunity for more heat capture and reuse. That is, the heat generated by servers in data centers can be put to work, for instance to heat an apartment complex, rather than pumped into the atmosphere as a waste product like it is today. That’s because liquid is a much more efficient heat transfer medium than air, Beran said.

Beran declined to call out the expected winners and losers in the shift from air to liquid, in part because Dell’Oro’s deep dive report into the liquid cooling vendor market is still forthcoming. But he did note that key players in the thermal market today include Vertiv, CoolIT, Submer and GRC.

He added legacy air cooling vendors are taking the trend toward liquid solutions seriously. This is reflected in their decision to offer coolant distribution units (which are commonly needed for liquid cooling systems) to data center customers, he concluded.

We'll keep an eye on the liquid cooling wave. In the meantime, check out our previous coverage of what's happening in the liquid cooling market and why it matters, here.