It’s no secret that hyperscalers are expanding their data center footprints as cloud adoption rises. But does this necessarily spell the end for on-premises enterprise data centers? And what about colocation facilities? Synergy Research Group Chief Analyst John Dinsdale told Silverlinings that while on-prem data centers haven’t been and won’t be thrown overboard entirely, growth is essentially dead in the water.

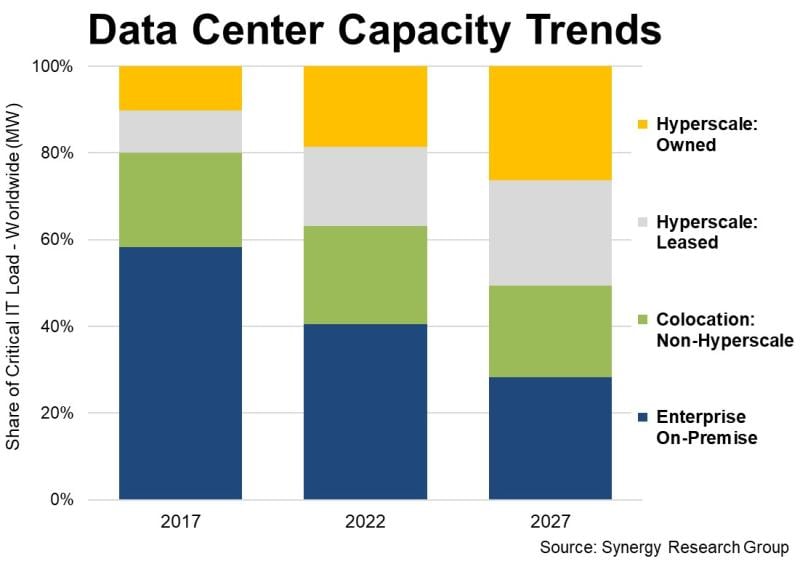

There are somewhere in the realm of 900 hyperscale data centers in total across the globe and these currently account for around 37% of worldwide data center capacity, according to Synergy. Dinsdale said the number of hyperscale data centers is expected to grow by “well over a hundred per year in our five-year forecast,” and by 2027, these data centers will account for more than half of all data center capacity.

That comes in start contrast to what’s predicted for on-prem enterprise data centers. Five years ago, these accounted for nearly 60% of data center capacity. Today, the figure is more like 40% and by the time 2027 rolls around, Synergy has forecast they’ll account for less than 30% of worldwide data center capacity.

Data center low-down

Interestingly, this doesn’t mean the amount of capacity offered by on-prem enterprise data centers will fall drastically in absolute terms. Rather, Dinsdale said it will actually decline “very gradually — by less than 1% per year.” What’s actually happening is hyperscalers and colocation companies are simply sucking up all the growth as capacity demand – and thus worldwide capacity available – increases.

In other words, as the capacity pie gets bigger, the slice occupied by on-prem data center deployments is getting smaller.

That also means that non-hyperscale colocation capacity – which is expected to continue to hover at about 23% of worldwide capacity – will actually be adding capacity in absolute terms given the overall capacity growth. After all, 23% of 100 is a larger number than 23% of 10, right?

Dinsdale declined to share a figure for current or forecasted data center capacity, but told Silverlinings “I can tell you that the average annual growth in total capacity is 5-10% per year over the next five years. That may not sound like a lot, but this is based on an extremely large installed base, so the annual increment is a big number.”

Of course, more hyperscale capacity and less on-prem means enterprise cloud operations will increasingly be outsourced. In terms of what this means for things like reliability and cost, Dinsdale had this to say:

“While any service disruptions at hyperscale operators get a lot of media attention (and rightly so), the fact is that reliability and security are generally strengths of public cloud providers. Private networks have more issues, but they don't tend to get publicized," Dinsdale said.

He continued: “Cost is a tricky issue to pin down. It may well be that enterprises start spending more money once they've transitioned to public clouds, but that is often because they are getting added functionality, scope and features. Doing an overly simple $[dollar]s spent comparison pre- and post-cloud transition can easily miss the point of cloud benefits. Certainly, the onus is on enterprises to manage cloud usage levels and associated costs in order to stay within planned budget levels.”

Want to learn all about cloud data centers? Catch Silverlinings’ on-demand Cloud Data Center Strategies virtual event here.