-

Microsoft edged out AWS with the highest cloud adoption among all organizations

-

It also led among big spenders

-

However, more enterprises said they had "significant workloads" running in AWS

Amazon and Microsoft have been duking it out for cloud supremacy for some time now, but it seems the latter’s Azure platform may have the upper hand as the market heads into Q2 2024.

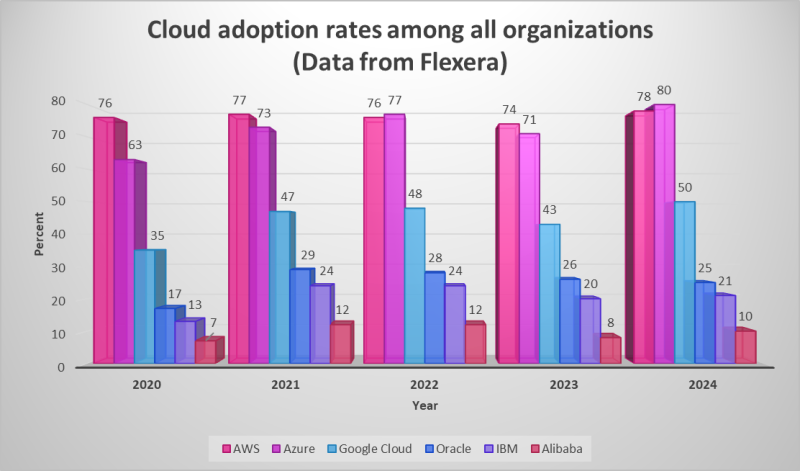

Fresh data from Flexera’s annual State of the Cloud report showed Microsoft is leading Amazon by a nose in terms of public cloud adoption among all organizations. This marks the second time ever that Microsoft has pulled ahead – it also eked out a lead in 2022 before falling back to the number two spot last year.

Flexera’s 2024 report was based on survey responses from 753 technical professionals and executive leaders worldwide in the winter of 2023.

Microsoft’s adoption stood at 80% to Amazon’s 78%. Google Cloud was in a distant third with 50% adoption, with Oracle (25%), IBM (21%) and Alibaba (10%) following. Check out a chart of their adoption trends based on Flexera’s data below.

The report fleshes out the picture painted by other data points, including Synergy Research Group’s market share figures. As of the end of Q4 2023, Synergy noted Amazon had 31% market share, Microsoft 24%, Google 11%, Alibaba 4%, and Oracle and IBM 2%.

But just because more organizations are using Microsoft, that doesn’t mean that’s where most of their workloads are running.

Flexera indicated that 49% of organizations said they had “significant workloads” on Amazon Web Services (AWS) compared to 45% for Microsoft Azure. That mix shifted slightly to a tie at 49% when Flexera looked at enterprises specifically. And zooming in even further to look at small and medium businesses, AWS remained the favorite by a mile. Half of SMBs said they run significant workloads on AWS compared to 29% for Microsoft.

Azure lures big spenders

However, Microsoft also beat out AWS when it came to attracting big spenders. Azure led in five out of six high-tier spending categories, beating AWS in the $100,000-$200,000, $200,000-$500,000 and $2 million-$5 million brackets. It tied AWS in the $500,000-$1 million and more than $5 million brackets.

Google Cloud was pretty much in third place across the board, except among those spending less than $50,000 per month. There, it beat both Microsoft and AWS.

Flexera’s spend findings backed up data put out by HGInsights last year.

We'll have an eye on things evolve, especially given Oracle's ambitions to become a powerhouse in the cloud market. Stay tuned!