Google Cloud is out for blood. The company accused rivals Microsoft and Oracle of using their incumbent positions in the software market to give their cloud products an “unearned advantage” in the market. Oracle in turn slammed Amazon Web Services (AWS) for using “predatory” egress fees to lock customers into its infrastructure.

The comments came in response to an inquiry by the U.S. Federal Trade Commission (FTC) into the state of the cloud market. The agency recently asked interested parties to weigh in. While Amazon Web Services (AWS) and Microsoft painted a rosy picture of a robust and dynamic competitive landscape, Google Cloud countered that narrative.

According to the company, the cloud industry is at a crossroads, facing a choice between “legacy software constructs” that include restrictive licensing and closed ecosystems and the promise of a cloud landscape that’s “open, elastic, and free from artificial lock-ins.”

“At this critical moment, anticompetitive licensing restrictions on cloud services are causing a wide range of harms, from higher costs for businesses and end-consumers, to government waste for taxpayers, to more security breaches, to a chilling effect on local cloud and software providers,” Google Cloud wrote. It urged the FTC to scrutinize such practices.

Egregious egress fees

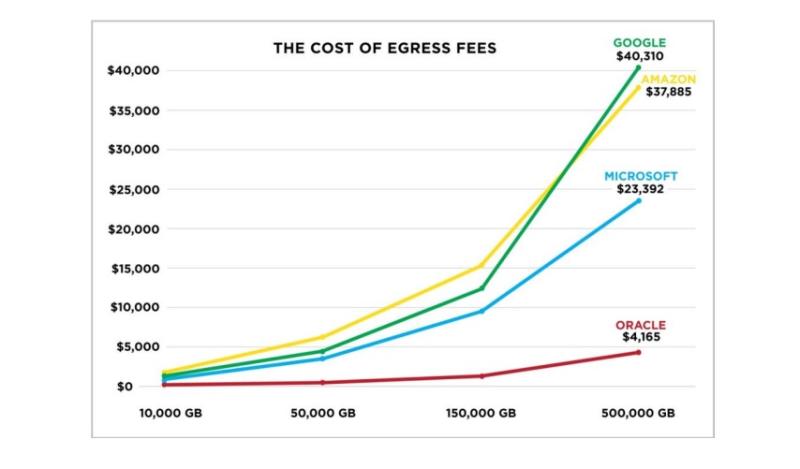

Meanwhile, Oracle used its filing to call out “predatory billing practices” it claimed rivals use to “exclude competition in what should be…a technologically competitive market.” It pointed to AWS as the “worst offender” on this front, accusing the company of forcing U.S. customers to pay 80 times AWS’ costs for such transactions.

A chart provided by the company depicted Amazon as having the highest egress fees for all but the largest workloads. At the top end of the workload range depicted on the chart – which went up to 500,000 GB of data – AWS was surpassed by Google.

Oracle argued that egress fees have “become the most powerful tool for a legacy [communications service provider (CSP)] to lock in their customers and exclude their competitor.” It added “the sole purpose of egress fees is to frustrate competition on the merits by locking in customers to their legacy CSP.”

Cloud security and content delivery network company Cloudflare seconded this position, stating that such a pricing scheme disincentivizes not only data transfers but also the use of tools outside the cloud.

“Once customers build their entire stack on a hyperscaler’s cloud and get their data into the platform (at zero cost for putting data into the cloud), egress fees can make it prohibitively expensive for the customer to re-architect and migrate the full application – or even parts of it,” Cloudflare explained.

U.K. regulator Ofcom previously highlighted egress fees as an area of concern in its own cloud competition probe.

Cloudflare also flagged issues with hyperscaler partner programs which incentivize lock-in to a particular cloud platform. “In the short term, the partners may benefit from hyperscalers’ practices, but it is only a short-term benefit that disappears in the long run,” the company concluded.

Comments on the FTC probe were due June 21. A full list of filings can be found here.

Look who’s talking

It’s worth noting that the companies taking swipes are those with the most to gain from a change in the status quo.

According to data from Synergy Research Group, AWS held the largest share (32%) in the cloud infrastructure services market as of Q1 2023, followed by Microsoft (23%). In contrast, Google Cloud had 10% market share while Oracle was lumped in with the “next 20 companies,” which collectively had a 26% share.