-

Overall spending jumped to nearly $65 billion.

-

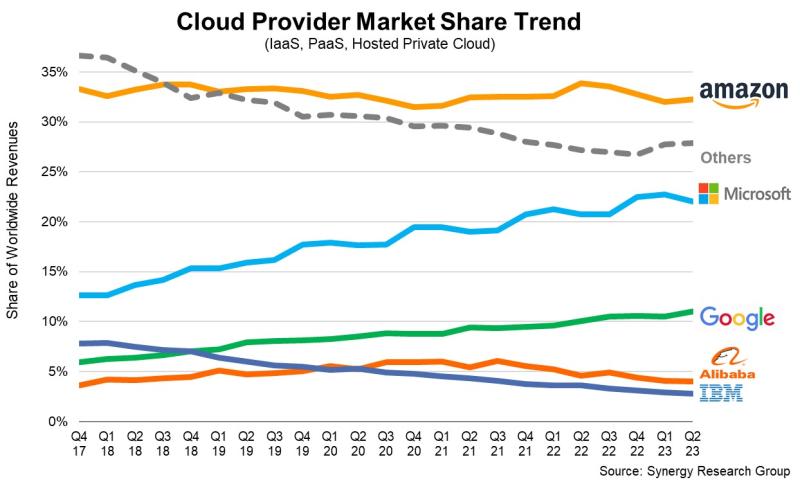

Market shares for Amazon, Microsoft and Google remained virtually unchanged.

-

Synergy tipped the cloud market to remain “buoyant” despite a growth slowdown.

Growth slowed across the board for the big three cloud providers, but that didn’t stop spending in the cloud infrastructure market from rising significantly in Q2 2023. Fresh data from Synergy Research Group showed revenue rose $10 billion year on year to an estimated $64.8 billion.

Synergy’s data includes revenue from infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and hosted private cloud service offerings. Gartner previously predicted that worldwide end-user spending on public cloud services – including IaaS, PaaS, Cloud Application Services (SaaS), Cloud Business Process Services (BPaaS), Cloud Desktop-as-a-Service (DaaS), and management and security services – will reach $597.3 billion in 2023, up from $490.9 billion in 2022.

Looking at Q2, Synergy noted that “macroeconomic pressures, some belt-tightening by enterprises, local market issues in China, and, above all else, the law of large numbers” drove a slowdown in growth. But it added “With the Chinese market potentially returning to somewhat more normal circumstances, many economic pressures easing, and enterprises having rationalized historic cloud usage and spending, Synergy expects future cloud growth rates to remain buoyant.”

Tier 2 cloud providers with the fastest growth rates included Oracle, Snowflake, MongoDB, VMware, Huawei and China Telecom. However, their gains had little impact on overall market share standings. Amazon remained in the 32-34% range, with Microsoft (22%) and Google Cloud (11%) each gaining one percentage point.

Q2 revenue rundown:

- AWS: $22.1 billion

- Microsoft Intelligent Cloud: $24 billion (it does not break out Azure revenue)

- Google Cloud: $8 billion

Q2 growth rates

- AWS: 12%, down from 37% in Q2 2022.

- Microsoft Intelligent Cloud: 15%, down from 20% in the year ago quarter

- Google Cloud: 28%, down from 35% in Q2 2022.

Don't forget to follow us on LinkedIn and Twitter and sign up for our weekly newsletter here.