SAN FRANCISCO—Charter’s Craig Cowden, the cable company’s SVP of wireless technology, offered a detailed look at the company’s wide-ranging embrace of wireless technology, including its planned move to 802.11 ax technology for Wi-Fi, its plans to launch an MVNO service through Verizon by June or July of next year and the company’s multiple test markets for both fixed and mobile services running on 3.5 GHz CBRS spectrum.

“Charter already is a wireless company,” Cowden proclaimed here during a presentation at the Mobile World Congress Americas trade show, in conjunction with the CBRS Alliance. He explained that the cable operator’s network carries as much as 80% of wireless traffic in customers’ homes or offices. “Although we do not monetize that. We are not a mobility provider.”

A big part of Charter’s efforts to change that involve the company’s plans to launch an MVNO through Verizon; Charter will join Comcast (via Comcast’s Xfinity Mobile service) in operating an MVNO service with Verizon. Those MVNO agreements stem from a sale of AWS spectrum by a group of cable companies to Verizon in 2012.

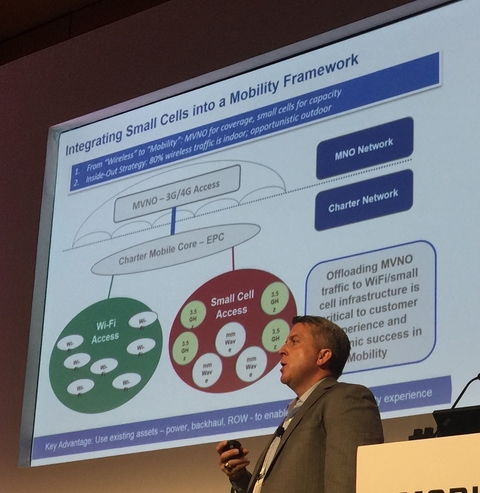

“So we’ll do that using an MVNO as an umbrella coverage layer, and then we’ll start using our Wi-Fi infrastructure to offload that MVNO,” Cowden said. (Comcast’s Xfinity Mobile also offers Wi-Fi offloading.) “And then eventually, as licensed and unlicensed small cells develop, we would further introduce that small cell infrastructure to further offload, and other use cases that licensed small cells can provide.”

Specifically, Cowden said Charter is conducting MVNO field trials between now and March of next year, and is planning to launch commercial services in June or July of next year, 2018.

“We want to make sure most of that traffic goes over Wi-Fi and not the MVNO,” Cowden added. “Wi-Fi is an important part of what we do and will continue to be.”

Interestingly, he said Charter is working to deploy 802.11 ac Wave 2 Wi-Fi technology today, and next year will move to 802.11 ax Wi-Fi technology.

Further, Cowden provided a clear look at how Charter plans to manage its MVNO with Verizon. “There’s a whole continuum of MVNOs. There’s a light or reseller MVNO on one end of the continuum and there’s really a full model on the other end, and with Verizon we have a light or reseller model, where we’re using their Evolved Packet Core, we’re using their IMS infrastructure, their SIM cards, their roaming relationships, and in general that’s how the United States works from an MVNO model standpoint,” he explained, noting that European MVNOs traditionally opt for the “full” MVNO model. “So, the timing of when we would roll that more into a fully MVNO model, that’s not as much of a technology issue, though there are certainly a lot of technology issues to overcome, but it’s really more of a business and strategic issue between us and Verizon.”

But Cowden said that Charter is moving toward the "full” MVNO model, where it would own and operate many of the core network services for the offering. “We certainly have RFPs out there right now for the EPC. We’re using virtual EPCs to manage the two mobility trials in Tampa and Charlotte. So we’re doing that right now. But in terms of our full scale Evolved Packet Core infrastructure, it will be a virtualized infrastructure I’m sure, but the actual timing of that is really more timed to this migration from a reseller MVNO to a full MVNO.”

He added that Charter’s MVNO would likely support Voice over LTE technology, since Verizon does.

During his presentation, Cowden offered a slide outlining Charter’s general approach to the wireless market, and its MVNO service:

Charter testing mobile, fixed services in 3.5 GHz CBRS band

Alongside Charter’s MVNO efforts, Cowden also discussed the cable operator’s tests of 3.5 GHz services in the CBRS band. That band is expected to soon be freed by the FCC for both licensed and unlicensed usage in a unique shared spectrum model. Charter is one of a number of companies considering services in the band, either through licensed or unlicensed operations.

Cowden said that Charter expects three main 3.5 GHz CBRS use cases: “neutral host” networks for all wireless players, point-to-point and point-to-multipoint fixed wireless services and private LTE networks for industrial IoT and other applications.

Along those lines, Cowden offered a detailed look at Charter’s 3.5 GHz tests. He said the company is planning to test mobile 3.5 GHz services in downtown Tampa and Charlotte, mainly with outdoor small cells. He said the company will use four unnamed vendors per market, and expects to operate a total of 200 sites. He said those tests will start later this month, and will focus on mobile handoff capabilities.

Separately, he said Charter is also testing fixed wireless services via 3.5 GHz CBRS spectrum in Denver now with two unnamed vendors, via equipment installed on rooftops. He said that fixed wireless testing will expand later this month to Bakersfield, Tampa and Michigan via test van mounting, and will include two or three unnamed vendors. Cowden said Charter’s fixed wireless tests are an effort by the company to potentially expand the area it can sell internet services to without having to deploy a wired network.

Cowden was asked when Charter might launch commercial 3.5 GHz CBRS services, and he said that was “anyone’s guess.” He said the company would monitor how fast the spectrum might be freed and auctioned by the FCC, and which vendors would support the bands. He said he expects Charter to engage in limited 3.5 GHz CBRS deployments in 2018 and more fully in 2019.

Cowden’s comments came just days after Samsung said it will be expanding its small cell portfolio with a line of 3.5 GHz CBRS products, as well as LAA small cells—and that it is collaborating with Charter in 5G trials.