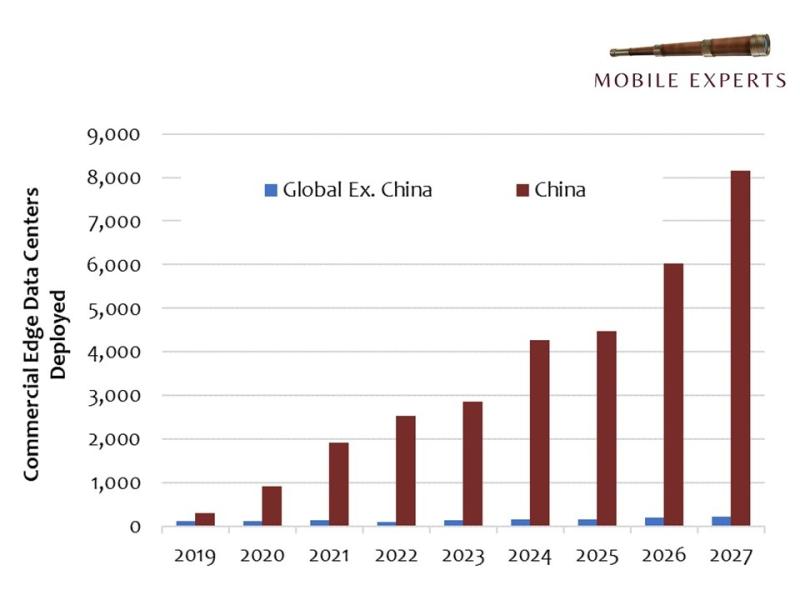

If you compare the numbers of commercial edge computing data centers in China vs. the rest of the world, you would think that China has an insurmountable lead. By the end of 2023, more than 5,700 telco-controlled "data centers" will exist in China, compared with only 560 commercial "data centers" in the rest of the world.

Yes, the ratio is 10:1. Assuming that the Chinese government can continue to invest, this discrepancy will grow tremendously over the next four years.

These numbers are shocking, but in fact the numbers are much higher in the West when you consider private edge clouds implemented by individual enterprises. The real difference is not in the level of investment, but in the business model behind the investment.

In China, companies like Alibaba, Tencent and Baidu have been forced to combine their cloud operations with the state-owned telecom operators in a process called “mixed ownership.” This has effectively neutered any independent deployment of edge clouds in China; everything runs through the government.

Conversely, in the U.S. market, hyperscalers, telecom operators and neutral hosts engage in a free-wheeling environment in which all kinds of experiments are taking place. These companies are investing in commercial edge data centers at a regional level (about 20 data centers to cover the USA), while individual enterprises are investing in on-prem clouds so that they can control access to their data best.

At the same time, thousands of American enterprises are implementing various forms of edge computing in their operations without using a commercial edge computing service. Exxon Mobil, Chick-Fil-A, H&R Block, John Deere, Walmart and many other companies have developed very specific applications on customized private edge clouds that they keep on-premises.

In fact, I would say that the variety of solutions in the Western world is far superior to the Chinese one-size-fits-all approach because we have mini-servers under the counter at Chick-Fil-A and we have highly secure servers running digital twins for industrial companies.

In my analysis this year, I have illustrated how the business model is taking shape for several vertical markets and I see different roles for the hyperscalers, the telcos and the neutral hosts in streaming, gaming, manufacturing, automotive and other application areas.

In each vertical market, the leading companies are developing customized software to integrate the edge cloud with the existing operations. In some cases, we are already starting to see those early customized solutions turning into a blueprint for a common platform. This is going to lead to tremendous growth in the number of enterprises using a local commercial edge data center for some kind of automation.

Here’s the long play: The Western, Darwinian approach will result in a business model and one software platform that is easy to use, with millions of developers. Possibly two or three different models/platforms. The Fortune 500 companies may continue to use on-prem edge clouds, but millions of other businesses will shift over to a telco-based or a hyperscaler-based edge cloud model because it will be cheaper and faster to market. In the end, we expect the insular Chinese model to be “unexportable,” and the organic Western model will win.

The Western market for edge computing services will have a different flavor than the Chinese version. But in the long term, I expect the spicy Western dish to taste better.

Joe Madden is principal analyst at Mobile Experts, a network of market and technology experts that analyze wireless markets.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce Wireless staff. They do not represent the opinions of Fierce Wireless.