John Deere has chosen SpaceX’s Starlink low Earth orbit (LEO) satellite network to supplement LTE coverage for farmers using its connected and autonomous farm machinery. The agriculture equipment maker spent more than a year reviewing proposals from satellite providers before announcing Starlink as its choice.

“We are bringing satellite communications service to the farm at scale so farmers with cellular coverage challenges can maximize the value of connectivity to their operations,” said Jahmy Hindman, SVP and CTO at John Deere, in a statement.

Farmers who want to connect their equipment to the satellites can have a Starlink terminal installed directly on their machines if they’re compatible with the new solution, the companies said. The vehicles are also equipped with Deere’s JDLink LTE modems, which the company manufactures itself.

The machines will try to connect to LTE, and if they cannot reach a tower they will use the satellite network, explained Doug Sauder, director of produce management and user experience at John Deere. In the U.S., Deere’s connected farm equipment uses AT&T’s LTE network.

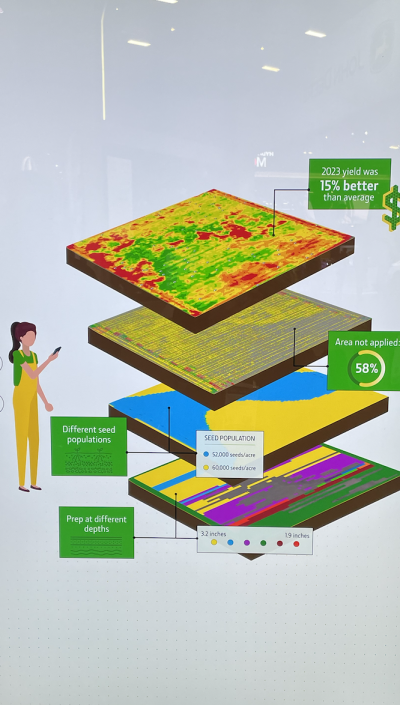

Farmers connect to their machines through Deere’s Operations Center app, which gives them a real-time view of their equipment, as well as status reports about the land they’re working on. The app is part of a cloud platform that also supplies users with information about emissions and soil health. The sustainability tools in Deere’s Operations Center app earned the company an honoree designation at the CES Innovation Awards this year.

The app gets its data from sensors and smart cameras deployed on John Deere’s tractors, which connect to an onboard processing unit and to the AWS cloud. Time-sensitive information is communicated to the farmer at once, while the rest of the data goes to the cloud, where it is processed and analyzed to prepare extensive reports which the farmers use to determine optimal use of labor, fertilizer and other resources. It’s also aggregated with input from thousands of other connected farm vehicles, creating a valuable dataset for Deere.

Autonomous tractors

Connectivity enables tractors to share data in real-time, and for some of them it also enables autonomous operation. Sauder said tractors can currently till the fields on their own, and by 2030 Deere wants to automate all steps of farming, including tillage, planting, fertilizing and harvesting.

Sauder said autonomous tillage is important because in the fall months, farmers often need to harvest and till at the same time. The labor supply can be tight, and they need people to drive combine harvesters and trucks headed to crop storage facilities. So they might have to delay tillage, potentially jeopardizing the next planting season.

Deere demonstrated its autonomous tractor at CES, controlling a vehicle in Central Texas from the Las Vegas show floor. The company showed how farmers can use the app to accelerate, steer and stop the tractor, and how the tractor sends alerts through the app if it encounters something unexpected in the field.

“The SATCOM solution unlocks the John Deere tech stack so every farmer can fully utilize their current precision agriculture technology in addition to the new innovative solutions they will deploy in the future,” said Hindman.

Satellite backup

Last year, a Deere executive predicted 10-15% of the company’s connected machines will ultimately rely on satellites. He said Deere would target speeds of 5 Mbps for both the uplink and the downlink via satellite.

SpaceX has already launched more than 5,000 Starlink satellites, and has said it wants to more than double that number. So far, the service has been marketed primarily to consumers, but the company is expanding its enterprise business in several forms. In addition to the deal with Deere, SpaceX has a partnership with T-Mobile to provide satellite connectivity directly to cell phones. And earlier this week, BT confirmed it’s talking to Starlink about possibly using the LEO satellites to improve connectivity for its customers. BT reportedly wants to use the satellites to supplement its existing network, but it does not plan to sell terminals to consumers to use as their primary internet connections.

Starlink itself has sold millions of the terminals and recently told the Federal Communications Commission it has 2.2 million internet customers worldwide, 1.3 million of whom are in the United States. The company shared these numbers with the FCC in December, after the agency reaffirmed its decision to deny Starlink access to the government’s Rural Digital Opportunity Fund, which the satellite operator wanted to use to subsidize the buildout of its network. The FCC said Starlink “failed to demonstrate that it could deliver the promised service.” Starlink’s initial application said the satellites could deliver 100 Mbps on the downlink and 20 Mbps on the uplink.