It’s been over a year since T-Mobile and SpaceX announced their intentions to team up on a direct-to-cell service, and on Tuesday, SpaceX’s Falcon 9 rocket launched the first set of six Starlink satellites to support the endeavor.

In a webcast that was livestreamed, the event hosts describe how the low Earth orbit (LEO) satellites are part of this initial launch. In total, the constellation will involve about 840 satellites. T-Mobile is providing its G-block PCS spectrum.

They expect to “soon” begin field testing the new service that leverages SpaceX’s satellites with direct to cell, or direct to device (D2D), technology and T-Mobile’s network. SpaceX last month was given FCC authorization to conduct trials that involve about 2,000 test devices.

“Our mission is to be the best in the world at connecting customers to their world and today is another step forward in keeping our customers connected even in the most remote locations for added peace of mind when they need it most,” said T-Mobile President of Marketing, Strategy and Products Mike Katz in a statement. “Today’s launch is a pivotal moment for this groundbreaking alliance with SpaceX and our global partners around the world, as we work to make dead zones a thing of the past.”

Until now, T-Mobile has been relatively quiet about its plans with SpaceX, which were announced in August 2022 with T-Mobile CEO Mike Sievert taking the stage alongside SpaceX founder Elon Musk.

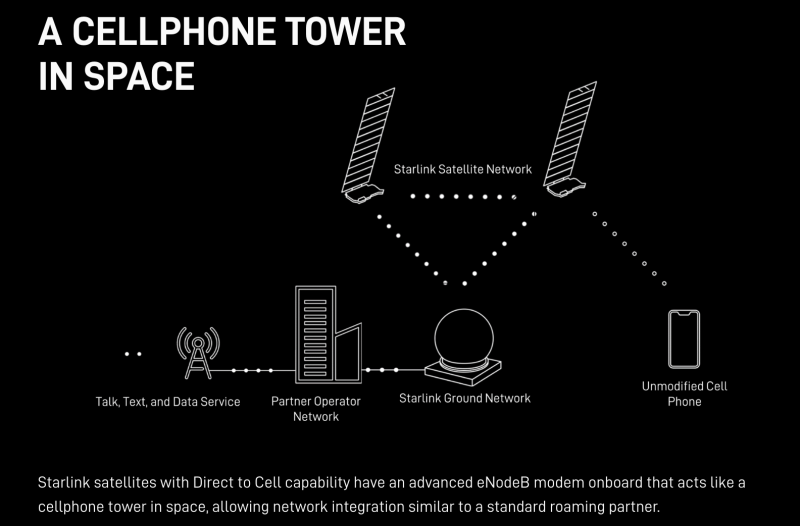

According to today’s press release, the goal of the new service is to eliminate worrying about mobile dead zones and lugging around expensive satellite phones. T-Mobile customers would be connected nearly everywhere they can see the sky, and in most cases, with the phone they already have.

Last year, T-Mobile and SpaceX issued an open invitation to wireless providers around the world to expand globally with reciprocal roaming. So far, five wireless providers answered that call, including Japan’s KDDI, Australia’s Optus, One NZ in New Zealand, Rogers in Canada and Salt of Switzerland onboard to launch direct to cell technology.

Rivals lag behind

As for T-Mobile’s U.S. rivals, AT&T is working with AST Space Mobile to bring satellite connectivity to its customers. Verizon has a deal in the works with Amazon for backhaul, but it’s been mum on plans for D2D.

So far, the SpaceX/T-Mobile service is in the testing phase. Tim Farrar, principal analyst at TMF Associates, said he expects SpaceX and T-Mobile ultimately will get approval from the FCC to offer service to customers. SpaceX has typically come out on top in terms of its proposals before the FCC, he said.

The big question will be around how the FCC decides to handle power limits and/or the number of satellites involved, he said. Unlike a tower, where the signal stays within a concentrated area, there are other issues of spillover effect when it comes to satellites.

“A tower in New York is not going to affect Canada, whereas a satellite beam that’s covering part of New York state might well have effects in Canada,” he said.

Although SpaceX says it will comply with the same sorts of power limits that a terrestrial network would have to comply with, “the power drops off a lot more quickly from a tower than it does from a satellite as you get farther away from the center of the beam,” he said.

While a lot of players are in the direct-to-device game, SpaceX’s money and time to market appear to give it the edge at the moment. “Clearly, it’s intimidating for anyone to try to compete with Starlink,” Farrar said, noting its plans for 840 satellites. “We’re seeing that happen in the broadband arena.”

The T-Mobile service is targeting people who are hiking and doing other recreational activities in remote areas typically not covered by the terrestrial network.

Where satellite falls down is where people want to make calls inside buildings and they’re not visible to a satellite. The satellites are not going to provide “5G speeds” and in most cases, will require some user cooperation, ‘like going outside,” he said.

It’s a costly business, and a lot of people, including Verizon and Globalstar, are starting to openly question whether it’s really a game-changer.

“Certainly. we did not see Apple sell a lot more iPhone 14s as a result of offering the satellite messaging” via Globalstar, Farrar said. “To me, that’s where a lot of the challenges are – in the business model.”