The cover of last week’s Signals Research Group (SRG) report suggests 5G Multi-user Multiple Input Multiple Output (MU-MIMO) is bringing some superhero-like qualities to T-Mobile’s network.

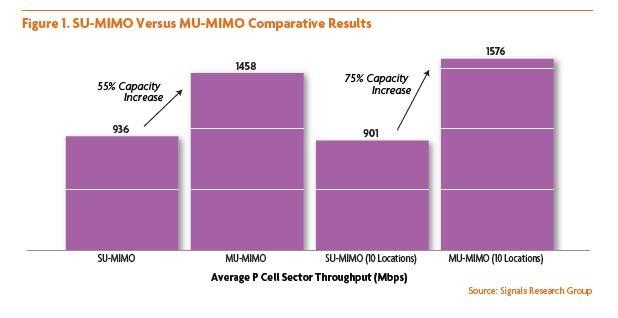

The analysts at SRG conducted tests of T-Mobile’s 2.5 GHz network in Southern California where Ericsson is the infrastructure supplier. Their conclusions show significant increases in capacity – over 50% – when MU-MIMO is present compared to Single User MIMO, aka SU-MIMO. That’s especially relevant for T-Mobile’s fixed wireless access (FWA) business.

For SRG’s tests, T-Mobile provided logistical support, including phones, SIMs and guidance on where to find a large cluster of cells supporting MU-MIMO with 10 Gbps backhaul. Neither T-Mobile nor Ericsson provided financial support for the study. The analysts used commercial smartphones OnePlus 10 Pro and the Samsung Galaxy S22, as well as pre-commercial CPEs from Arcadyan. Spirent Communications and Accuver Americas provided test and measurement tools.

SRG President and founder Mike Thelander said his firm provided T-Mobile and Ericsson with short presentations prior to publishing the report, which is how he found out that T-Mobile has implemented MU-MIMO functionality with Sounding Reference Signal (SRS) technology nationwide where it’s using Ericsson gear. Plans call for rolling out similar functionality to Nokia 2.5 GHz sites by the middle of 2023. He noted that not all smartphones support SRS, although SRG believes the functionality exists in the operator’s FWA CPEs and at least certain iPhone models.

Everyone in the pool

Last year, Thelander encountered MU-MIMO in the Verizon band n77 (C-band) Ericsson network in Minneapolis. Verizon confirmed to SRG that it is evaluating the technology, Thelander said. “There’s clearly interest from all operators. I don’t know where Verizon’s at in terms of deploying it” or testing it, he said. Both T-Mobile and Verizon use Ericsson and Nokia 5G gear; Verizon also uses Samsung.

“If an operator can increase their network capacity by 50% through a basic software upgrade, that’s a no brainer,” he said. “That’s why it’s so compelling.”

There are different ways of implementing MU-MIMO. What Ericsson is doing is based on technology called SRS and Thelander equated it to a game of Marco Polo in a swimming pool.

“This is a similar concept whereby the phone is transmitting signals in the uplink. Those signals allow the base station to figure out where that mobile phone is,” and it can precisely send data to it and use the same resource block to send data to another phone, he said. It works best in a low-mobility situation, which is where FWA operates.

SRG included some insights based on its observations while testing and analyzing the study results that are unrelated to MU-MIMO. “The Reader’s Digest version is that T-Mobile is currently evaluating a new configuration for its TDD frame structure which will allow it to increase downlink capacity/downlink data speeds,” the report notes.

Spidey gets resourceful

Thelander also explained the meaning behind the illustration on the cover of the MU-MIMO report. It shows a Spider-Man character shooting signal beams aimed at Doctor Octopus, who has four “arms” and each one is holding a phone. Two beams of light are coming from the base station to each phone, and these beams represent data streams, tallying up to eight.

With SU-MIMO, each network resource can be re-used up to four times. The terms “4x4 MIMO” and “4-layer MIMO” refer to one network resource being re-used four times, and there’s a theoretical quadrupling of the throughput over a single network resource, he said.

MU-MIMO is conceptually like SU-MIMO, but “the difference is that single network resource can be shared across multiple phones,” he said, adding that in theory, the same network resource can go to eight different phones at the same time. That’s effectively doubling the capacity of the network, and capacity is a big deal when it comes to FWA.

Both T-Mobile and Verizon insist they’re taking steps to ensure they don’t run out of capacity for FWA users who use more data on average than mobile customers. But the question of capacity and how much they can offer continues to come up on a regular basis.

It stands to reason that operators will tap every tool at their disposal to boost capacity, especially when there’s not a lot of mid-band 5G spectrum in the pipeline.

“When you’re talking about things like fixed wireless access where there’s a lot of data consumption, this is a great means for an operator to boost the overall capacity in their network,” Thelander said.