A new report from U.K.-based analyst outfit Point Topic predicted India and Indonesia will experience rapid growth in fiber broadband subscribers toward the end of the current decade, a shift which will see them become two of the top five largest markets in terms of subscriber count by 2030. On the cable front, the U.S. was set to continue leading, though the number of subscribers there was tipped begin a steep downward slide starting at the end of 2025.

India’s fiber subscriber trajectory was forecast to really take off in the 2025 timeframe and by the end of 2028 a chart from Point Topic showed it will tie or narrowly surpass the U.S. to occupy the number two position. Indonesia’s acceleration appeared to begin more in 2026, with it due to pass Brazil and Japan for the number four spot in the 2029 timeframe. China is set to remain at number one throughout the forecast period.

All told, Point Topic predicted China will have 523 million fiber broadband subscribers by 2030, while India will have somewhere in the realm of 110 million. The U.S. was forecast to reach around 80 million in the same timeframe with Indonesia following with just under 60 million. Brazil is expected to narrowly edge out Japan for the number five spot, though both will have around 40 million subscribers.

Looking at fiber penetration, however, Spain and the U.K. are expected to dominate, with rates of 100% or more by 2030. Vietnam, Chile, China and Japan will all have rates around 90%.

“In terms of household penetration, fiber will be used by more than half of all global households, while overall fixed broadband penetration will be 70%,” the firm wrote.

Cable slide

By technology, fiber was forecast to be used by 52.3% of households globally by Q4 2030, with cable the second most prevalent at 7%. Fiber-to-the-curb (FTTC) and vDSL were tipped to be used by 5.8% of households with DSL/ADSL bringing up the rear with 3.0%. Approximately 1.5% of households were predicted to use other technologies.

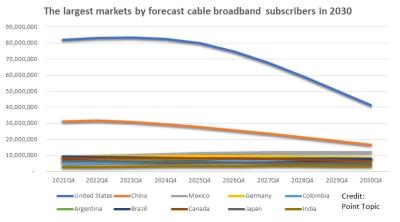

The U.S. currently holds a dramatic lead as the country with the largest cable broadband subscriber count, with around 80 million compared to second place China’s 30 or so million. But figures in both countries were forecast to take a dramatic downward turn starting in 2025. By Q4 2030, Point Topic forecast the U.S. will have just over 40 million subscribers using cable technology, while China will have around 16 million.

Point Topic’s prediction for the U.S. cable market jibes with commentary from MoffettNathanson in June 2021 which suggested the impact of fiber builds on cable operators would peak in 2024 or 2025. It offers a stark contrast to a forecast put out by New Street Research in July 2021 which tipped U.S. cable operators’ overall subscriber count to grow from 73.3 million in 2020 to 85.9 million by 2030. However, New Street's forecast covers the total number of residential customers cable operators will have regardless of technology, rather than just those on DOCSIS connections.

Editor's note: The cable numbers in the Point Topic report refer to the number of users on cable technology (i.e. DOCSIS 3.0 and 3.1) rather than the total number of subscribers cable operators are forecast to have. New Street's forecast is inclusive of all of cable operators' broadband subscribers regardless of technology. The story has been updated to reflect this.