AT&T and CenturyLink have advanced their standings in the global Ethernet space as the two service providers broaden their portfolio of IP and cloud-based services for global multinational corporation (MNC) customers.

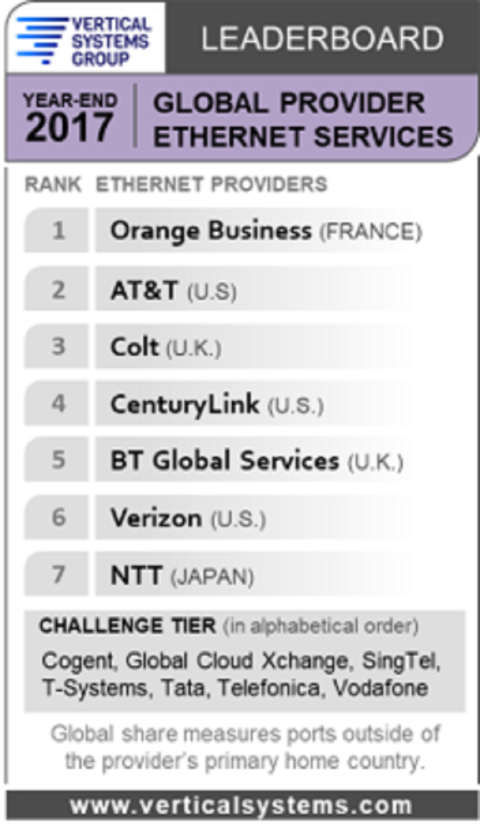

In Vertical Systems Group’s 2017 Global Provider Ethernet Leaderboard, AT&T overtook the second position from Colt, which dropped to the third position. AT&T has continued to advance its global network capabilities, announcing in February that its SD-WAN service is now available in the more than 150 countries and territories.

“AT&T is the top provider of global network services to U.S.-based multinational companies,” said Rosemary Cochran, principal for Vertical Systems Group, in an interview with FierceTelecom.

RELATED: CenturyLink, Frontier make big Ethernet moves as Charter and Comcast become bigger threats

But the biggest move came from CenturyLink. By completing its acquisition of Level 3, CenturyLink took the fourth position on the Leaderboard. As of the middle of 2017, Level 3 ranked fourth on the Global Provider Leaderboard and CenturyLink was in the Market Player tier.

This acquisition was significant in that it gave CenturyLink immediate presence in key markets inside Asia-Pacific, Europe and Latin America. From a network point of view, CenturyLink gained an additional 200,000 route miles of fiber, including 64,000 route miles in 350 metropolitan areas and 33,000 subsea route miles connecting multiple continents.

“The new CenturyLink is now a global player,” Cochran said.

Despite the moves by AT&T and CenturyLink, Orange retains the top position on the Global Provider Ethernet Leaderboard based on year-end 2017 port share results. What has enabled Orange to maintain a top spot in the global Ethernet market is its network reach.

“Each of the top providers in the global segment have wide presence out of their home countries,” Cochran said. “Orange has the most expansive footprint for managed VPN services.”

While it is still a developing concept, service providers’ Ethernet market positions will continue to evolve as they roll out more SDN-based services to satisfy their MNC’s customers multi-site service needs.

“Market shares in this segment are going to shift based on how and when providers deploy their advanced SDN-based features and services in the markets they serve around the world,” Cochran said.