As AT&T and CenturyLink deal with their megabillion-dollar acquisitions of Time Warner and Level 3, these two providers have cut back or delayed big purchases of next-gen optical gear.

The slower spending trends at these two carriers combined with weak cloud and colocation capex spending by other providers drove what Cignal AI says is a weaker-than-expected North American optical capex situation.

“Anemic cloud and colo optical capex—combined with brutal 200G pricing, weak deployments by incumbent and wholesale vendors, and a decline in long-haul WDM purchases—resulted in lower overall spending during 2017,” said Andrew Schmitt, lead analyst for Cignal AI, in a report. “In fact, cloud and colo was the weakest North American customer market for the year; a counterintuitive development considering the priority equipment companies place on it.”

RELATED: From AT&T to Zayo: Tracking wireline telecom earnings in Q4 2017

Schmitt added that “a general slowdown in spending by both AT&T and Level 3/CenturyLink exacerbated the North American decline.”

Already, some optical vendors have been citing the pain of slower or delayed carrier capex spending in the North American market.

Take Infinera, for instance. During its fourth-quarter earnings call, Infinera CEO Tom Fallon said that spending patterns at CenturyLink remain unclear.

“While we remain confident in our position with CenturyLink, we are uncertain when spending will begin to improve,” Fallon said.

Infinera reduced its workforce by 10% in the third quarter as capex spending decisions appeared to be limbo following CenturyLink’s completion of the Level 3 acquisition.

Alternatively, Cignal AI reported that Nokia and Ciena saw the best performance in the quarter. Schmitt said that “outside of vendors that sold into the hot Chinese market, Nokia and Ciena reported the best performance in the fourth quarter of 2017, and their success was driven by increased quarterly sales for metro WDM as well as submarine.”

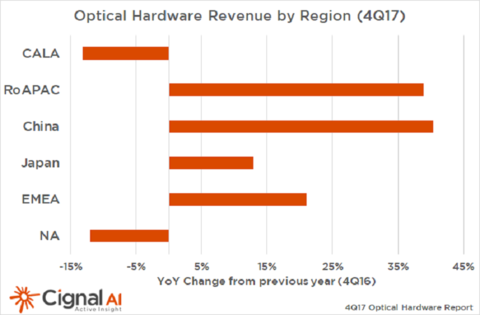

While North America saw struggles, Cignal AI found that spending in the Chinese metro WDM jumped in 2017.

“Chinese optical spending grew despite concerns of market saturation for coherent 100G ports,” Schmitt said. “2017 marked a transition in spending from long-haul to metro WDM equipment in all regions, but China played a predominant role in all spending.”

From an overall global perspective, metro WDM spending grew 11% but only at a more modest 3% excluding China.

Besides China, the EMEA market also showed some potential in 2017. The research firm said that EMEA spending stabilized with a surge in fourth-quarter sales being seen at a larger set of vendors.

“While Huawei benefited from strong end-of-year purchases in EMEA, Nokia, Ciena, Cisco, and Infinera increased their presence in this market,” Schmitt said.