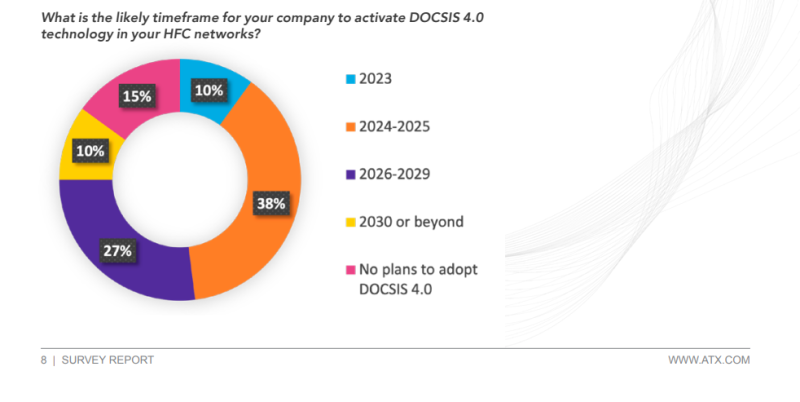

Cable operators are eager to take advantage of the forthcoming DOCSIS 4.0 rollout, as a survey from ATX Networks found nearly half (48%) of cable companies plan to activate DOCSIS 4.0 in their hybrid-fiber coaxial (HFC) networks by the end of 2025.

Furthermore, nearly 65% of cable professionals indicated their companies will install DOCSIS 4.0-capable equipment “as soon as it is available.” Despite fiber’s increasing playing field, less than a quarter (20%) of cable operators think fiber-to-the-home providers pose a “significant threat,” suggesting operators are now more confident they can provide multi-gigabit speeds, said ATX.

ATX, which has conducted its 2050 Project survey for the past three years, polled 81 cable industry professionals who represent more than 60 companies worldwide (though 75% are based in North America). One-third (32%) of respondents said their companies have over 1 million homes passed.

Among the major cable operators, Comcast and Mediacom have said they are targeting a DOCSIS 4.0 rollout later this year. Charter and Cox Communications, meanwhile, are plotting to deploy the technology by 2025.

ESD favored

DOCSIS 4.0 comes in two different variants; extended spectrum (ESD), which is also known as frequency division duplex (FDD), and full duplex (FDX). With ESD, operators can use dedicated chunks of spectrum for the upstream and downstream traffic flows. Meanwhile, FDX involves the simultaneous transmission of data upstream and downstream using the same spectrum.

ATX asked operators which version of DOCSIS 4.0 they are more likely to adopt. While a quarter of providers said they are still unsure, 43% expressed a preference for ESD/FDD, which leverages 1.8GHz spectrum. Only 16% of operators are leaning towards FDX, though Comcast has publicly been one notable FDX proponent.

“The fact that support for FDX has only marginally increased over the past few years is a little surprising, given that significant progress has been made in introducing a version of the technology that works in N+X environments,” ATX wrote in its report. ATX noted FDX was originally believed to only be viable in networks without amplifiers. But in September 2022, Comcast demonstrated FDX operating in an N+6 setup.

N+X refers to the number of amplifiers deployed in a cascade between the node and a user location.

Endgame for copper replacement

Alongside DOCSIS 4.0 upgrades, cable operators are ultimately working on transitioning their networks from copper to fiber. Around 74% of providers estimate the transition will take anywhere from 6-20 years, but 13% suggested complete replacement could take more than two decades.

While migration is the endgame for operators, ATX noted there are still a million miles of coax running through North America alone. Almost half (45%) of respondents said they are engaged in some form of proactive replacement or overbuilding, but ATX said that method isn’t the most sustainable.

ATX argued upgrading the HFC network, rather than overbuilding it, “eliminates the need to immediately dispose of millions of pounds of discarded coaxial cable or fire up the fossil-fuel-burning machinery required to build out fiber networks.”

It should be noted, of course, that ATX has a horse in the DOCSIS race. The company has long served the cable segment and is a notable supplier of amplifiers.