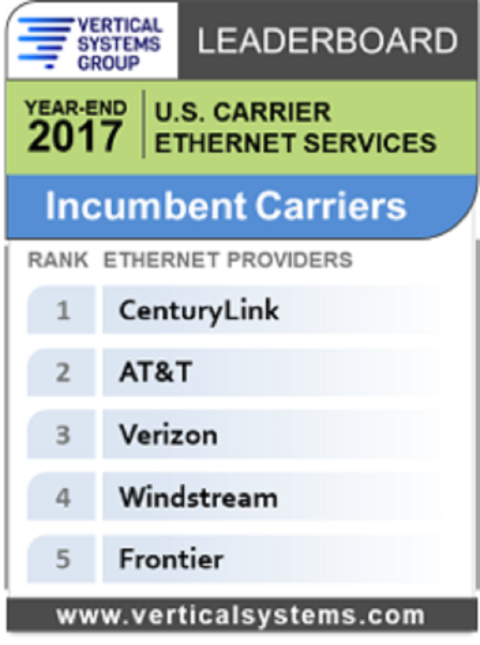

CenturyLink recently took the Ethernet industry segment by storm when it surpassed AT&T as the top Ethernet position in terms of port shares sold on Vertical System Group’s Ethernet Leaderboard, but the service provider will continue to face new competitive threats from an array of aggressive cable MSOs and competitive providers.

What vaulted CenturyLink to the top position on the research firm’s 2017 U.S. Incumbent Carrier Ethernet Leaderboard was the Ethernet ports it gained from its Level 3 acquisition, up from third position in the previous year.

RELATED: CenturyLink steals AT&T’s Ethernet crown following Level 3 acquisition

Fiber availability is a key element of CenturyLink’s standing is the broader fiber footprint. By acquiring Level 3, CenturyLink gained an additional 200,000 route miles of fiber, including 64,000 route miles in 350 metropolitan areas and 33,000 subsea route miles connecting multiple continents.

Due to this move, AT&T dropped into second position from first, a position it had held since 2005. Verizon, including ports from its acquisition of XO, is in third position, followed by Windstream at fourth position.

But the one new surprise entry on the incumbent Leaderboard is Frontier, which gained fifth position for its initial entry to the Incumbent Carrier benchmark ranking. Like CenturyLink, Frontier also gained a larger on-net fiber footprint by acquiring Verizon’s assets in the California, Texas and Florida (CTF) markets.

Dan McCarthy, CEO of Frontier told investors during its fourth quarter 2016 earnings call that it had “mapped and targeted over 30,000 on net fiber-fed multi-customer buildings and footprint.”

More recently, Frontier said in its fourth quarter 2017 earnings call that the small to medium enterprise (SME) business segment is showing signs of revenue progress as it implements new sets of services and methods to reduce service activation times for Ethernet and cloud services.

Cable gets active

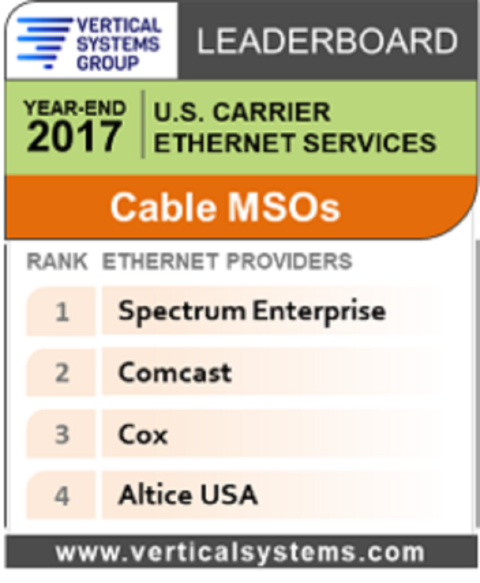

While the incumbent telcos certainly have the brand name and customer recognition, it’s hard not to notice the growing momentum cable MSOs are seeing in the Ethernet segment.

Driven by strong growth in fiber-based Ethernet connections, VSG said Spectrum Enterprise retained the top position on its 2017 U.S. Cable MSO Ethernet Leaderboard.

Spectrum Enterprise reported during the fourth quarter of 2017 that commercial revenue in SMB and enterprise combined grew by 6% to $1.5 billion. Within Spectrum Enterprise’s commercial sector, SMB revenues rose 4.5% year over year to $931 million, while Enterprise grew 8.3% to $570 million.

No less compelling is Comcast, which continues to hold second position, followed by Cox in third. Interestingly, each of these companies also holds a top rank on the 2017 U.S. Carrier Ethernet market benchmark. Finally, Altice, which received a 2017 U.S. Challenge Tier citation, holds fourth position in the cable MSO segment.

What’s helping cable MSOs advance their Ethernet ranking is steady fiber network expansions to more businesses.

“Leading Cable MSOs have made strategic commitments to deep fiber buildouts, aggressive service pricing, and market expansion to include mid-market and national enterprises,” VSG said in a release. “Spectrum Enterprise is the top Cable MSO on the U.S. Fiber Lit Buildings Leaderboard. Comcast had the highest organic growth rate of companies across all 2017 U.S. Carrier Ethernet Leaderboards.”

Competitor shakeup

By completing their purchases of Level 3 and XO, CenturyLink and Verizon paved the way for Cogent to become the top competitive Ethernet provider on VSG’s U.S. Competitive Provider Ethernet Leaderboard.

Cogent moved up due to the exits of Level 3 and XO, which previously held the first and second positions in 2016.

Additionally, Zayo moved up to second from fourth position, and Sprint moved up to fourth from fifth position. GTT gained a third position for its initial entry to the Competitive Provider benchmark ranking.

VSG noted that “each of these top four competitive providers has a Challenge Tier citation on the 2017 U.S. Carrier Ethernet Leaderboard.”

The research firm added that for “the first time, no Competitive Providers qualified for a Leaderboard rank.”