Ciena has taken the number one position in the Ethernet Access Devices (EAD) market, a factor fueled by its deployments with large Tier 1 telcos and carriers in North America.

In its fiscal first quarter 2018, Ciena reported total networking platform revenues of $496 million, up from $490 million in the same period a year ago.

Trailing Ciena were ADVA, RAD, Actelis and MRV, according to IHS Research.

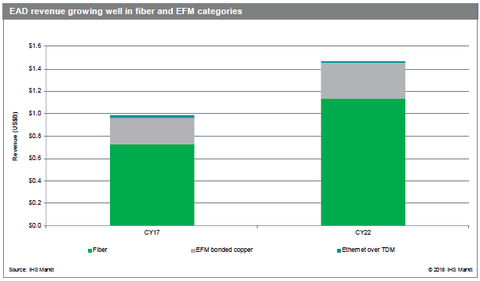

Worldwide EAD revenue totaled $987 million in 2017, increasing 8% over 2016. The market is forecast to reach $1.47 billion in 2021, achieving a 2017–2022 compound annual growth rate (CAGR) of 8%.

RELATED: Ciena’s Smith: 200G is in our rear-view mirror as 400G becomes more important

“The EAD market is growing as a direct reflection of the continuous, steady demand from operators for mobile backhaul and wholesale services—and from business, broadband and building applications,” said Richard Webb, associate director, mobile backhaul and small cells research at IHS Markit.

North America, according to the research firm, remained the largest market for EADs in 2017, with 50% of EAD revenue. Europe, the Middle East and Africa (EMEA) had 24%, Asia Pacific held 20% and the Caribbean and Latin America (CALA) had 6%.

IHS said that now and in the foreseeable future, North America maintains its lead through the early adoption of higher-capacity ports over fiber.

But it’s clear that the EAD market is evolving. A key part of that evolution is the emergence of the universal CPE or uCPE concept. Driven by large telcos such as AT&T with its FlexWare concept and Verizon's uCPE solution, uCPE devices can support an array of services besides Ethernet such as security as well as carrying out virtualized network functions.

“A new sub-segment is beginning to make an impact in the EAD market: the universal CPE, or ‘uCPE’—a device that provides a ‘pico cloud’ of computing, storage and switching capable of executing virtualized functions,” Webb said. “Still, there will be an ongoing role for EADs even as virtual CPE takes off.”