Equinix and Digital Realty were the two most aggressive consolidators of the data center industry segment, spending in aggregate a total of $19 billion between 2015 and 2017.

During this two-year period, Equinix made major acquisitions in all four regions of the world, while Digital Realty has focused on the United States and Europe.

Some of Equinix’s high profile deals include its $3.6 billion purchase of Verizon’s 29 data centers in 15 markets. The purchase, which closed in May 2017, extended Equinix’s North American footprint into two new markets, Houston and Culpeper, Virginia, and expanded its Latin American presence by adding a facility in Sao Paulo and Bogota, Colombia.

RELATED: U.S. houses 44% of all major cloud and internet data center sites, Synergy Research Group says

Digital Realty was also aggressive on the data center M&A front, purchasing DuPont Fabros for $7.6 billion in 2017—one of the year’s largest deals.

However, Cyxtera, Peak 10 and Digital Bridge also made large data center deals during the year. Cyxtera purchased CenturyLink’s data center assets for $2.15 billion in 2016, while Peak 10 acquired ViaWest for $1.7 billion. CyrusOne, Peak 10, Digital Bridge, NTT, Carter Validus, Iron Mountain, Cyxtera and Elegant Jubilee were active in scaling their data center facilities via targeted acquisitions in 2017.

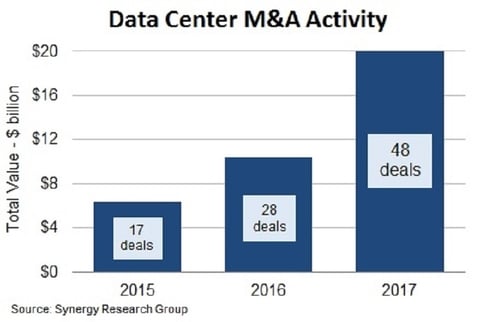

Synergy Research revealed in new data that the total value of significant data center-oriented M&A deals that closed in 2017 reached $20 billion, surpassing the total for 2015 and 2016 combined. The research firm noted that there are also four additional pending deals that have not closed, with a total value of over $2.6 billion.

The research firm added that on average through 2017, there was almost one significant M&A deal closed every week.

John Dinsdale, a chief analyst and research director at Synergy Research Group, said what’s driving the consolidation of the data center industry is enterprises outsourcing their data center capabilities to third parties.

“Above all else, what is driving the data center M&A activity is enterprises focusing more on improving IT capabilities and less on owning data center assets,” Dinsdale said. “That shift is driving huge growth in outsourcing, whether it is via cloud services, or use of colocation facilities, or sale and leaseback of data centers.”

Dinsdale added that the emergence of new cloud providers will continue to look to data center operators to house and deliver their apps, a trend that could result in more data center provider acquisitions.

“The dramatic growth of cloud providers is also driving changes in the data center industry, as data center operators strive to help them rapidly increase scale and global footprint,” Dinsdale said. “We expect to see much more data center M&A over the next five years.”