Fixed wireless access is a hot topic—again.

Several topics were hot in 2017 and will remain hot in 2018 including 5G and fixed wireless access (FWA). For those of us with gray hair, FWA is not new. While FWA has been used only in limited deployments to date, we expect it to become a viable broadband access approach for a broader range of scenarios, joining the toolbox of wireline access solutions.

Remember the “A” in FWA

Wireless operators and integrated operators can take advantage of existing LTE networks, or future 5G networks, to alleviate some FWA network build costs, but broadband-to-the-home access monetization scenarios are highly dependent on numerous factors, whether fixed or wireline, including:

- Density of homes.

- Subscriber take-up rates.

- Bandwidth offerings and ARPU per bandwidth offering.

- CPE devices and whether they are self-installed or require professional installation, e.g. truck-rolls.

- Mobile backhaul architecture such as fiber versus microwave.

- Network contention or oversubscription rates.

- Labor costs.

And these are in addition to possible FWA spectrum costs.

Moreover, the “A” in FWA requires a different kind of attention paid to marketing, sales and support for residential subscribers compared to wireless subscribers.

But first, don’t equate 'homes passed' with subscribers in either wireline or FWA

This analyst has always been wary of "homes passed" statistics when it comes to FTTH subscriber forecasts. The issue applies to the wireless world too.

In FTTH network builds, "homes passed" provides an indication of the potential subscriber base but just an indication. First, it takes time to market FTTH services and not all potential subscribers will choose to move to FTTH. Then, it takes time to pull the fiber into the housing unit and connect the CPE device to be able to bring up the residential service.

Even Google Fiber experienced a time delay between activating subscribers and having homes passed. We must remember that Google Fiber only passed homes when enough homes in a particular neighborhood had signed-up in advanced for FTTH.

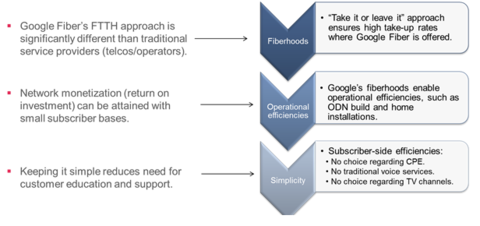

And just for reference, I went back to a slide used back in 2014 that highlighted Google’s approach as shown in Figure 1.

Let’s take this another step, to where an operator installs antennas to support FWA. Again, there is a major difference between passing dwelling units with a roof antenna on top of the MDU (multi-dwelling unit) versus having those occupants becoming subscribers.

While I am delighted to see several operators publicly state their FWA homes passed or coverage goals, coverage does not immediately or directly translate to subscriber numbers.

Marketing, sales and support models are different too

While cellular bills can be very complex, most subscribers know when they are eligible for device upgrades, they know how to replace their devices and they know how to activate their new devices. At risk of dating myself further, today’s youth regards the countdown to upgrade eligibility as I regarded the “days until I could get my driver’s license.”

The broadband-to-the-home market is complex when compared to mobile services and I would say it is downright convoluted at times. Some subscribers opt for multiplay services while others pick and choose from multiple suppliers to achieve the best basket of services at the best price. We rarely know when we are eligible for CPE upgrades. Furthermore, the self-install box approach often leads to more frustration than waiting for a technician to arrive.

On top of these issues, let’s spend a minute on connectivity throughout the home. Broadband-to-the-home subscribers expect seamless and consistent connectivity throughout the home.

It has been well documented that many calls into an operator’s support center are due to Wi-Fi problems even though Wi-Fi is not really an operator’s responsibility. Regardless, operators are incorporating more Wi-Fi intelligence into their CPE units to improve Wi-Fi coverage and improve diagnostics, thereby eliminating Wi-Fi issues and support calls.

But FWA is an opportunity for vendors and operators

For this column, let’s focus on the vendors.

- Wireless-only equipment vendors: FWA may appear to be an easy add-on for wireless equipment vendors, but as discussed, the broadband-to-the-home market is fundamentally different than the mobile market. Wireless-only equipment vendors should carefully analyze the FWA market opportunity along with their competitive capabilities or lack thereof. These vendors will either need to develop, partner or acquire any missing broadband-to-the-home equipment, software and support capabilities.

- Wireline-only equipment vendors: These vendors must decide whether to enter the FWA market and if so, how to do so. They must decide whether to develop solutions themselves or to partner with FWA equipment vendors. While wireline-equipment vendors are well versed in the broadband-to-the-home market, a partnership would dramatically increase their ability to sell to and support FWA operator initiatives.

- Integrated-access equipment vendors: These vendors should have a clear advantage in selling to the FWA market. They have both broadband-to-the-home and wireless network expertise, product lines, marketing, sales and support teams. However, they must resolve internal positioning or competition between their wireline access division and their mobile/FWA division to provide operators with sound analysis of the best solution for specific coverage areas.

One approach is to combine FWA and wireline access teams to create a single strategy and overall KPIs regardless of the underlying technology or solution. We have seen several vendors do just this.

Julie Kunstler is a principal analyst at Ovum specializing in wireline/fixed broadband access, particularly next-generation broadband technologies, deployments and monetization strategies.