Peak 10 + ViaWest, the data center company created out of Peak 10’s acquisition of ViaWest last August, has taken on a new brand identity as Flexential. The company says the new name reflects its flexible, customer-focused approach.

A key focus for Flexential is to help clients that have hybrid IT needs.

RELATED: Peak 10 acquires ViaWest for $1.7B, scales reach into multiple markets

Flexential CEO Chris Downie said that the new name was created with the desire to establish a common identity for the company.

“We wanted to come into 2018 with a new brand that we thought was a clear reflection of the combined value proposition of both companies, which was very similar before the acquisition and in a lot of ways we were creating scale on a common value proposition,” Downie said. “The legacy names, which have their strengths as both companies had about 17-18 years in tenure, and neither company fit with the new platform with a national set of capabilities the company had going forward.”

During a five-month period, Peak 10 + ViaWest worked with third parties and conducted research in the market, conducting 700 interviews with customers and employees.

“In establishing a new brand, we wanted it to reflect what we have been doing, but also everything that is appreciated by those audiences,” Downie said. “We came up with Flexential, which has the words flexible, essential and potential and we look at those words as core parts of our value proposition.”

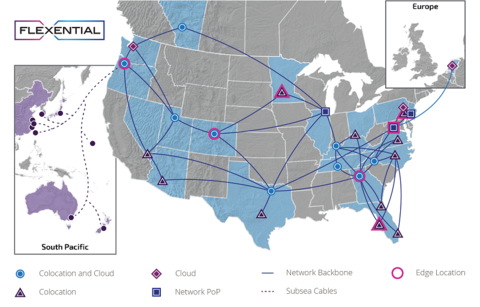

While the name has changed, the data center provider said its service focus will remain unchanged, Flexential will continue to deliver data center solutions spanning colocation, connectivity, cloud, managed solutions and professional services to help its 4,200+ customers increase competitiveness as their industries evolve. The data center provider has a wide array of assets, including 41 secure and redundant data centers that span 21 domestic and international markets.

Like Digital Realty’s deal to acquire DuPont Fabros, Peak 10’s acquisition of ViaWest was all about scale. The purchase also reflects the ongoing expansion and consolidation of the data center market.

Creating greater scale in more large markets will be important to satisfy customer needs. According to a recent Synergy Research Group report, there are 20 main global metros where there’s a large community of data center providers.

Flexential certainly does not disappoint in the reach department as the data center provider currently serves 21 domestic and international markets including 18 U.S. cities and two international locations—Amsterdam and Calgary.

Besides scale, Downie said that its wide-scale network, created via partnership with a mix of Tier 1 service providers, creates necessary reach across the United States and key international sites in Europe.

“The one thing we have that I don’t see any of our peers having is a true network backbone that ties all our capabilities together that also extends to the primary carrier hotels that I think that enables our portfolio to make it relevant on a global basis,” Downie said. “We have some overseas fiber cables coming into our Pacific Northwest facilities and going to London and Amsterdam.”

The research firm revealed in its third-quarter 2017 report that the top colocation markets include 10 in North America, four in the EMEA region and six in the APAC region. Across the 20 largest metros, retail colocation accounted for 72% of third quarter revenues and wholesale 28%.

Flexential may be the latest data center provider that’s going through a name change following a large acquisition, but it certainly won’t be the last. After the venture capitalist consortium BC Partners and Medina Capital purchased CenturyLink’s data centers in 2016, the unit was renamed Cyxtera.