As service providers decelerate their deployments of VoLTE and overall spending, VoIP and IMS product revenue has dipped 12% year over year to $4.5 billion.

IHS Markit said in its quarterly Service Provider VoIP and IMS Equipment and Subscribers report that overall worldwide revenue is forecast to decline at a compound annual growth rate of 3%, falling to $4 billion in 2022.

The research firm attributes this decline to the slowing of voice over LTE (VoLTE) network deployments and overall spending falling in what it calls a “steady pattern.”

RELATED: Cloud-based VoIP, UC seats to surpass 70M mark in 2020

Additionally, pricing declines due to competitive factors and large deals in international markets such as India, China and Brazil are also hampering growth. One of the key factors preventing new growth is the fact that the large push to roll out VoLTE is starting to taper off.

IHS said that as of January 2018, 119 wireless operators launched commercial VoLTE services, with more coming every year. Most of the VoLTE launches in 2017 took place in Europe as well as some expansion in Chinese provinces, due to growth from China Mobile. In Brazil and India, Vivo and Bharti Airtel have conducted large VoLTE launches.

With the expansion of large VoLTE projects in India and China, the Asia-Pacific region ranked first in global revenue in 2017, accounting for 37% of the market. Spending from VoLTE projects in Asia-Pacific and the Caribbean and Latin America continue, but it is not enough to move the worldwide market back into growth territory, primarily due to price compression in both regions.

“The big story over the past four years has been mobile operators and the transition to VoLTE, which has been the number-one driver of VoIP and IMS market growth, along with voice over WIFI (VoWiFi) and other mobility services,” said Diane Myers, senior research director for VoIP, UC, and IMS at IHS Markit, in a release. “However, after initial VoLTE network builds are completed, sales growth drops off, as operators launch services and fill network capacity.”

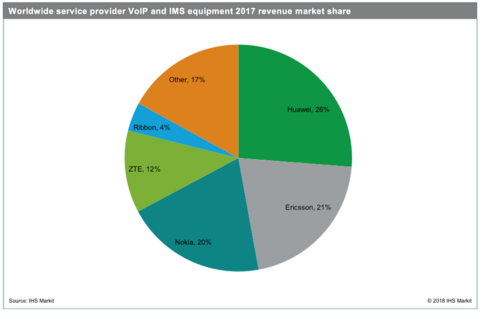

Huawei was the dominant vendor with 26% of worldwide revenue in 2017. Joining Huawei was Ericsson in second place at 21%, followed by Nokia, ZTE and Ribbon Communications.