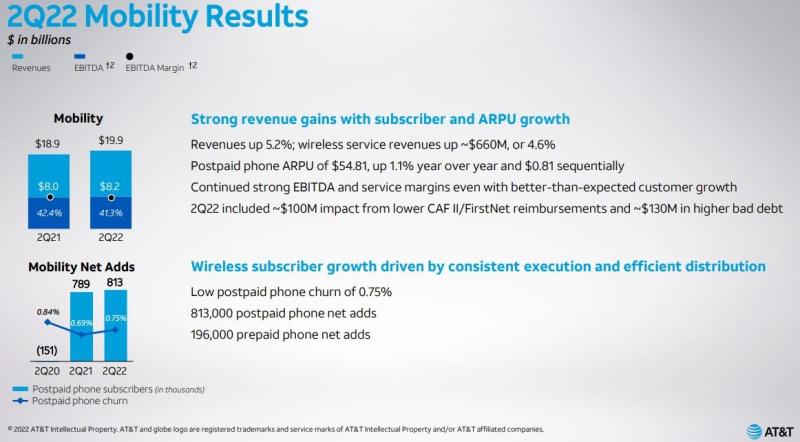

AT&T in the second quarter of 2022 posted 813,000 postpaid phone subscriber net adds for its best second quarter in over a decade.

Postpaid phone churn was 0.75% in the second quarter of 2022, which was better than what most analysts had expected.

In May, AT&T said it was raising prices on some older wireless plans by up to $6 a month for single-line customers and up to $12 per month for families. Verizon followed suit with similar price increases, while T-Mobile mostly stayed on the sidelines, claiming its Price Lock commitment as an advantage.

Asked during the earnings call how customers were reacting to the price increase, AT&T CEO John Stankey said “everything is tracking as we kind of expected when we laid it out.”

In some cases, customers are choosing to pay the increase to their existing plan, but there’s also some who are choosing to migrate to another plan and trade up, he said.

Addressing inflationary pressures, Stankey said historical patterns in previous economic cycles suggest customers have managed their accounts similar to what they’re experiencing today.

“In fact, we feel even better about the resiliency of our services, given the elevated importance of connectivity in everyone's lives. We view this cycle no differently and still expect customers will pay their bills, albeit a little less timely,” he said during Thursday’s conference call.

“This typically is not an issue of people not paying. It’s an issue of when they pay,” Stankey said.

Revenues in AT&T’s mobility segment, its largest business, were up 5.2% year over year, to $19.9 billion due to higher service and equipment revenues. Service revenues were $15 billion, up 4.6% year over year, driven primarily by subscriber growth. Equipment revenues were $4.9 billion, up 7.2% year over year, driven by increased sales of higher priced smartphones.

Operating income was $6.2 billion, up 3.4% compared to a year ago.

AT&T’s total net adds were 6.6 million, including the aforementioned 813,000 postpaid phone net adds, as well as 7,000 postpaid tablet and other device net adds, 196,000 prepaid phone net adds and 238,000 “other” net adds.

Prepaid churn was less than 3%, with Cricket substantially lower.

Postpaid phone-only ARPU was $54.81, up 1.1% versus the year ago quarter, due to better international roaming and a shift to higher-priced unlimited plans.

Regarding the rest of the year, “we like the momentum in the mobility business, both on a service revenue and EBITDA basis,” said AT&T CFO Pascal Desroches.

Analyst questions consumer value proposition

At the heart of their subscriber gain story is low churn, wrote MoffettNathanson analyst Craig Moffett in a report today. “AT&T’s ‘best deals for all’ promotion continues to keep churn very low,” he said.

But Moffett stressed that AT&T is lacking in terms of a consumer value proposition. Verizon for a long time had its network story and it’s well ahead of AT&T in densifying its network with small cells. T-Mobile has had its lowest price strategy and now claims a 5G win in both network and price.

The analyst wonders how long AT&T’s Mobility results can be maintained. “Promotions have obviously helped lower churn and therefore boost net adds, but AT&T has increasingly goaded Verizon into following suit. Meanwhile, T-Mobile’s network advantage continues to expand,” he said. “What’s left is a fundamental question that is, to us, increasingly pressing. What is AT&T’s consumer value proposition?”

To be sure, AT&T’s mobility business is a shining star among some of its other units. But the earnings call was a reminder of just how critical voice communication remains in an industry overrun by high-speed data connections and video shares.

The first question from an analyst during the Q&A portion of AT&T’s earnings call Thursday came from a garbled line. “You’re breaking up,” Stankey told the caller, who responded with the age-old “Can you hear me now?” refrain made popular in rival Verizon’s old commercials. Ultimately, they moved onto the next analyst’s question.