It’s well-reported that there are staffing shortages in many industries, and this often translates into bad customer experiences.

According to a new survey from J.D. Power, U.S. wireless purchase customer satisfaction is going down.

The analyst group measured satisfaction with carriers across four purchase channels and compared the latest results (Vol. 2) with a similar survey (Vol. 1) whose results were released in February. The four purchase channels were phone calls to carrier customer service centers; visits to carrier stores; carrier websites; or the carrier mobile apps. The customer satisfaction was measured from initial contact to problem resolution.

The Vol. 2 study was fielded from January through June 2022 and based on responses from 14,056 customers.

According to J.D. Power, respondents that had a wireless purchase experience in the past six months said transactions are taking longer to complete, and they feel like they’re putting more effort into the process than ever before.

“Staff retention constraints, shorter representative tenure and less training is leading to a longer time to complete the purchase, more perceived effort from the customer and, ultimately, a decrease in satisfaction,” said Ian Greenblatt, managing director at J.D. Power, in a statement.

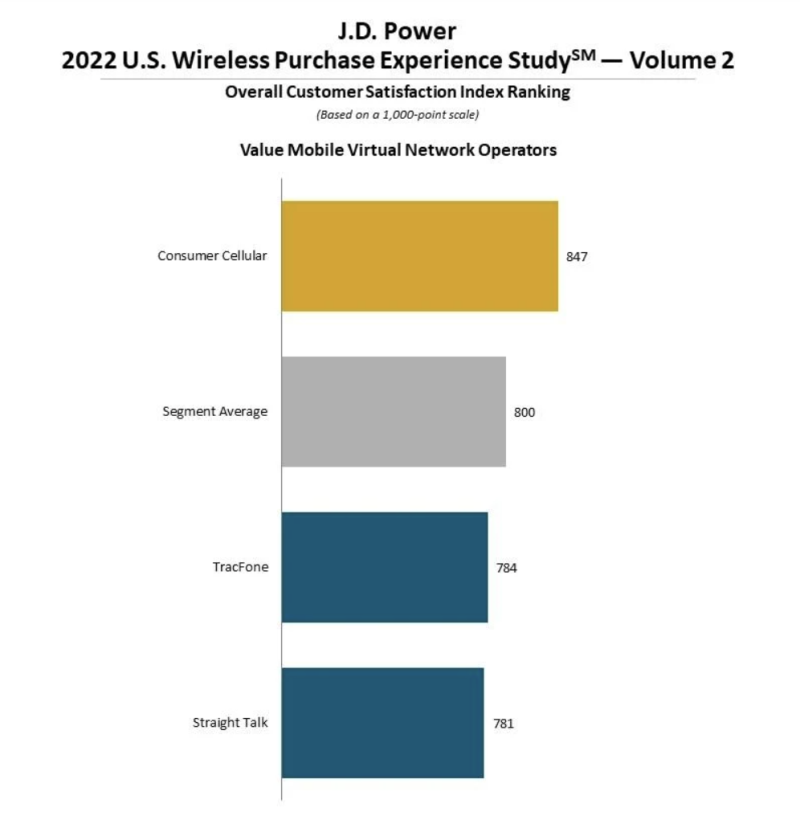

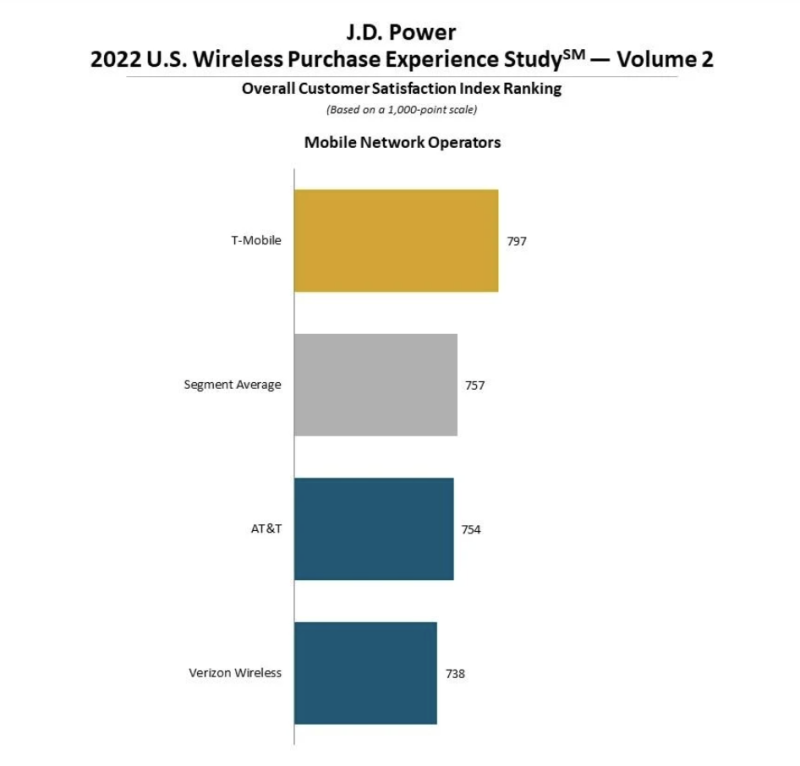

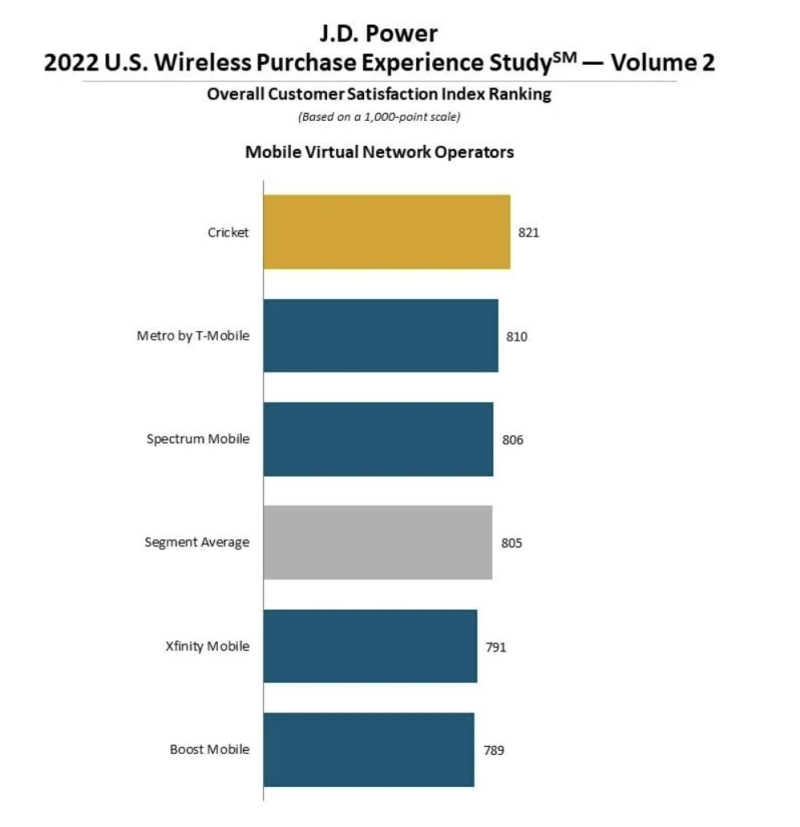

There are three categories of operators, and here are the changes in category averages from Volume 1 to Volume 2, based on a 1,000-point scale.

- Mobile Network Operators: 775 in V1 to 757 in V2

- Mobile Virtual Network Operators: 804 in V1 to 805 in V2 (a nominal uptick)

- Value Mobile Virtual Network Operators: 821 in V1 to 800 in V2

Among mobile network operators, T-Mobile ranked the highest for a 10th consecutive volume, with a score of 797. But it had a score of 807 in Vol. 1.

Cricket ranked the highest in the Mobile Virtual Network Operators segment with a score of 821, and Metro by T-Mobile (810) ranked second. But during Vol. 1, Cricket ranked highest with a score of 826, followed by Metro by T-Mobile with 814.

Consumer Cellular ranked the highest in the Value Mobile Virtual Network Operators segment with a score of 847. But this dropped from 859 in Vol. 1