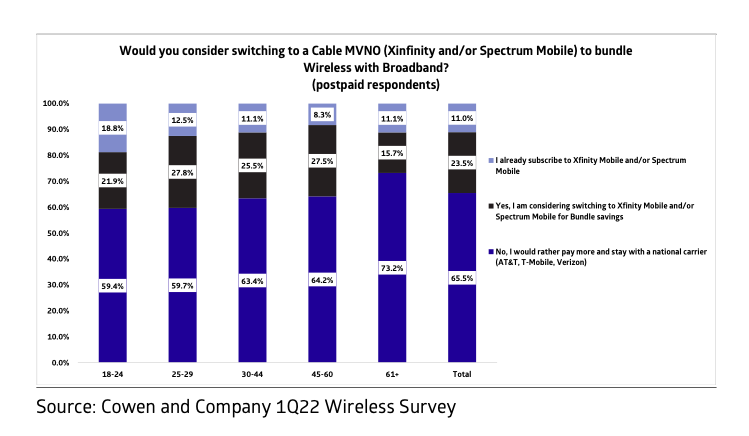

According to a new survey from the analysts at Cowen, 23.5% of postpaid wireless customers would consider switching from their current provider to a cable mobile virtual network operator (MVNO) such as Xfinity Mobile or Spectrum Mobile.

“It’s worth noting that loyalty to the Big 3 carriers increased with age, as we note younger cohorts more likely to leave their national carrier to reap bundle savings with a cable MVNO,” stated the Cowen analysts led by Gregory Williams.

However, the analysts did note that cable operators actually prefer older customers who use less data, thus reducing wireless wholesale costs.

Comcast and Charter only offer their MVNO services to their existing wired broadband customers.

Cowen’s survey was conduced on March 23 with 1,086 people responding. It also found that lower-income subscribers were less loyal to national carriers, while loyalty to the big carriers increased with household income.

Both Comcast and Charter have indicated their main interest in wireless is to provide their valuable fixed broadband customers with more choice. “We continue to see cable as being in an advantageous position in the wireless industry, willing to take little (or no) margin on mobile subs as cable instead focuses on the ‘total household telecom bill’ and reaps the benefits of reduced broadband churn,” stated Cowen.

Coincidentally, the analysts at MoffettNathanson also published a new report yesterday entitled “It’s Time to Take Cable’s Wireless Business Seriously.”

Moffett noted that in the past year it became apparent that cable’s traffic offload to Wi-Fi “is much more effective than we had previously estimated.” This Wi-Fi offload causes cable’s variable costs to be lower, and margins higher, than Moffett had previously modeled.

Comcast recently said it has about 20 million Wi-Fi hotspots. That’s up from about 19 million Xfinity Wi-Fi hotspots in 2019.

Although the cable MVNOs say their main interest in wireless is to prevent churn of their valuable wired subscribers, they have been ramping their mobile efforts.

“Comcast’s and Charter’s purchase of CBRS spectrum presents the opportunity for meaningful additional traffic offload, expanding margins accordingly,” wrote Moffett.

Both Charter and Comcast saw record line additions in the fourth quarter of 2021. Altice also recently expanded its MVNO deal with T-Mobile for its Optimum Mobile MVNO offering.

“All said, while the cable mobile story is still in its early innings (3.5% 1Q22E phone market share), there is a large runway ripe for share stealing,” wrote Cowen.