NEW ORLEANS — It was curious to have a cable company executive from Charter present a keynote at this week’s Wireless Infrastructure Association (WIA) Connect(X) show. But perhaps it was an indication of convergence between the wireless and wired worlds, as Charter gains more traction with its Mobile Virtual Network Operator (MVNO) business.

Gary Koerper, SVP of Emerging Technology with Charter, noted that the cable companies have used wireless spectrum and technology for many years for their Wi-Fi networks. And now Charter and Comcast are offering their combined Wi-Fi footprint for each others’ MVNO customers.

Fierce Wireless reached out to Koerper after his speech, for more detail about the Wi-Fi sharing.

Koerper said via email, “Spectrum Mobile customers can access the Xfinity Wi-Fi network, having the benefit of mobile offload. Xfinity (and other MSO partners’) customers can access the Spectrum Wi-Fi network, as well.”

For smart phones, this is transparent. “Charter, Comcast and our partners work behind the scenes to ensure that phones connect seamlessly and securely to our respective Wi-Fi networks,” said Koerper. “The Phone UX would simply show it is connected via Wi-Fi. For computers, the consumer (the first time) has to log in through a captive portal or download a profile, but after that the device is remembered and allowed seamless and secure access.”

In his speech at Connect(X) Koerper said smartphones would automatically look for a participating Wi-Fi hotspot “whether a neighbor’s or a small business location” and attach to it.

Looking back at Charter's 2022 Annual Report, it states: "We continue to focus on improving the customer experience and integrating our mobile and fixed internet products, providing greater Wi-Fi access, speeds and performance using more than 500,000 of our out-of-home Wi-Fi access points across our footprint combined with approximately 25 million out-of-home Wi-Fi access points from other networks with which we partner, providing near nationwide coverage."

Charter’s MVNO

Charter started its MVNO business four years ago and now has about 6 million customers. About 10% of those wireless customers signed up during the first quarter of 2023, when Charter blew past analyst expectations of MVNO subscriber growth.

Related

Charter scores 686,000 new mobile lines in Q1 2023, Comcast reports 355,000

The company has been very vocal about offloading as much of its MVNO traffic as possible from Verizon’s network onto its own Wi-Fi.

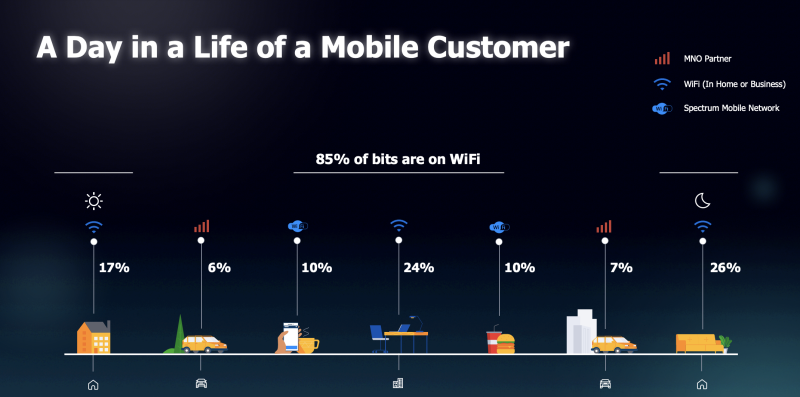

“When we look at the bits on Spectrum Mobile, about 85% are on Wi-Fi,” said Koerper. “We’re working to increase that number and have more Wi-Fi. Every one of our 6 million mobile phones automatically look for Wi-Fi and automatically attach to it.”

“Cable companies in America have tens of millions of access points for Wi-Fi offload,” he added. “The scale the cable industry has reached as far as a Wi-Fi network to support mobile connectivity is tremendous.”

Charter's speed boost

Charter also likes to tout its Spectrum Mobile Speed Boost, a feature offered to its Spectrum One customers. Spectrum One combines broadband, Wi-Fi and mobile into one bundle. Charter uses Speed Boost to increase the speed of Wi-Fi for these customers, regardless of what tier of broadband they're signed up for.

Related

Charter taps its Wi-Fi to provide speed boost for its mobile customers

Wireless spectrum

In his speech, Koerper talked about wireless spectrum, in general. He said Charter is interested in unlicensed, licensed and shared spectrum. Unlicensed supports its Wi-Fi network. Licensed (via Verizon's network) supports its mobile traffic when not on Wi-Fi. And Charter is interested in shared spectrum due to the fact that it owns Citizens Broadband Radio Service (CBRS) spectrum, which it purchased in 2020 for $464 million.

Related

Charter CEO hints at acquiring more licensed spectrum

Koerper was bullish on shared spectrum at this week’s show. He said, “We want to broaden the use of shared spectrum,” which he said is proven to work through the CBRS sharing model. He said there have been 300,000 CBRS devices deployed already, and there have been “no problems with interference."

Both Charter and Comcast have said they plan to use their CBRS spectrum to offload some of their MVNO traffic. Charter has said it's trialing CBRS in one market but hasn't given a date as to when it might use the spectrum for real.