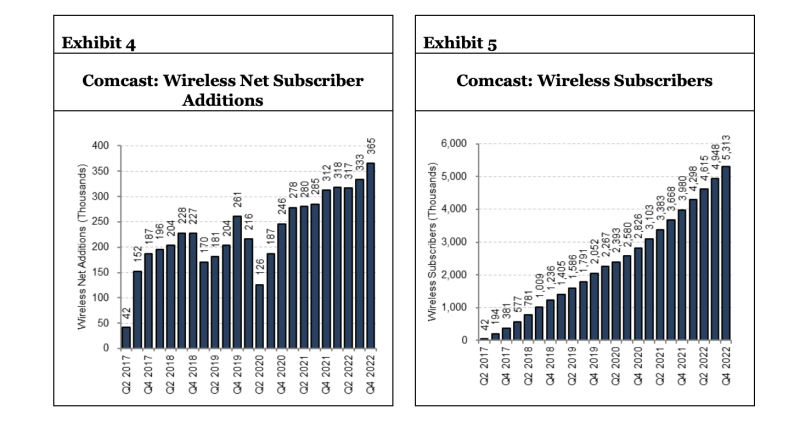

Comcast reported this week that it added 365,000 wireless lines in the fourth quarter of 2022, and its wireless revenue increased 25%. The line additions in the fourth quarter amounted to its highest number of net additions for any quarter since it began offering its mobile virtual network operator (MVNO) services five years ago.

For the full year 2022, Comcast added 1.3 million mobile lines.

The analysts at MoffettNathanson wrote, “Wireless is unambiguously Comcast’s next big growth engine. Their total wireless subscriber base now stands at 5.3 million, a remarkable achievement in such a short time.”

The analysts said, “Comcast’s wireless business now accounts for 5.3% of Cable segment revenue, annualizing at more than $3.5 billion revenue, and it is growing at a 24.5% annual growth rate.”

Comcast CEO Brian Roberts said on the company’s earnings call, “Wireless is playing an integral part of our overall strategy at cable, and it's an area where we continue to shine.” He said the current 5 million-plus lines represent only 9% penetration of Comcast’s current base of residential broadband customers.

“We have plenty of runway ahead, and we're just getting started in offering wireless to our commercial segment, which is another great example of how we are selling more products into our existing base of business customers,” said Roberts.

The MoffettNathanson analysts said Comcast is clearly leaning into wireless, recognizing not only that it will be their most important growth driver, but that it also potentially holds the key to churn reduction in broadband.

RELATED: Comcast loses 26K broadband subs, targets 1M new passings in 2023

Dave Watson, CEO of Comcast Cable, stressed the same point. He said, “The mobile game plan is really to support broadband. When you package the broadband with mobile, there is a churn benefit to that.”

The analysts also noted that Comcast’s wireless prices are well below those of Verizon and AT&T, enabled by high levels of traffic offload onto Wi-Fi. Their next phase, just now getting underway, is to offload still more traffic, further reducing their marginal costs, by deploying strand-mounted 5G small cells operating on their CBRS spectrum.

Comcast also owns Sky in the U.K., and it reported that the MVNO Sky Mobile has surpassed 3 million lines.