Ever since Comcast launched its Xfinity Mobile MVNO service last year, the market’s primary question has been: Which of the existing nationwide carriers will suffer the most from Comcast’s entry into the space?

Based on new survey data provided exclusively to FierceWireless, the answer is somewhat surprising. It’s Verizon.

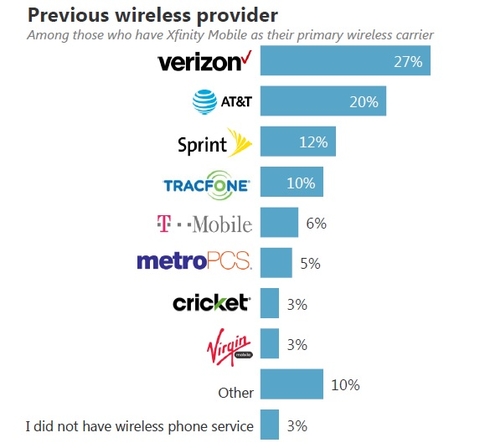

According to a recent survey of Xfinity Mobile customers conducted by Market Strategies International, a majority of them came from Verizon. Specifically, almost one in four, or 27%, previously paid Verizon for their wireless service.

That’s a particularly surprising finding considering those customers are actually still on Verizon’s network, they’re just sending their money to a different company (a company that’s reportedly paying Verizon $5 for every GB its Xfinity Mobile customers use). Comcast’s Xfinity Mobile service is an MVNO, which means that Comcast handles all of its mobile customers’ billing and service issues, but the actual underlying network they’re using is Verizon’s.

What’s even more surprising is that Xfinity Mobile customers generally ranked the MVNO’s network coverage as slightly better than Verizon’s network coverage, even though the underlying network is exactly the same. (That’s not a huge surprise considering just 29% of Xfinity Mobile’s customers knew that Verizon is the actual network provider for Comcast’s mobile service.) Xfinity Mobile customers also rated the MVNO’s price and speed higher than Verizon’s, though Xfinity Mobile customers did give Verizon a slight lead when it comes to customer service.

To be clear, the reason that Verizon is the leading contributor to Comcast’s Xfinity Mobile customer base may be partly due to the fact that Verizon is also the nation’s largest wireless network operator, with around 150 million customers at last count. So, all things being equal, Verizon would mathematically supply the majority of Xfinity Mobile’s customers. That argument lines up with the fact that AT&T is the second largest contributor to Xfinity Mobile’s customer base, with 20% of the MVNO’s customers hailing from AT&T.

Interestingly, only 6% of Xfinity Mobile’s customers are coming from T-Mobile, according to Market Strategies International, despite the fact that the operator is the nation’s third largest. That may be why T-Mobile’s CEO has described Xfinity Mobile as “very irrelevant.”

(It’s also worth noting that Verizon’s CFO said that network usage from Comcast's Xfinity Mobile has "pretty much been as expected in terms of the volumes" and the carrier remains pleased with its MVNO agreement with Comcast.)

It’s important to state here that Market Strategies International obtained its data from interviews with 1,044 consumers aged 18 to 64 between March 14 and 28, 2018. “Respondents were recruited from the Full Circle opt-in online panel of U.S. adults and were interviewed online,” the firm noted. “Survey invitations were sent in proportion to U.S. census populations and the data were weighted to match wireless provider market share. Due to its opt-in nature, this online panel (like most others) does not yield a random probability sample of the target population. As such, it is not possible to compute a margin of error or to statistically quantify the accuracy of projections. Market Strategies will supply the exact wording of any survey question upon request.”

And exactly how many of those 1,044 consumers actually subscribe to Xfinity Mobile? The firm said it oversampled for Xfinity Mobile customers and got responses from 108 of them.

No, that’s not a sizable chunk of the 577,000 people who subscribe to Xfinity Mobile, but it’s certainly better than nothing, and it definitely offers some insights into why wireless customers might be switching to a new brand in the wireless industry.

So, why are customers switching to Xfinity Mobile? The top reason, according to Market Strategies International, is cost. Fully 57% of the MVNO’s customers said they switched because they got a better deal from Xfinity Mobile, and 70% of those who were dissatisfied with their previous wireless provider said it was because of the monthly cost of their plan. (Interestingly, the second leading reason was coverage or network quality at 52%.)

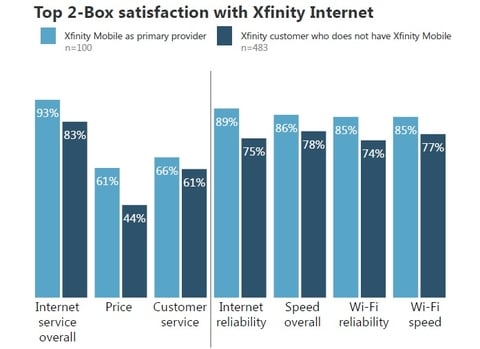

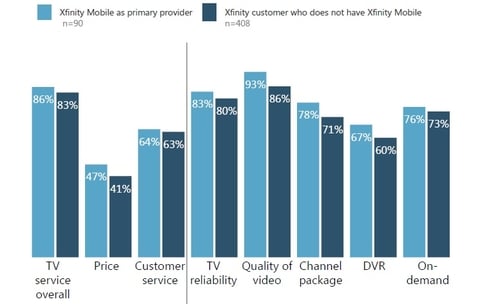

Now, here’s the final, and perhaps most important, point to take away from the survey: Xfinity Mobile customers tend to be more satisfied with their internet and/or TV service than other Comcast/Xfinity customers.

And that’s a huge reason why Comcast finally decided to go all-in with a wireless offering. As Netflix and other online video providers threaten the company’s TV business, and fixed wireless providers edge into its internet business, the addition of a mobile offering makes Xfinity customers happier and less likely to ditch Comcast.

Whether that’s a growth strategy though remains to be seen. — Mike | @mikeddano

"Editor's Corners" are opinion columns written by a member of the Fierce editorial team. They are edited for balance and accuracy.