Americans have now more good internet options than before. The times when Americans could choose from DSL and cable, with cable the mostly better choice are quickly coming to an end for everyone. Fixed wireless is rapidly becoming available to a vast majority of Americans, and fiber is being rolled out by a large number of telcos with the promise of major government support for further fiber rollout coming as soon as late this year.

When we look at how fast the different technologies are performing, we see currently fiber having a slight edge over cable. Fiber has started making multi-gig speeds of up to 5 Gbps available and provides the lowest latencies available, and cable providers are in the process of catching up with high splits. Fixed wireless is between 80 Mbps and the low hundreds of Mbps unless a customer has 5G mmWave. At the distant bottom is DSL with speeds in the tens of Mbps. Do these technical advantages actually register with customers? In a nutshell, the answer is: it depends.

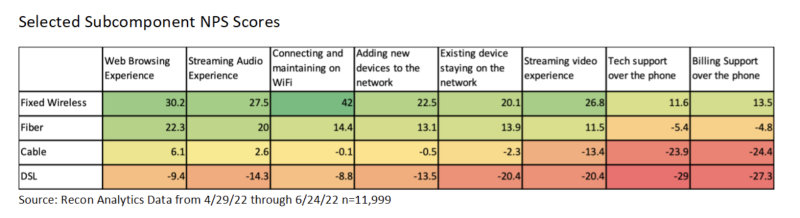

Every week, Recon Analytics measures the pulse of connected consumers in the United States and provides insights on what is going on in the comprehensive communications market based on what consumers tell us they have done and are intending to do. We collect the net promoter scores (NPS) for a large number of different aspects of the communications customer experience for more than 20 providers. NPS, which is used by many companies in the communications area to identify areas of improvement is a subjective measure of how much customers would recommend a certain product, service or in our case how likely they are to recommend a specific part of their customer experience.

What immediately jumps out from the chart above is that fixed wireless customers would recommend their service more than that of any other service even though in many cases it has slower speeds – with the exception of DSL – than the other options available. This should be a wake-up call for the providers of every other technology.

The other interesting observation is the difference between fiber and cable. Fiber currently outperforms cable in every metric in the above chart. Customers enjoy the fiber experience, and when presented with a choice the majority choose fiber over cable, the same way consumers prefer cable over DSL. The reason cable is growing is that there are still a lot more places where cable competes against DSL than where it competes against fiber. With the emergence of fixed wireless as a competitor, however, the game is changing. FWA presents a small threat right now, but a threat nevertheless.

In our customer flow analysis we see how consumers of all other access technologies flow toward fixed wireless. Since it is such a new technology and, in many cases, the fixed communications infrastructure has not changed sufficiently yet, we have not seen a reverse flow.

Despite having slower speeds than other technologies right now, fixed wireless has higher NPS scores for web browsing, streaming audio and streaming video, which are successively more difficult to solve technical challenges. Carriers offering FWA seem to be focused on improving the streaming experience of their customers. This is a very smart move as a significant number of new consumers who signed up during the pandemic were younger, more diverse and streaming subscribers.

Network operators offering FWA have also focused on making it easier for consumers to add devices to the Wi-Fi network, ensuring that the devices stay on the network and that the connection is not interrupted. Having only one or two device types and generally only one or two rate plans makes support easier.

Many providers — wireless-only providers, landline providers, and cable providers — are embracing fixed wireless as it gets the job done today and customers like it. This might change with the emergence of VR and especially volumetric video where continuous data speeds will just explode.

Volumetric video will require sustained data speeds of at least 10 Gbps in 2k resolution, and 4k volumetric video has four times the resolution of 2k. This is why you see fiber providers and cable providers heavily investing in their networks. The most compelling use case for volumetric video is live sports where it will allow the viewer to pick their point of view instead of only having the option of the one or few that the director of the sports cast chose. Basically, unlimited points of view. This type of gargantuan bandwidth is where fiber and cable, especially in the future DOCSIS 4.0 version, shine. 5G and 6G fixed wireless will try to close the gap but will have problems with such raw speed requirements on a mass scale.

As I mentioned earlier, the federal government will spend not only $42.5 billion through its Broadband Equity, Access and Deployment (BEAD) Program but up to another $10 billion in different plans to build out access to get as many people as possible internet access that allows them to participate in the full suite of commercial and educational activities regardless of where they live.

But NTIA deciding to ignore strong customer preference for fixed wireless access puts the BEAD effort on a troubling path. It is true that fiber and its related technologies are robust solutions for closing digital divides, but wireless fixed access also has an important role to play by providing cost effective access with speeds that stretch dollars further than they otherwise would go.

Roger Entner is the founder and analyst at Recon Analytics. He received an honorary doctor of science degree from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger on Twitter @rogerentner.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not necessarily represent the opinions of Fierce.