Sometimes old album titles say it best. Today, AT&T marks the start of the expansion of AT&T’s fixed wireless home internet service called AT&T Internet Air. After offering it in its DSL footprint for the last few months, it is now becoming the third nationwide mobile network operator (MNO) to launch a 5G (where available) internet offer.

AT&T is starting in Los Angeles, Philadelphia, Cincinnati, Harrisburg/Lancaster/Lebanon, PA; Pittsburgh, Chicago, Detroit, Flint-Saginaw-Bay City, MI; Las Vegas, Minneapolis-St. Paul, Phoenix (Prescott), AZ; Portland, OR; Salt Lake City, Seattle-Tacoma, Tampa-St. Petersburg (Sarasota), and Hartford-New-Haven, CT. Notably, Los Angeles is Charter’s largest market and a T-Mobile FWA stronghold. Philadelphia is Comcast’s home market, and Seattle is T-Mobile’s home market. If the carriers are looking for attention, these launch markets are certainly going to attract it.

Another very interesting market is Phoenix. Gigapower, a joint venture in which AT&T is involved, is building out fiber in Mesa, AZ. While the two are about 100 miles apart, it will be interesting to see how the two technologies will be adopted in the same market.

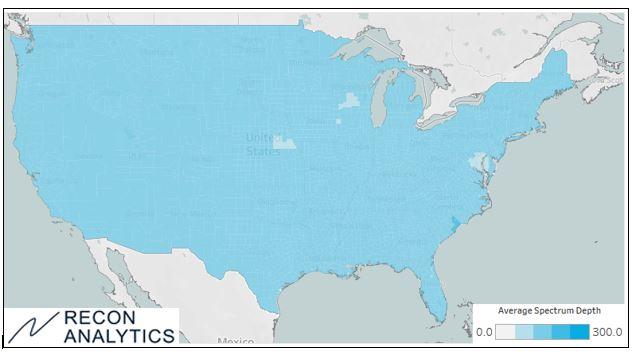

With nationwide combined 3.45 GHz and C-Band of 120 MHz on average, and with at least 100 MHz in every market, AT&T can put significant bandwidth behind its FWA offer. The theoretical maximum speed achievable with 100 MHz of spectrum is 2.3 Gbit/s. It is important to keep in mind that what is possible in theory is also possible in reality – and that wireless is a shared resource. Will someone sitting next to a tower be the only person on the cell to get 2.3 Gbit/s? Possibly, but even though quite a few wireless speed testers have reported wireless download speeds of 600 to 800 Mbit/s, it is far from certain on a loaded network. Even half the theoretical speed is still more than respectable. Quieter than its competitors, AT&T has rolled out its mid-band network to more than 175 million PoPs.*

AT&T Mid-Band Spectrum Depth of 3.45 GHz and C-Band

Some might argue that AT&T is late to the game with T-Mobile and Verizon having a two-year head start. AT&T took the time to make some nice improvements to the product. One of the major customer pain points that leads to a lot of returns is that customers cannot figure out what the best location for the wireless router is in their house.

AT&T’s router comes with a cool app that lets customers find the best place in their house and confirms it with an ad hoc speed test. With such a great feature it is only a matter of time until the other providers offer the improvement to the setup process that will reduce the device return rate. With only 5.5 million customers, we are only at the beginning of the FWA party, and AT&T has plenty of time to catch up. Given AT&T’s spectrum depth, it is not unreasonable to expect that the company can get somewhere between 4 million to 7 million FWA customers, a similar number to what Verizon and T-Mobile announced.

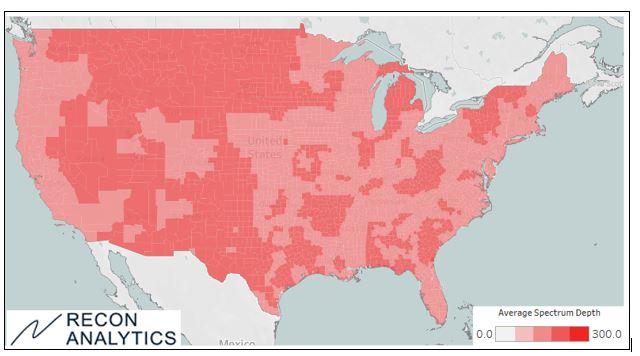

When we look at the other two operators, their FWA strategy has been divergent. Up until now, Verizon has been heavily focused on urban areas. This strategy is in line with their initial assignment of C-Band in 46 PEA markets, followed by the initial early release markets after Verizon paid the satellite companies to vacate their licenses early.

While it would be reasonable to expect all FWA operators to offer FWA in rural areas – the combination of significant spectrum position with nationwide coverage in a low population density environment allows for high speeds due to low spectrum utilization – Verizon has an edge. With its newly available C-Band spectrum, Verizon has up to 200 MHz of spectrum in rural areas and can give fiber a run for its money in sparsely populated areas where fiber deployments, even with government assistance, are still cost prohibitive.

Verizon Mid-Band Spectrum Depth of C-Band

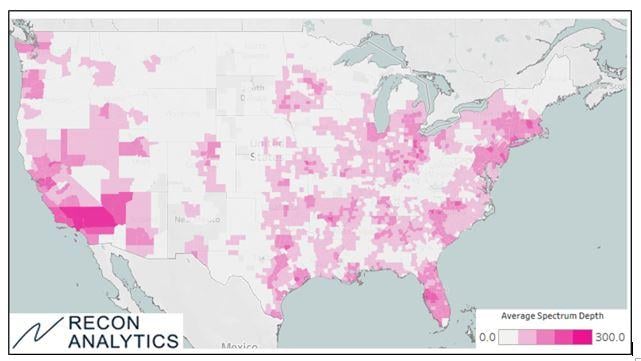

T-Mobile’s FWA results have been much more distributed than Verizon’s due to its much more distributed 2.5 GHz spectrum holdings. Even without the 2.5 GHz spectrum it won during Auction 108, which the FCC has not assigned to T-Mobile yet due to the expired FCC spectrum authority, T-Mobile has been successful in rural America. We see roughly one third rural, one third suburban, and one third urban subscriber population in our Pulse survey.

With more rural 2.5 GHz spectrum, T-Mobile will have an even stronger spectrum position to accelerate its goal of expanding market share in small markets and rural areas where its market share is less than half of what it often commands in urban areas. The map below shows the importance of T-Mobile getting the licenses it won to better position itself against the likely buildout by AT&T and Verizon as well as the fiber buildout fueled by the government’s BEAD subsidies.

T-Mobile Mid-Band Spectrum Depth of 2.5 GHz, 3.45 MHz, and C-Band

Recon Analytics administers the largest telecom survey in the world. Every year, we ask more than 400,000 consumers about their wireless and home internet experience and intentions. This allows us to capture emerging trends such as FWA when they are tiny, as our large sample picks them up as they happen. A year ago, as cable executives were quizzed by investment analysts about the impact of FWA on their business without a real answer, our clients already had robust insights.

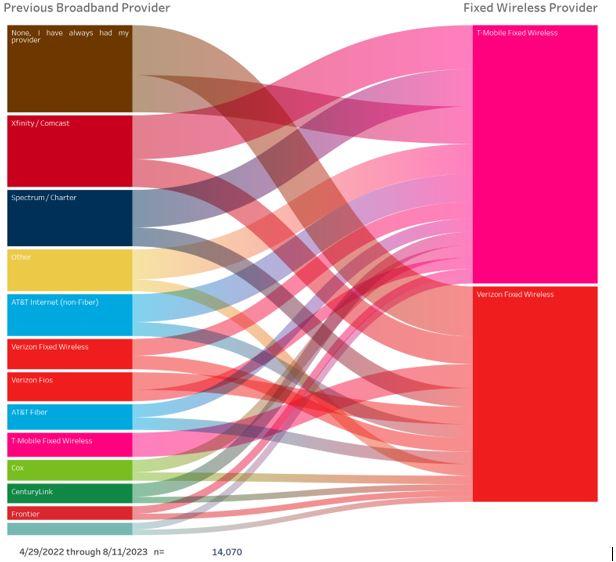

AT&T’s emergence as an FWA player highlights that FWA is both an opportunity to expand the market and a threat to everyone. The largest source for FWA is market expansion, as it reaches people who have never had broadband before. The low price, usable speed and ease of installation are significantly lowering the barriers for adoption.

Cable providers are, combined, the largest contributors, but they only represent around a third, making them by far not the only ones who feel the sting. DSL providers are the second largest contributors, but even fiber customers are attracted to the good enough quality and lower price of FWA. Additionally, FWA customers are significantly less likely to have acquired their connection when they moved – indicative of an active switching pool that is not reliant on moving to drive gross adds.

What is the most remarkable is the emergence of a new class of customers: The FWA Converts. These customers have fully bought into the FWA value proposition and have switched from one FWA provider to another in order to get the best experience and price possible. We have developed a detailed perspective on who these FWA converts are.

There are a couple of interesting observations: While T-Mobile AWS leads Verizon AWS by about 3:2, for customers who never had broadband, Verizon is leading by about 3:2. At the same time, the leading indicator for what FWA provider a customer chooses is who their mobile operator is. The bundling effect of FWA is very strong. Traditionally, T-Mobile appealed to lower income population segments that would also be less likely to have home internet or look for a lower cost solution. This does not seem to be the explanation to why Verizon is leading T-Mobile in connecting previously unconnected Americans with wireless broadband.

With roughly 125 million households in the U.S., Verizon’s approximately 17 million fiber passings and AT&T’s goal of 25 million passing in their respective footprints, and T-Mobile only now dabbling in fiber partnerships, it is clear that FWA will play a significant role in their mission to drive converged customers. This is equally true for the cable companies’ mobility aspirations.

For all of them, the mission to find more converged customers has turned into a quest for the proverbial holy grail. Converged customers have typically lower churn and spend more with their operator than when the spend is divided. As competition intensifies, with cable companies now growing faster than mobile carriers in mobility, and mobile carriers growing faster than cable broadband providers with broadband connections, the drive for more customers is on. Likewise, a multi-dimensional battle is on for the business customer, with mobile, FWA, fiber, HFC, dedicated and shared access as well as DSL as the main weapons.

Recon Analytics has launched a business telecommunications service along the lines of our consumer offering, so stay tuned for more insights.

Roger Entner is the founder and analyst at Recon Analytics. He received an honorary doctor of science degree from Heriot-Watt University. Recon Analytics specializes in fact-based research and the analysis of disparate data sources to provide unprecedented insights into the world of telecommunications. Follow Roger @rogerentner.

"Industry Voices" are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by Fierce staff. They do not represent the opinions of Fierce.

*Article updated to say 175 million PoPs covered, not 175 million households.