Industry Voices are op-eds from industry experts or analysts invited to contribute by Fierce staff. They do not represent the opinions of Fierce.

Every 8-10 years, our industry feasts with another “G." New spectrum opens up. The operators raise billions of dollars, and spend it on radio gear. But after a summer of love, there is always a winter. We are entering the deep freeze of that 5G winter now.

This time, I’m expecting one aspect to be different. Every previous slump in the mobile industry resulted in a major vendor losing their independence. After 2G, Motorola dropped out. After 3G, we saw the NSN joint venture, with Alcatel and Lucent joining forces. Nortel dropped out and became part of Nokia. And after 4G, Nokia acquired Alcatel-Lucent, with a multiple smaller players in Asia dropping out as well.

Players tend to drop out when the market resets and another major R&D investment appears on the horizon. Nortel simply could not invest enough cash to tackle 4G R&D, so they evaporated. Alcatel, Siemens, Lucent, Motorola and others all dropped out of the market with variations on the same theme. It’s expensive to stay in the game.

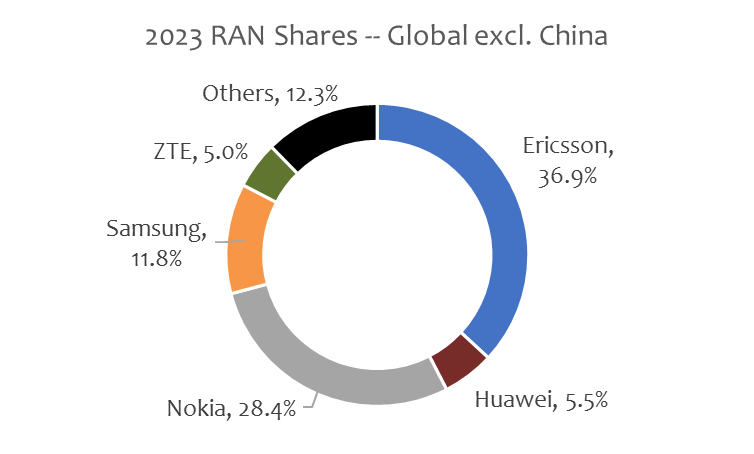

This time around, we only have three large suppliers of mobile infrastructure, so the type of consolidation that we have seen in the past is not likely. Ericsson holds the strongest share at about 37%, and Nokia is a solid #2 at 28% (excluding China). Samsung is no weakling — their mobile networks business is thriving and has reached a leadership position in vRAN. I don’t expect Samsung to drop out of the mobile networks market soon because their deep pockets and expertise in AI put them in a good position.

The Chinese vendors hold a small share of the market outside of China, and I don’t really consider them to be serious players anymore when it comes to the market outside of China. So we will simply ignore them in this analysis.

A different kind of consolidation

In fact, I do expect consolidation to happen, but it will be different this time. Instead of companies buying each other, let’s take the AT&T/Ericsson open RAN deal as a marker. That’s a case where the customer has chosen a single vendor for the software, moving the competitive action to the hardware side in order to keep costs down. This moves AT&T into a single-source position, but they will actually increase the number of suppliers involved as they introduce Cloud RAN, with various server vendors, chip vendors, and RU vendors. It’s less competitive in one aspect and more competitive in other areas.

I believe that vRAN software is becoming the strategic high ground of the RAN market. Will Ericsson dominate the vDU and vCU software, like Microsoft has dominated the OS software for PCs? Will Nokia be the ‘spoiler’ in the market, like Apple has been for non-Windows software? Or is Samsung far enough ahead in vRAN to take a key position?

We collapsed down to two major operating systems in PCs and in smartphones. Will the same dynamic play out in RAN software, with migration to the two ‘best in class’ software platforms? Or will the entanglements of legacy RAN prevent the migration?

My new vRAN report dives into some of these questions and provides a view of how vRAN will be adopted quickly as new spectrum comes into play.

By 2032, I expect more than half of the RAN market to be virtualized, so the battle for control of the software is key.

Don’t forget the lessons of 2G, 3G, and 4G: We have a long winter ahead of us, as new spectrum will be scarce through about 2029. Companies that can’t keep investing in R&D to keep up will be left behind, and those that keep investing in cloud RAN software evolution will emerge stronger.

Joe Madden is principal analyst at Mobile Experts, a network of market and technology experts that analyze wireless markets.