Now that 5G is official with the completion of 3GPP Release 15 nonstandalone (NSA) specification, we are beginning to see operator 5G announcements. In the U.S., where 5G rollout announcements have been more prominent of late, each operator’s 5G focus appears different. Verizon has announced a 5G fixed wireless service commercial launch in a handful of cities in the second half of this year. Meanwhile, T-Mobile has been vocal about launching a 5G mobile and NB-IoT service leveraging its recent 600 MHz spectrum winnings. Sprint is touting an expansion of its network infrastructure leveraging 2.5 GHz spectrum. Meanwhile, AT&T has announced its plan to launch 5G mobile service in a dozen markets by late 2018. Not surprisingly, each operator appears to be focused on its unique spectrum assets to target the initial 5G market and use cases.

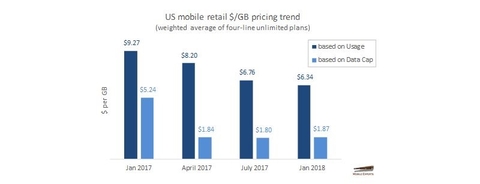

While the 5G marketing battle steps up a notch, the competitive intensity among the U.S. mobile operators has been subdued, despite occasional promotions-driven advertising on TV. We have been tracking mobile retail pricing to gauge competitive intensity and the mobile-fixed convergence trend. As of this month, the retail “$ per GB” has not budged much from six months ago. In fact, it has slightly gone up, indicating that the four major operators seem reluctant to start another price war that marred industry profitability in the first half of 2017.

With a stable competitive environment, the operators seem eager to plan their next growth strategy. While it is debatable how 5G (NR, to be specific to those who are tracking the official 5G technology) will play into their growth strategies, mobile operators are certain to harness the power of 5G NR technology with its better spectral efficiency, low latency and massive connections.

The pace of 5G announcements will pick up this year and more earnestly in 2019 as operators continue to expand network capacity and prepare their networks for 5G devices and applications. The success of 5G may be gauged by how many “network slices” are being served by the operators. Fixed wireless and wired broadband, industrial IoT, AR/VR and other unimagined applications may represent those network slices running in operators’ core networks. In the meantime, continued access infrastructure buildouts will be needed with small cells, massive MIMO and of course, 5GNR radio deployments.

While each operator pursues its growth strategy via spectrum and content acquisitions or mergers, 5G will be leveraged on different spectrum and in different ways to target specific markets and use cases. In the end, everyone is trying to deliver the best customer experience at the lowest cost. How each operator gets there, will be different, depending on its network and spectrum assets. As the Sly and Family Stone’s "Everyday People" song goes, “sometimes I’m right and I can be wrong, my own beliefs are in my song.” Right now, each operator is playing its own “song.” How 5G fits into their “songs” will be different. Different strokes for different folks.

Kyung Mun is a senior analyst at Mobile Experts LLC. Mobile Experts is a network of market and technology experts that provides market analysis on the mobile infrastructure and mobile handset markets. Over the course of his 20+ years in wireless and cable industries in a dynamic range of roles from engineering to product management and technology strategy, Mun has contributed to the advancement of mobile communication while working at leading companies in the mobile value chain including Motorola, Texas Instruments, Alcatel-Lucent and a few startups in between. He holds undergraduate and graduate degrees in electrical engineering from the University of Texas at Austin and Georgia Tech, and studied finance and strategy at Southern Methodist University.